It was fun while it lasted…

The Federal Reserve’s response to the pandemic helped create a bubble in everything.

Tech stocks, meme stocks, bonds, bitcoin, even nonfungible tokens (NFTs) of bored monkeys… My nine-year-old son complains the price of Pokémon cards went through the roof. Alas, I’m no expert on the valuation of a vintage Pikachu card.

Any bubble fueled by extreme monetary policy is at risk of imploding when the easy money drains out of the system. That’s what we’re seeing today.

Markets are complex beasts. Why prices move isn’t always clear.

But it couldn’t be clearer this time around. The nutty market of the past few years was a result of the Fed spiking the punchbowl. What we are experiencing today is a wicked market hangover.

And there’s one popular investment that might need more time to recover: single-family home prices.

Home Prices in the Middle

With low mortgage rates and millions of Americans stuck at home desperate for more space, buying a house became a top priority during the pandemic.

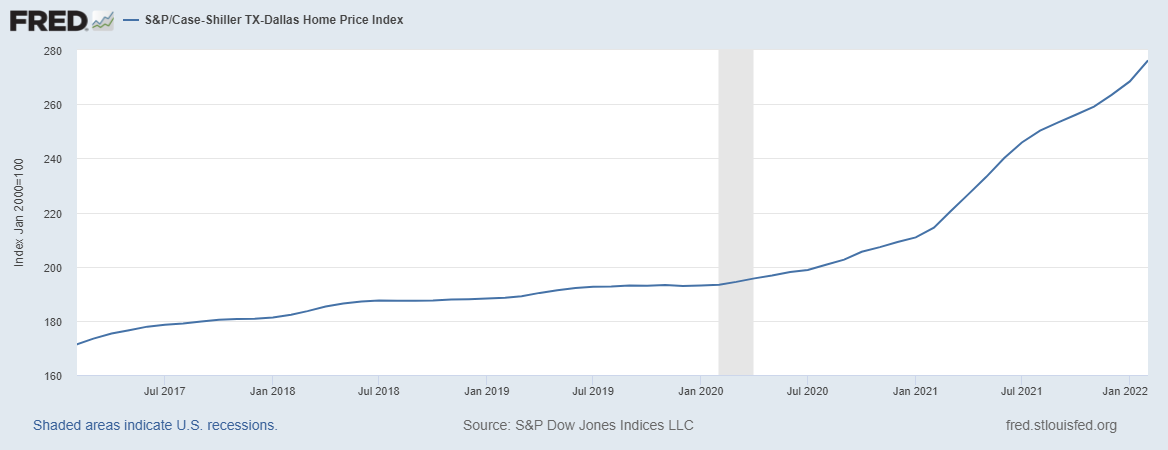

The Case-Shiller National Home Price Index is up 34% since the onset of the pandemic.

Prices in certain cities are even crazier. In my hometown of Dallas, prices are up 43% — in two years.

Case-Shiller National Home Price Index

Source: Federal Reserve.

A 43% home price spike in a city as large as Dallas is, shall we say, unusual.

Dallas isn’t a trendy resort town. It’s a large city dominated by suburban, single-family houses. Home prices rise at or around the rate of inflation in normal times.

After an epic rise in home prices, what happens next? Do home prices crater like everything else these days?

Maybe. But I wouldn’t be so sure about that.

2 Reasons Millennials Will Keep Home Prices High

Millennials — the generation everyone loves to make fun of — have grown up. They’re finally settling down, starting families and — yes — buying houses.

A recent poll by Bank of America found that two-thirds of millennials were “likely” to buy a home in the next two years.

Now, I wouldn’t fixate on the exact number. I would take this polling data with a grain of salt. A poll respondent might say they “intend” to buy a home, but that doesn’t mean they will or can. Still, the data gets more interesting the deeper you dig.

For a generation with a reputation for tilting at windmills, the millennials are practical.

Citing affordability, 80% of millennials indicated a preference for buying an older home and fixing it up rather than buying a brand-new home. And 75% of millennials start a home improvement project after buying a house.

Most interesting of all, a larger percentage of survey respondents said they were receiving financial support from others than in previous years.

If you’re wondering how millennials can afford homes at these prices … it appears many of them can’t. They’re getting help from their boomer parents or other avenues.

So, what’s the takeaway here?

Home Improvement Reboot

Don’t expect a collapse in home prices. Prices might level off or fall in some markets. But demand should be strong enough to keep the floor from falling out.

And with so many millennials looking for fixer-uppers, there should also be continued opportunities within home improvement stocks.

Bottom line: You don’t necessarily need to go run out and buy Home Depot Inc. (NYSE: HD) stock today. HD rates a mediocre 54 on our Stock Power Ratings system. But keep your eyes open for opportunities here.

This is a trend that has years left to run. As the market continues to melt down, I expect to find some real gems in the home improvement space in the months ahead.

To safe profits,

Charles Sizemore, Co-Editor, Green Zone Fortunes

Charles Sizemore is the co-editor of Green Zone Fortunes and specializes in income and retirement topics. He is also a frequent guest on CNBC, Bloomberg and Fox Business.