Chances are if you’re an investor, you’ve heard a lot about the coming 5G revolution and want to know how to profit, so Money and Markets has done the homework and this is our list of three cheap 5G stocks to buy right now.

The next big evolution in tech is always right around the corner and worth talking about, especially considering the impact it will have on our daily lives and the potential money you can make as an investor.

However, there are a ton of companies out there that stand to gain from the implementation of 5G technology, and the problem is a lot of the best ones are simply too expensive to invest in, particularly for younger traders.

The thought of paying hundreds of dollars for just one share is can be a turn-off or even a complete nonstarter if you don’t have much to invest.

That’s why we have created a list of the three cheap 5G stocks to buy right now.

Don’t be misled. Just because they are inexpensive doesn’t mean they don’t hold value. It means, even as a new investor, it is more affordable to earn a profit from the 5G revolution.

The Criteria

As with any investment, determining a company to put your money in can’t be done just by looking at the share price.

There are other fundamental characteristics that make a stock valuable.

Here are some of the things we look at when determining whether a company is worth the risk of investing in or not:

- Price-to-sales ratio — This is calculated by taking the number of outstanding shares a company has and multiplying the share price. Usually, a lower P/S means a more attractive investment, but not all the time.

- Price-to-book ratio — This is calculated by dividing the company share price by its book value per share. That book value is the total assets minus liabilities. Like the P/S, a lower P/B can signal an undervalued company.

- Price-to-earnings ratio — The P/E or PER measures the current share price relative to its per-share earnings.

Remember, not one of these ratios alone can determine the value of a company. Sometimes one ratio is high while the other two are low.

Also, you have to know each sector has averages for each of ratio. Because each sector is different, knowing those averages can tell you how a company performs relative to its sector.

Of course, another criteria we used to determine the three cheap 5G stocks to buy right now is the price (obviously). We wanted to find companies whose share price is less than $20.

3 Cheap 5G Stocks to Buy Right Now

Ericsson ADR

You may have heard about Swedish-based Ericsson ADR (Nasdaq: ERIC) in the news lately because U.S. government officials discussed investing in it and competitor Nokia for 5G infrastructure.

That’s all well and good but for our purposes, we want to look at what will potentially make you money.

For that, Ericsson has a ton of potential.

Ericsson is planning to partner with TDC to launch the first 5G network in Denmark, which could serve as a test case for other 5G networks around the globe. It is also working with the Kingdom of Saudi Arabia to upgrade government and private sectors to 5G capability.

The big thing is Ericsson is trading at just below $9 per share, which makes it remarkably inexpensive, even for a new investor. Since 2018, shares are up more than 45%.

Its price is still well above its 52-week low of $7.58 and short of its 52-week high of $10.46, giving it a lot of cushion for an upward swing in 2020.

In looking at our other factors, here’s what the numbers say:

- Price-to-earnings ratio — Ericsson currently has a very high P/E ratio of 129. That high number is primarily because there are a lot of outstanding shares of the company available (3.3 trillion to be exact).

- Price-to-book ratio — The company’s P/B ratio is actually quite low — just 1.3. The technology industry average is 1.7 meaning Ericsson is an undervalued company, even by industry standards.

- Price-to-sales ratio — Because of its low share price, Ericsson’s P/S ratio is low at 3.5. That is well below the industry average of 5.03 — further suggesting the company is undervalued.

Because of that undervaluation, Ericsson ADR is one of our three cheap 5G stocks to buy right now.

Nokia Corp.

Another name mentioned with Ericsson in terms of direct U.S. government investment for 5G is another well-known Scandinavian company.

Nokia Corp. (NYSE: NOK), like Ericsson, specializes in mobile communication — most notably, its cellular phones. However, it also specializes in mobile, fixed and IP networks.

It’s another company that is set for a big breakthrough as the 5G revolution takes hold.

Nokia shares are trading at a price point even lower than Ericsson — just under $5 per share. That makes it one of the cheapest 5G-related stocks on the market.

After suffering a brief dip in October 2019, Nokia shares are up nearly 23% and climbing. They are well below their 52-week high of almost $7 per share.

And Nokia is a heavily undervalued company:

- Price-to-sales ratio — Nokia’s undervaluation starts with its P/S ratio. At 1, it’s far below the technology sector average of 5.03. That is just one factor showing investors have undervalued the company.

