Avoid the complexities of looking for individual stocks and focus on these five 5G ETFs to buy now.

Most investors know that diversification is key to a more stable portfolio. That’s where investing in exchange-traded funds come into the fold. ETFs are automatically diversified as they hold numerous companies in certain sectors.

You’ve also seen the news about 5G technology and how it is coming, so why not combine the two and find ways to make money?

You may have caught our seven 5G stocks to buy right now, but if you are looking to diversify your holdings more, check out our Top 5 5G ETFs to buy now:

Global X Internet of Things ETF

Assets Under Management: $141 million.

Annual Dividend Yield: 1.12%.

Management Fee: 0.58%.

Underlying Index: Indexx Global Internet of Things Thematic Index

It may not be directly correlated with 5G, but the Global X Internet of Things ETF (Nasdaq: SNSR) is an ETF that will profit from the 5G revolution.

SNSR includes companies adopting the Internet of Things, as enabled by technologies such as WiFi, fiber optics and 5G telecommunications.

Among its Top 10 holdings are Skyworks Solutions (Nasdaq: SWKS) — a semiconductor company — and Garmin Ltd. (Nasdaq: GRMN). It also includes Intel Corp. (Nasdaq: INTC) which was one of our seven 5G stocks to buy right now.

In terms of performance, SNSR has been on a consistent upward trajectory in the last year. The ETF is trading close to $24 a share, which is on the cusp of its 52-week high. That share price is 41% higher than its 52-week low of $16.78.

Global X does have a very strong annual dividend yield of about 1.12%. It pays the dividend twice a year and, in December 2019, that dividend amounted to $0.18 per share.

On the downside, the ETF does come with a bit higher management fee than some others. Currently, the management fee for Global X is 0.58% or $58 for every $10,000 invested.

But the fact that its dividend yield is strong and the companies it holds are diverse in the 5G space is why Global X Internet of Things ETF one of the Top 5 5G ETFs to buy right now.

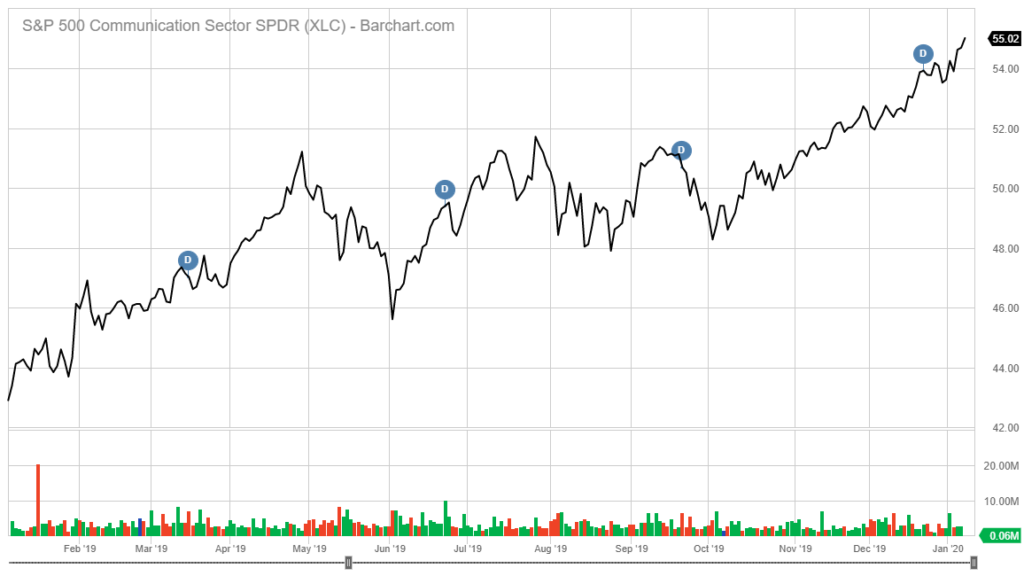

S&P 500 Communication Sector SPDR

Assets Under Management: $7 billion.

