Cyberattacks are brutal.

Even the word has a way of filling you with dread.

But most people without a technical background have only a vague idea of what a cyberattack is. They know it involves geeky bad guys attacking a computer system. But they don’t know how these hackers gain access to our devices … or why they do it.

It’s created a lucrative environment for devious individuals.

But the real moneymaker will come from efforts to cut these criminals off as cybersecurity becomes a necessity.

Of course, not all cybersecurity stocks are investable.

And as markets sell off, it’s tough to separate the stocks with market-crushing potential from the ones that lack a runway out of this mess.

That’s where my proprietary Stock Power Ratings system comes in…

Why Hackers Hack

The reasons a hacker does what they do runs the gamut.

In some cases, they are hunting for information that might be of value, such as sensitive financial data or military or state secrets.

In other cases, the strategy is more akin to blackmail. In a ransomware attack, a hacker might lock a company out of its own computer system and hold the company hostage until they agree to pay a ransom.

Often, the motivation for a cyberattack is money. It’s nothing personal… “It’s just business,” as they say in The Godfather.

But sometimes, it’s politically motivated. The U.S. and Europe have been on high alert for potential Russian cyberattacks since the war in Ukraine started, fearing Vladimir Putin might use cyberattacks as an alternative form of warfare.

And then there are “hacktivists” that attack companies or political opponents they consider unethical.

Whatever the rationale for the attack, you don’t want to be on the other side of one!

Cybercrime Is Big Business

Cybercrime Magazine estimated that the damages due to cybercrime in 2021 amounted to $6 trillion. It expects that figure to top $10 trillion by 2025. That’s trillion … with a “t.” These hackers could band together to create the world’s third-largest economy with those funds!

When we look at numbers that big, we’re talking about more than just the amount of ransoms demanded or the explicit costs. We’re also counting lost productivity, missed sales while websites are down, stolen intellectual property and too many other costs to list out.

But when you’re measuring the damage in trillions of dollars, you don’t need to be exact. You could be off by a factor of 10, and the numbers would still boggle the mind.

But huge problems create opportunities that are equally as big — if not bigger. The companies that step in and provide solutions stand to make a bundle while also making the world a safer and better place!

The only problem is that most of the major players in this space are far from investable.

3 Cybersecurity Stocks to Avoid

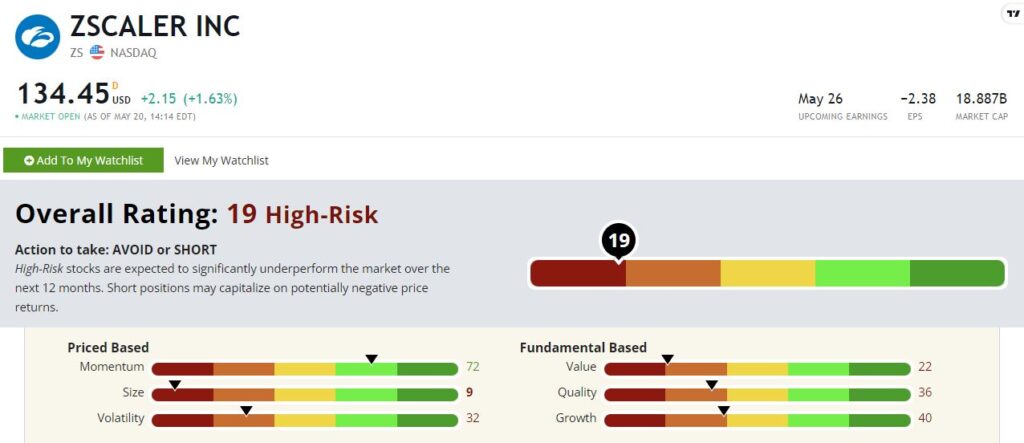

Take a look at Zscaler Inc. (Nasdaq: ZS), a popular cloud-based security company.

ZS rates a “High-Risk” 19 out of 100 on my Stock Power Ratings system. The shares have dropped by about 60% over the past six months, and they are still far from cheap, according to my value factor.