- Price-to-book ratio — Here is another metric that suggests the company is priced below its value. The P/B for Nokia is 1.5. That puts it in a similar spot with Ericsson.

- Price-to-earnings ratio — Nokia does not have a calculated P/E ratio, but that doesn’t indicate anything positive or negative.

The fact that Nokia is priced so low, has so much room to run and is grossly undervalued makes it one of our three cheap 5G stocks to buy right now.

Commun Systems Inc.

If there is a company that checks all of our boxes for a cheap 5G stock to buy right now, this Minnesota-based company is it.

Commun Systems Inc. (Nasdaq: JCS) manufactures and distributes connectors and wiring devices for voice, data and video connections. Companies will look to players like Commun for those connections when building out 5G communications.

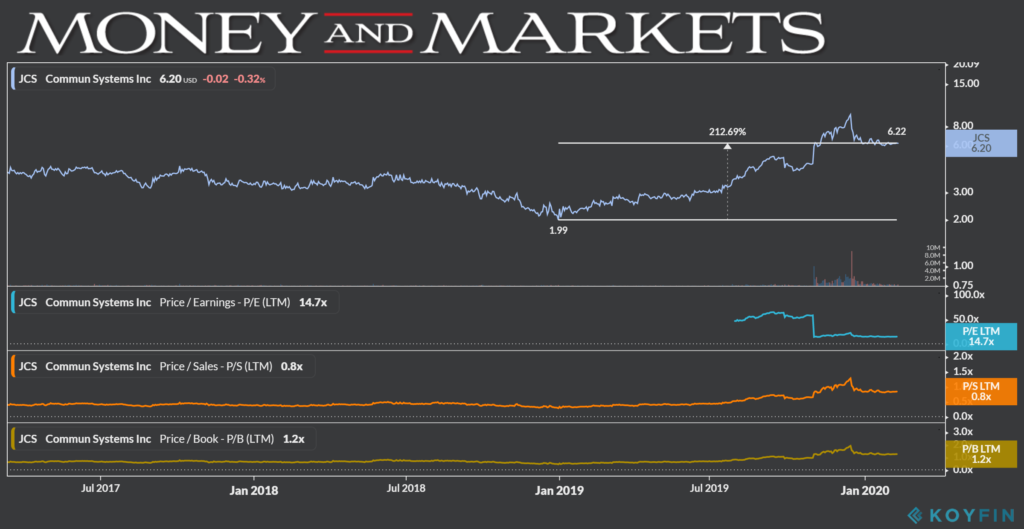

Like Ericsson and Nokia, Commun Systems is extremely cheap. Its shares are trading for a little more than $6 per share.

But since closing at $1.99 on Dec. 31, 2018, the share price has blown up — more than 212% to date. It’s still down from its 52-week high of $9.90 per share, meaning the running room for Commun’s share price is there.

Its other numbers show it to be a solid, undervalued stock:

- Price-to-earnings ratio — The technology industry average for P/E is 35.27. Commun’s ratio is less than half that — 14.7 — meaning that room to run we talked about earlier is most definitely there.

- Price-to-sales ratio — Commun is also well below the industry average in this department. Its P/S is at 0.8 — way below the tech industry average of 5.03.

- Price-to-book ratio — In this metric, Commun is close to value with Ericsson and Nokia. Its P/B is 1.2, and just like with the other two companies on the list, investors have tremendously undervalued this company.

Because it hits the mark with all of our metrics, Commun Systems Inc. is one of our three cheap 5G stocks to buy now.

One thing to remember is that with cheap stocks, the gains aren’t massive, particularly if you’re just investing a little bit of money.

But they are there.

The point is to minimize risk by not investing in high-priced companies that may or may not turn out to show you a profit.

You also want to be able to invest in the 5G revolution comfortably, without spending a ton of capital to do it — and every investor, large and small, needs a starting point.

That’s why these companies are Money and Markets’ three cheap 5G stocks to buy right now.

Related

- 6 5G Dividend Stocks to Buy Now

- 7 5G Stocks to Buy Right Now

- 4 Cloud Software Stocks to Buy Now

- 4 Semiconductor Stocks to Buy Now

- 5 5G ETFs to Buy Now

Looking for stocks to buy not on our list? Let us know by emailing feedback@moneyandmarkets.com or leave a comment below.