Annual Dividend Yield: 0.8%.

Management Fee: 0.13%

Underlying Index: Communication Services Select Sector Index

Sometimes you have to think a little outside the box as an investor.

When it comes to the 5G revolution there are companies we might not think of having a direct connection to it but stand to be a huge player.

That’s where the S&P 500 Communication Sector SPDR ETF (NYSE: XLC) comes in. Its holdings include a wide range of communications companies — Facebook Inc. (Nasdaq: FB) and Twitter Inc. (NYSE: TWTR) as examples — but it also has other companies that stand to make huge profits once 5G technology is fully rolled out.

Companies like AT&T Inc. (NYSE: T) — also on our top seven 5G stocks to buy now list — and T-Mobile US Inc. (Nasdaq: TMUS) are also in the ETF and those are companies that will be integral to the launch of 5G.

The ETF was trading just below its 52-week high of $55 per share, but it has been growing steadily since September 2019 — consistently breaking through resistance points along the way.

XLC has other advantages, such as a low management fee of 0.18% and a solid annual dividend yield of 0.8%. The most recent dividend was $0.11 per share.

The ETF is diverse and comes with a low management fee. It is still very affordable for even a new investor to get into comfortably. That’s why XLC is one of our Top 5 5G ETFs to buy right now.

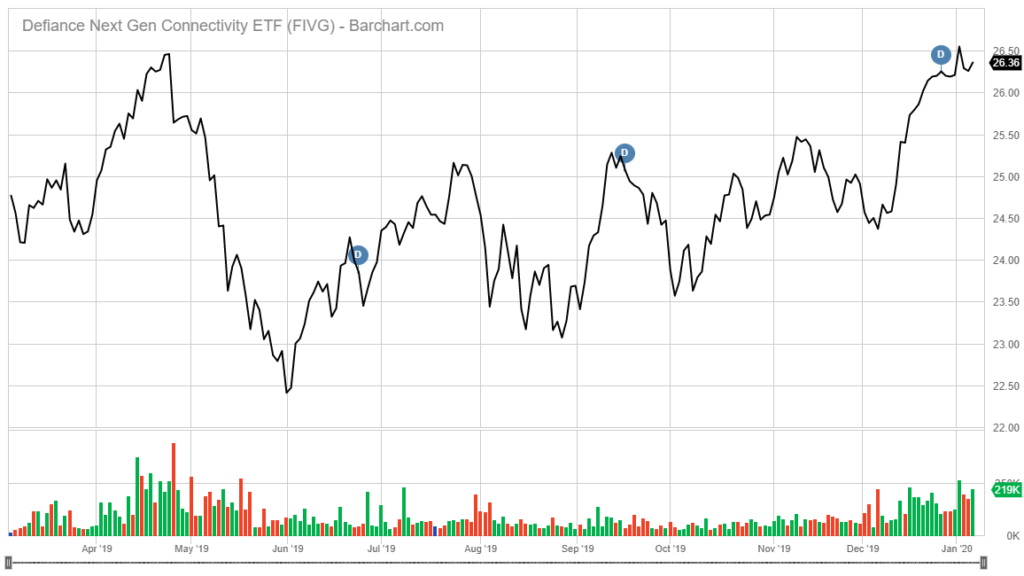

Defiance Next Gen Connectivity ETF

Assets Under Management: $175 million.

Annual Dividend Yield: 0.74%.

Management Fee: 0.3%

Underlying Index: BlueStar 5G Communication Index.

If you can find an ETF that is both inexpensive and has a nice dividend in the 5G space, you are a winner.

Look no farther than Defiance Next Gen Connectivity ETF (NYSE: FIVG). FIVG started in March 2019 and rapidly reached more than $175 million in its asset base.

This ETF includes around 60 companies that are engaged in the research and development or commercialization of systems and materials used in 5G communications.

