Editor’s Note: LIVE on November 4, Adam O’Dell will prove that there’s no better time to start trading than right now, during a once-in-a-lifetime Perfect Trading Window. He’ll also reveal a simple strategy that’s ideally suited to exploit this market anomaly (It already crushes the market by 6X, but things are about to go ballistic!) Click here to reserve a VIP spot to this game-changing live event.

In the latest Marijuana Market Update, I discuss assets in the cannabis market that aren’t facing the same headwinds as traditional cannabis stocks: cannabis real estate investment trusts, or REITs.

This presents buy opportunities for cannabis investors like us.

Cannabis Stock Headwinds

It’s no question that cannabis stocks continue to face headwinds. Most cannabis companies’ gains have vanished this year.

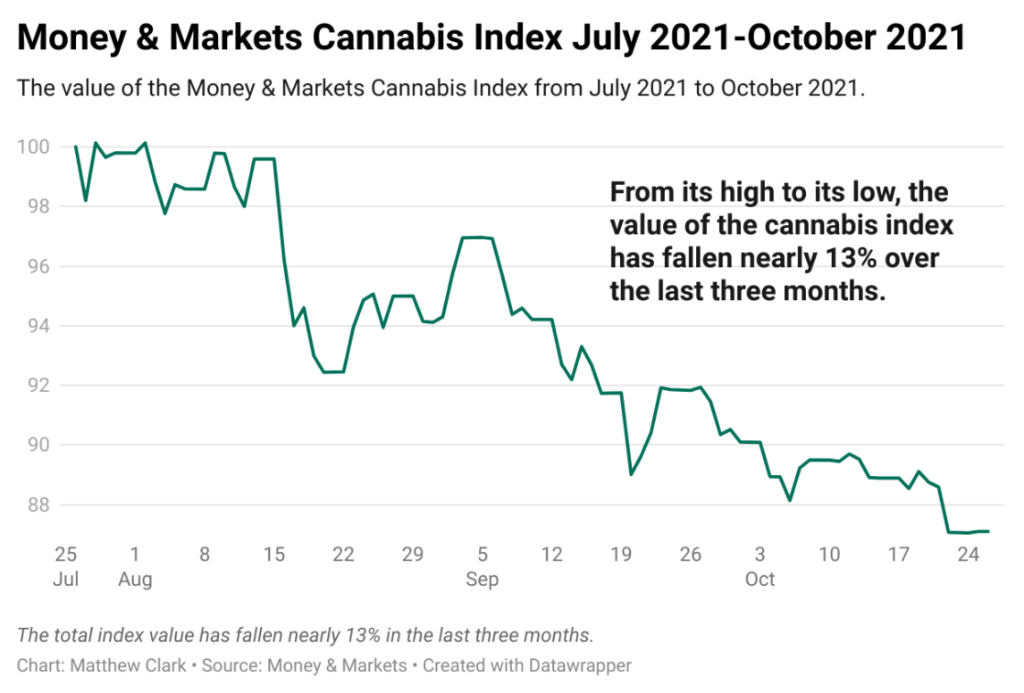

We’ll turn to the Money & Markets Cannabis Index — an equal-weighted index that holds cannabis-related stocks with market caps over $10 million — to see what happened to cannabis stocks over the past three months:

From late July to today, the index value fell almost 13% from its period high at the end of July.

Cannabis companies are dealing with two challenges:

- Stalled federal legalization talks in Congress.

- Investors’ belief that companies won’t maintain their COVID-19 sales and earnings momentum.

This causes selling pressure and either sideways or downward price movement for cannabis stocks in the U.S.

However, I found stocks that have weathered that pressure to provide solid momentum, even during these tougher times.

They aren’t traditional cannabis companies or even companies with a direct product tie to cannabis.

They are REITS.

About REITs

A REIT is a company that owns and operates commercial real estate. They buy and develop the property, then lease it to a company and collect rent.

REITs can cover offices, apartment buildings, warehouses, shopping centers and beyond. They pool together capital from investors to buy property.

In the case of cannabis, REITs buy land, develop it for growing or retail operations, then lease the property back to cannabis companies.

3 Cannabis REITs

I want to highlight three cannabis REITs:

- Innovative Industrial Properties Inc. (NYSE: IIPR).

- Power REIT (NYSE: PW).

- Zoned Properties Inc. (OTC: ZDPY).

All three own and operate real estate tied to cannabis and, in some cases, agriculture.

The beauty of a REIT is that it pays back profits in the form of dividends. To qualify as a REIT, it has to pay at least 90% of its taxable income back to investors.

Plus, as an investor, you’re getting into the real estate market without the pain and struggle of buying property.