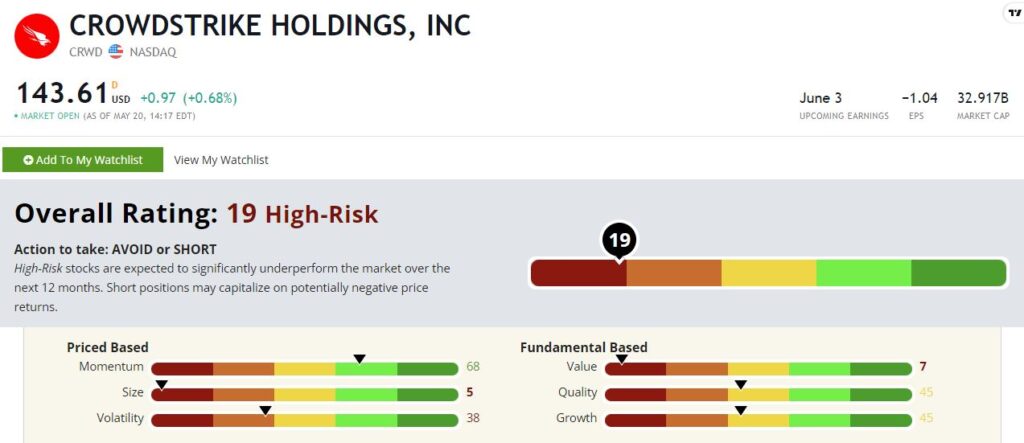

CrowdStrike Holdings Inc. (Nasdaq: CRWD), another popular play in the sector, doesn’t look any better.

The shares are down by about 50% since their November highs, and they aren’t showing any indication of bottoming.

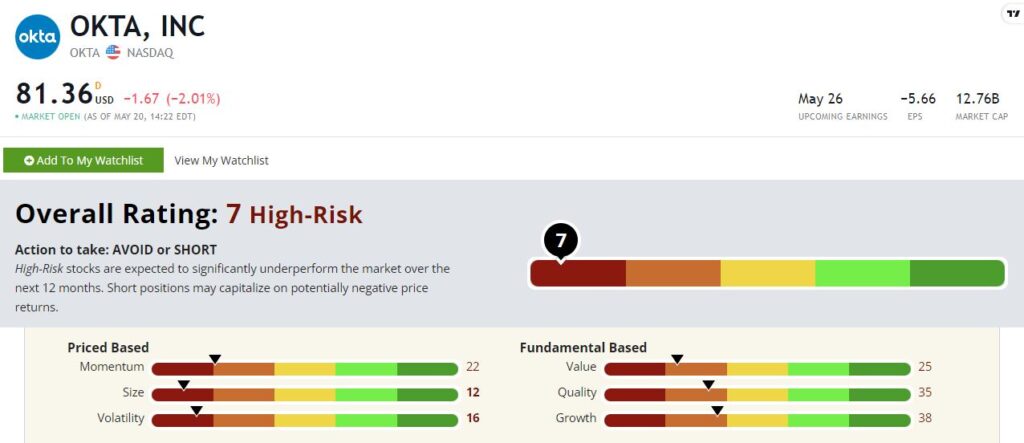

But if you think a 19 is nasty, just take a look at identity management and security company Okta Inc. (Nasdaq: OKTA). It rates a 7, meaning that 93% of the stocks in our universe of more than 8,000 rate higher. It doesn’t rate above a 40 on a single one of my six factors.

Now, I can’t speak for you, but no matter how much I believe in the cybersecurity mega trend, none of these popular options look worthy of our precious investment capital — even after these massive sell-offs.

But the good news is that I found a highly rated cybersecurity stock that is poised to crush the market in the months and years ahead.

It’s a leader in what is called “zero-trust” security, and my rating system scores it as “Strong Bullish.”

And I believe a certain X-factor will push this stock’s gains well beyond its peers.

To see what stock I’m talking about, you’ll have to join my premium stock research service, Green Zone Fortunes.

You can watch my “x.AI” presentation to see everything you’ll unlock by joining now.

You see, artificial intelligence (AI) is an important component of cybersecurity. Companies are developing complex systems to expose devious hackers.

But there’s a bigger sector that will benefit from the booming $80 trillion AI sector.

To good profits,

Adam O’Dell

Chief Investment Strategist