Stocks have been volatile this week — and with a trading strategy, we can profit from price action like this.

Traders often think high volatility is a sign of fear. That’s true since volatility rises when prices fall.

To develop a strategy, we need to quantify volatility.

We can measure volatility in several ways, but they’re all at high levels.

Since they all tend to say the same thing about the state of the market, I use one of the simplest definitions.

Volatility Begets Volatility

For volatility, I use the true range (TR) as a percent of the opening price. The TR is the difference between the day’s highest and lowest price, accounting for any gaps when trading starts.

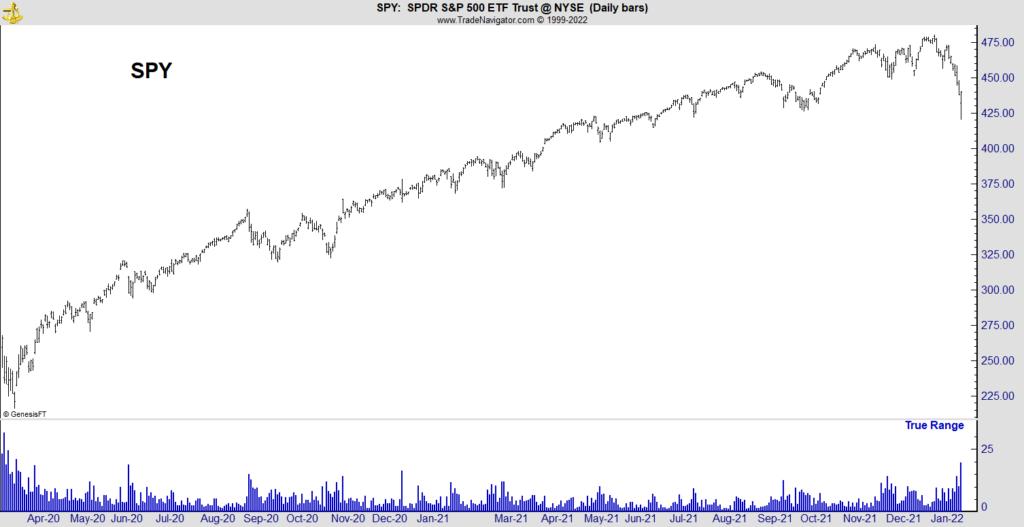

Over the past year, the daily TR for the SPDR S&P 500 ETF Trust (NYSE: SPY) has averaged about 1%.

It jumped to 3% on Monday and Tuesday, January 24 and 25, 2022.

You can see in the chart below that 3% is the highest it’s been since the bear market ended in 2020.

SPY’s Daily True Range Since 2020

Spikes like we saw this week are common, happening almost 120 times in the past 20 years. But many years had no signals, which is typical during market corrections or bear market years.

The recent signal comes as the S&P 500 recorded its first 10% correction in almost two years. It could signal that a rally is due.

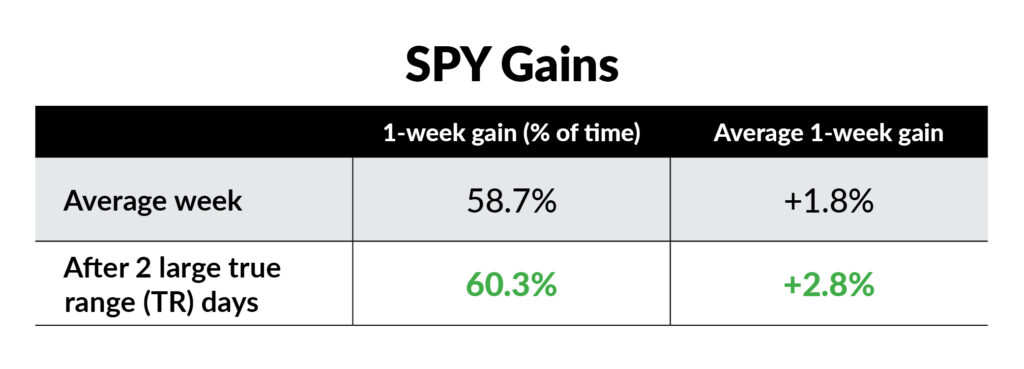

Testing shows that two large TR days are bullish for SPY, with the exchange-traded fund showing a gain 60.3% of the time one week later. The average gain is 2.8%.

Those numbers are slightly better than average, as you can see in the table below.

On average, SPY showed a one-week gain 58.7% of the time, and the average gain was 1.8%.

While the improvement in the winning percentage is small, the average gain size tells us that volatility is often followed by more volatility. Losing weeks decline much more than average.

Recent volatility presents a high-risk, high-reward opportunity.

Options work well in this type of market.

Call options on SPY can benefit from the potential upside while limiting risk to the amount paid to open the trade. That’s a substantial benefit when risks are so high.

Click here to join True Options Masters.