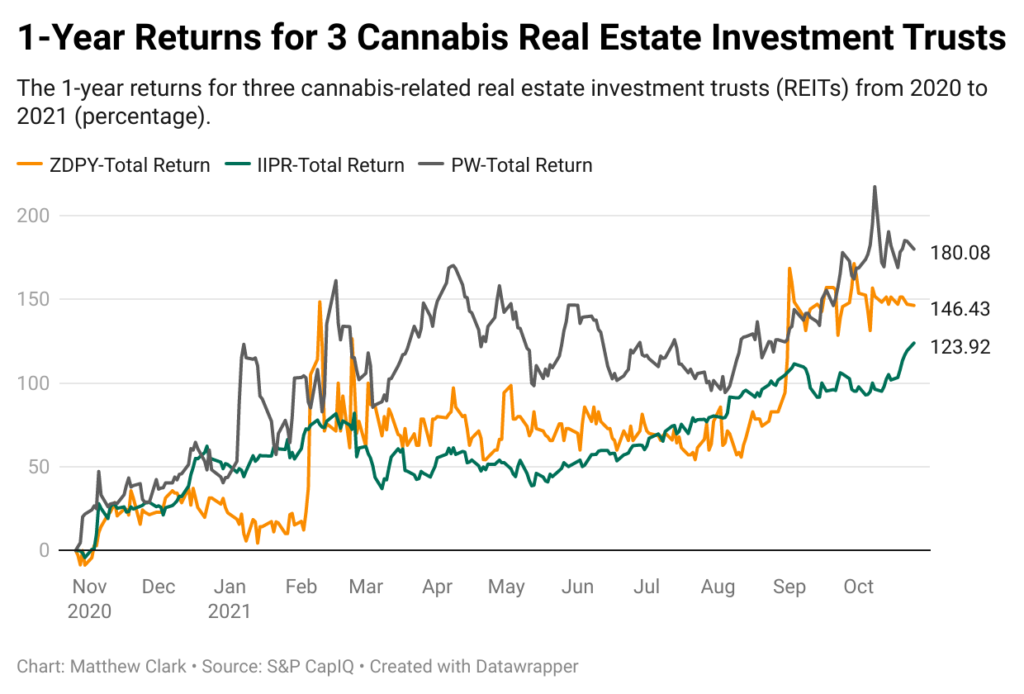

Zooming out over the last 12 months, all three of the REITs I mention turned in triple-digit returns.

- PW is up 180%.

- ZDPY has advanced 146%.

- IIPR is up 123%.

Now, you might explain this away as massive run-ups thanks to the cannabis jump in February.

But I think there’s more to it.

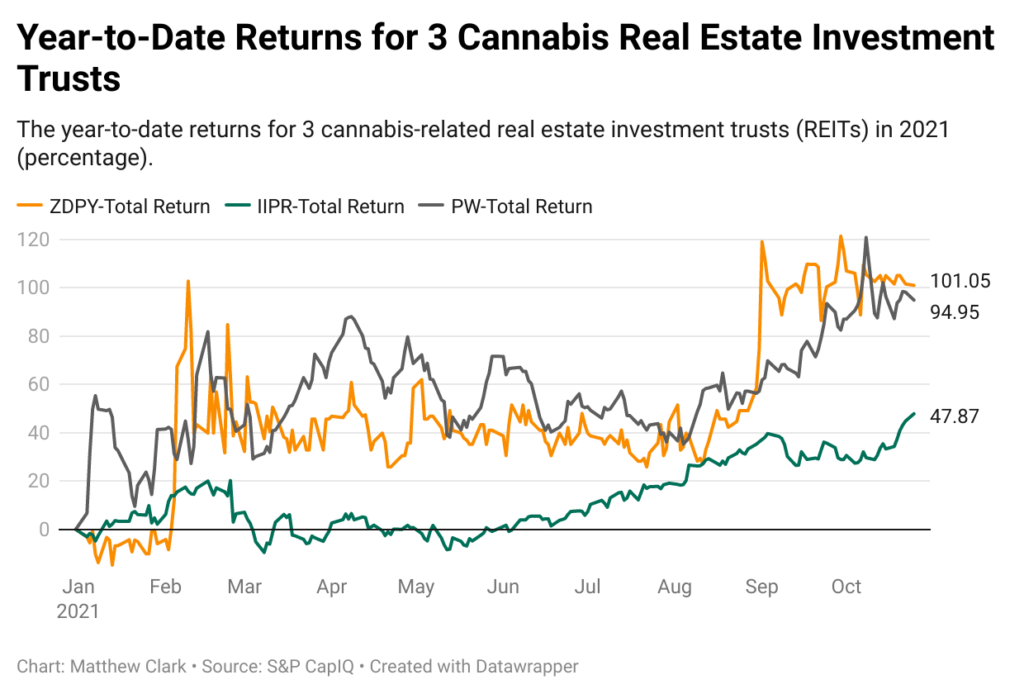

We can zoom in a little closer and look at the returns of these REITs year-to-date:

- ZDPY returned 101%.