The Defiance ETF reached its high of $26.56 on Jan. 2, which makes it a pretty inexpensive stock to get into. Since reaching that high, it has backed off only slightly.

It is trading more than 10% higher than its three-month low, but this ETF has grown quickly and seems to be on the track to keep up that momentum as 5G technology is researched and developed.

As with other ETFs, the Defiance Next Gen Connectivity ETF also pays a dividend to shareholders. Its latest annual dividend yield is 0.74%. That translated to about $0.20 per share in 2019.

This ETF has skyrocketed and only seems to be getting stronger. That is the reason why it is one of out Top 5 5G ETFs to buy now.

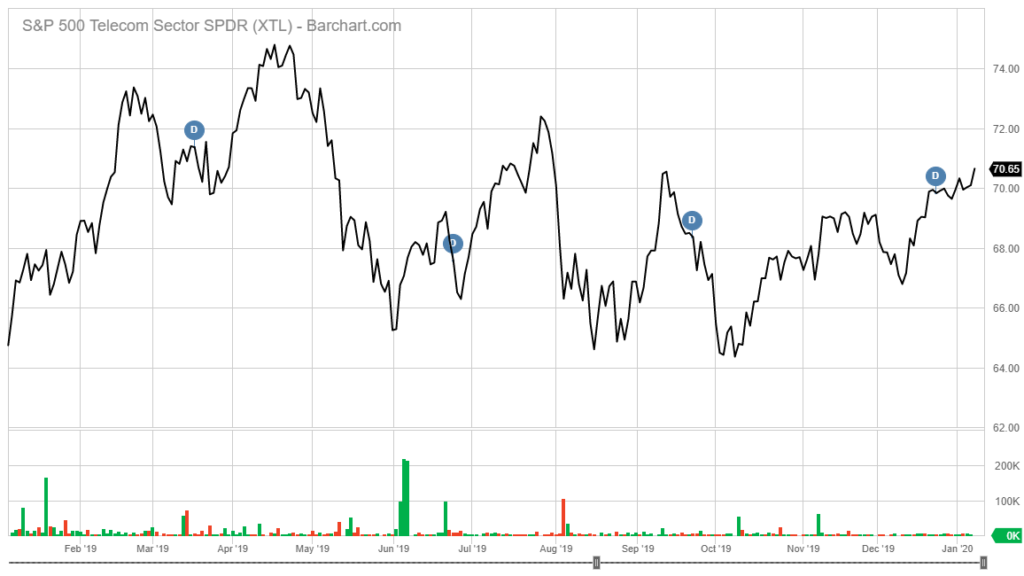

S&P 500 Telecom Sector SPDR

Assets Under Management: $50 million.

Annual Dividend Yield: 0.9%.

Management Fee: 0.35%

Underlying Index: S&P Telecom Select Industry Index.

When you think of the coming 5G revolution, you likely start thinking about traditional telecom companies.

That’s both a valid thought and a good one to have as telecom companies will be on the front lines of 5G implementation globally.

So what better way to invest in those companies than with the S&P 500 Telecom Sector SPDR ETF (NYSE: XTL)?

This ETF holds Ciena Corp. (NYSE: CIEN), AT&T Inc. (NYSE: T) and Cisco Systems Inc. (Nasdaq: CSCO) — all three companies in our seven 5G stocks to buy right now list. That’s a range of telecom, equipment and wireless companies.

XTL is still trading well below its 52-week high of $75 and its all-time high of $77.41, meaning there is a lot of growth room for the ETF that rebounded nicely from a dip in October, when it dropped to $64 a share.

It does come with a 0.35% management fee, which can seem a bit high, but it also comes with an annual dividend yield of 0.92% — which translated to a $0.14-per-share dividend at last payout.

But because it carries companies at the forefront of the coming 5G revolution, the S&P 500 Telecom Sector SPDR ETF is one of the Top 5 5G ETFs to buy now.

