Stock markets are cyclical — but that doesn’t mean they’re predictable.

After all, it’s impossible to nail with exact precision where the global economy will be headed in a month or in a year.

And while we can account for seasonal adjustments and macroeconomic factors such as interest rates, we can’t know precisely when an overheated market might start to correct.

As John Maynard Keynes once keenly observed: “Markets can remain irrational longer than you can remain solvent.” A wave of Reddit investors sinking hedge fund short sellers on GameStop (NYSE: GME) stock are living proof of that fact.

That means different stocks, industries and whole market segments can outperform (or underperform) the market for surprisingly long periods of time…

Over the last few years, we’ve seen Big Tech’s “Magnificent Seven” gain astonishing ground as the market gears toward an AI-powered future.

These mega-cap tech stocks have done so well, in fact, that many began to expect a reversal. Myself included…

Going into last year, I warned readers against the risks of chasing Mag 7 stocks at ultra-high valuations, instead guiding Green Zone Fortunes readers to Palantir Technologies Inc. (Nasdaq: PLTR), a stock that outperformed every one of the Mag 7 while being powered by the same AI boom.

So it should come as no surprise that I’m bucking the trend once again in 2025 — and strongly recommending the “underdog,” so to speak…

2025 Looks Good for Small-Cap Value Stocks

While mega-cap tech stocks surged over the last few years, small-cap stocks have been all but forgotten.

Mired by high interest rates and an unpredictable economy, America’s smaller businesses have struggled for years. This might come as a surprise, but small-cap stocks are currently in their second-longest period of underperformance since the Great Depression.

That all started to turn around late last summer, shortly before the Federal Reserve’s first interest rate cut signaled a change in policy. Yet despite changing tides, the small-cap Russell 2000 index still ended the year with just a little over half the return of the S&P 500.

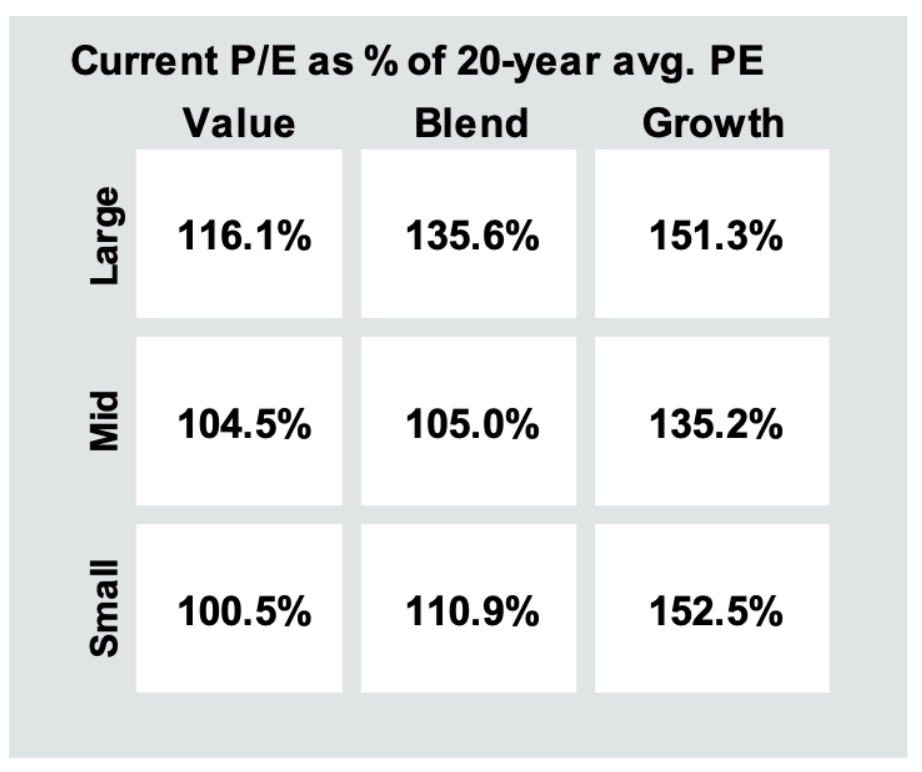

Now, we’re entering a whole new year. And one chart lays out the opportunity before us quite plainly:

You’ve probably seen a “grid”-style chart like this before. Morningstar popularized what it calls a “style box,” and now they’re quite widely used.

In this case, we’re looking at the price-to-earnings ratio (P/E) of different stocks as a percentage of the 20-year average. It gives us a broad measure of value for investing in (or holding) various types of stocks at today’s prices.

In the case of our large-cap growth stocks, we’re looking at 150% (or 1.5X) the 20-year historic P/E ratio.

That number is obviously quite high.

Indeed, large-cap stocks are valued quite high across the board. That’s to be expected after the consolidation, index investing, and utter dominance of the Mag 7 we’ve seen these last few years. I’ve been warning about the long-term effects of this for a while, many of which are yet to appear.

Meanwhile, you may notice one type of stock in that chart above that still looks like a bargain — and that’s small-cap value. They’re obviously not undervalued, but they’re priced more attractively than anything else right now.

Looking closer at small-cap stocks in general, their earnings per share (EPS) are also growing nearly 3X as fast as mid caps or large caps. One top Wall Street firm has a gangbuster projection for the earning growth of small-cap stocks in 2025 … I’ll be talking more about that later this month as earnings season gets underway.

Long story short — some of these small-cap value stocks still have surprisingly attractive fundamentals amid an otherwise overheated market.

And now that we’ve got a stock picker’s market on deck for 2025, a handful of small-cap breakouts will inevitably see massive gains.

I aim to add a few of these to my 10X Stocks model portfolio over the next few months. Stay tuned for a chance to follow my guidance into these opportunities soon.

To good profits,

Adam O’Dell

Chief Investment Strategist