- PW is up 95%.

- IIPR advanced 48%.

So, all three cannabis REITs outpaced the gains they each made in February when cannabis stocks exploded on talks of federal legalization.

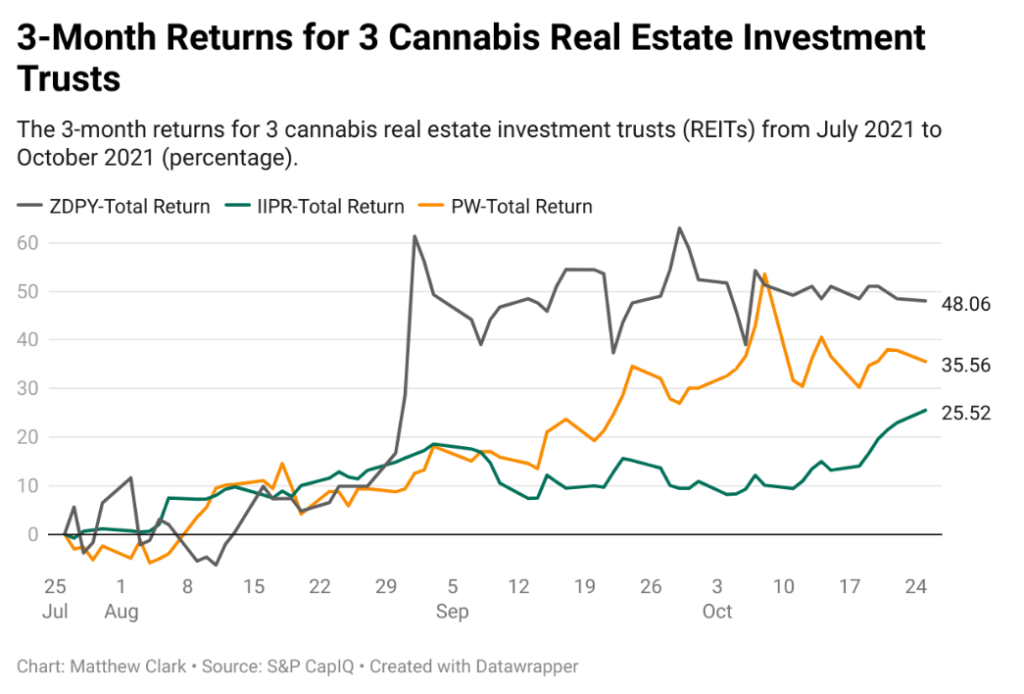

Finally, we’ll look at three-month returns.

Remember, the Money & Markets Cannabis Index shows a 13% decline in cannabis stocks over the last three months.

Here you can see that these three cannabis REITs gained double digits in the same time:

- ZDPY’s returns are 48%.

- PW’s returns are 35%.

- IIPR’s returns are 25%.

So, while traditional cannabis stocks struggle, these cannabis REITs keep advancing.

One reason is that investors know that a REIT is a smart business plan.

These companies don’t buy property blindly. They have a customer and its needs in mind before they buy. This ensures they are investing their capital wisely and providing their clients with exactly what they’re looking for.

Takeaway: The trends of these cannabis REITs suggest the overall long-term growth potential in the cannabis market.

Traditional (i.e., non-REIT) cannabis companies face issues beyond legalization:

- Cannabis investors focus a lot of attention on near-term sales growth, or the lack thereof.

- Investors focus on technical factors such as momentum and volatility.

REITs will continue to grow by providing real estate to the ever-expanding cannabis market.

Plenty of areas are underserved, and cannabis companies are chomping at the bit to gain a foothold in those markets. REITs simplify the process.

I consider all three cannabis REITs buys.

If you’re a cannabis investor, you might feel discouraged. The sell-off wiped away profits from February, but we can find diamonds in the rough … and cannabis REITs appear to be it for now.

If you have a question about a cannabis stock or the market, just email me at Feedback@MoneyAndMarkets.com. Send us a question, we use it … and you’ll get free Money & Markets gear, like T-shirts, hats and sweatshirts.

Where to Find Us

Coming up this week, we’ll have more on The Bull & The Bear podcast, so stay tuned.

And check out our Ask Adam Anything video series, where we ask any question to chief investment strategist Adam O’Dell, as well as our Investing With Charles series, in which our expert Charles Sizemore and I discuss the trends you write in to ask about.

Also, you can follow me on Twitter (@InvestWithMattC), where I’ll give you even more insights, not just in the cannabis market.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He is a certified Capital Markets & Securities Analyst with the Corporate Finance Institute and a contributor to Seeking Alpha. Prior to joining Money & Markets, he was a journalist and editor for 25 years, covering college sports, business and politics.