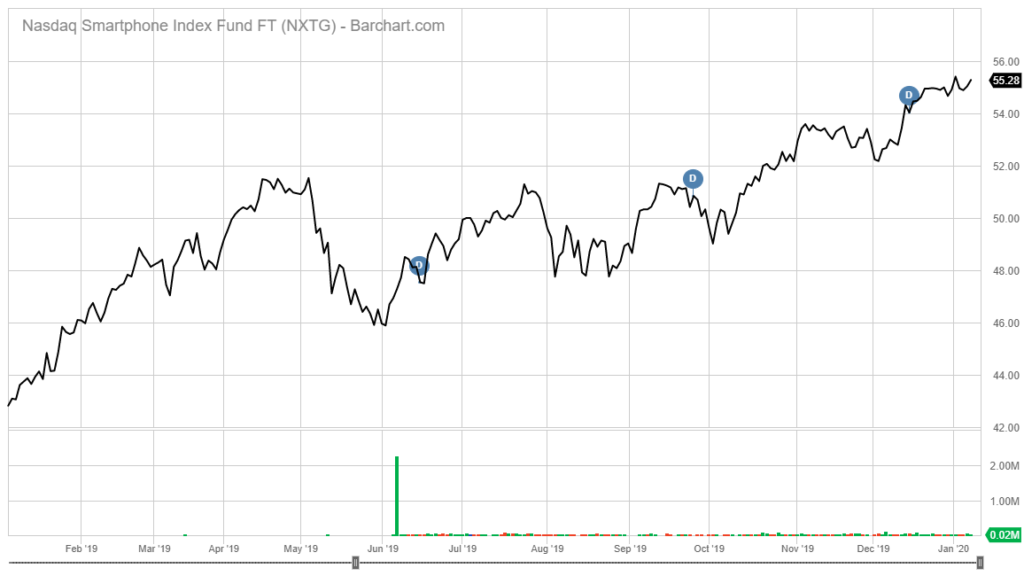

First Trust Indxx NextG ETF

Assets Under Management: $269 million.

Annual Dividend Yield: 0.77%.

Management Fee: 0.7%.

Underlying Index: Nasdaq CTA Smartphone Index

This ETF started out as purely a smartphone ETF but it has since switched to a 5G ETF, and has grown its total net assets to more than $269 million.

The First Trust Indxx NextG ETF (Nasdaq: NXTG) is very similar to the Defiance Next Gen Connectivity ETF that is also on our list. The difference is NXTG carries close to 100 companies in its holdings compared to only around 60 for FIVG.

A majority of the holdings in NXTG are related to semiconductors — which will be a huge player in the 5G revolution. But it also has cell tower player American Tower Corporation (NYSE: AMT) and telecom giant Nokia Corp. (NYSE: NOK).

The ETF has been up as much as 28% from its 52-week low of $43 per share and has tracked upward since taking a dip to around $46 in May. Its current price of close to $56 still makes it an affordable ETF for any level of investor.

Like the other ETFs on the list, NXTG comes with a dividend. Its current annual dividend yield is about 0.77%. Its last dividend payment was $0.23 per share.

One drawback of this ETF is the management fee. Currently, that fee is 0.7% which is higher than any of the other ETFs on this list. It is, however, close to its rival, Defiance.

But because it is extremely diversified in the 5G arena and still pays a solid dividend, First Trust Indxx NextG ETF is one of the Top 5 5G ETFs to buy now.

ETFs Can Get You in the 5G Game Easily

So there you have it; these 5G ETFs range from the narrow-focused to those with very broad holdings.

But they all have the 5G revolution at heart and could all see huge gains once 5G starts its broad implementation around the world.

We’ve said it before, but the 5G train is coming so why not invest and make money in the process?

These ETFs listed all have their benefits. However, like any investment, make sure you do your homework and understand what your investment limits are.

A good place to start is with these five 5G ETFs to buy now.

If you have questions about how to invest in an ETF, make sure to check out our Wall Street 101 guide on how to invest in an ETF.

Make sure you check out our other resources: