This year hasn’t been kind to the markets.

All three major indexes are up from their lows but remain in negative territory.

We’ve seen these market headwinds before — and we’ll see them again.

It’s inevitable that the market rebound will happen. When it does, you need to be ready for a huge run-up in stocks.

I’ll show you how markets always rebound and tell you about Sea Ltd. (NYSE: SE), a small tech company that soared after a similar downturn.

Then I’ll share how we can find these gems in market turmoil.

The Market Always Rebounds

Last week, the S&P 500 fell another 1.5%.

As noted in the chart below, January 3 was the last time the benchmark saw positive returns:

The S&P 500 is down 13.2% following last week’s drop. It fell as low as 17%, but rebounded a bit at the end of May.

We aren’t sure if this is a temporary recovery or a longer trend.

This isn’t the first time this happened. During the coronacrash of 2020, the Dow Jones Industrial Average fell 31.7% from its high to its low in just a month.

And after similar downturns in 2016 and 2018, here’s the key: The market always rebounded.

2018: Massive Rebound Followed 3-Month Market Crash

In late 2018, the market experienced a similar downturn to today.

You can see above that from October to December 2018, the S&P 500 dropped 14.8%.

We saw a few temporary recoveries before the market tanked in December.

After the drop in 2018 — like with previous market crashes — a massive rebound led to stocks rising higher than ever before.

Stocks rallied 40% from the end of the 2018 crash to the coronacrash of 2020. After that 2020 dip, stocks exploded.

The S&P 500 jumped 103.3% from the low of the 2018 crash to January 2022.

We’ve found a way to pinpoint individual stocks that will soar higher once the market has regained its footing. (I’ll tell you about that below.)

3 Mega Trends Helped SE Stock Crush Big Tech

In the run from 2018 to 2022, Big Tech companies, including Apple Inc. (Nasdaq: AAPL), Facebook parent Meta Inc. (Nasdaq: FB) and NVIDIA Corp. (Nasdaq: NVDA), ripped to new highs.

One digital company blew past the competition: Sea Ltd. (NYSE: SE).

SE participates in everything related to the digital space:

- Digital entertainment.

- E-commerce.

- Digital financial services.

Folks across Asia and Latin America use its digital entertainment platform, Garena, to access mobile and PC online games, as well as esports.

Created in June 2022.

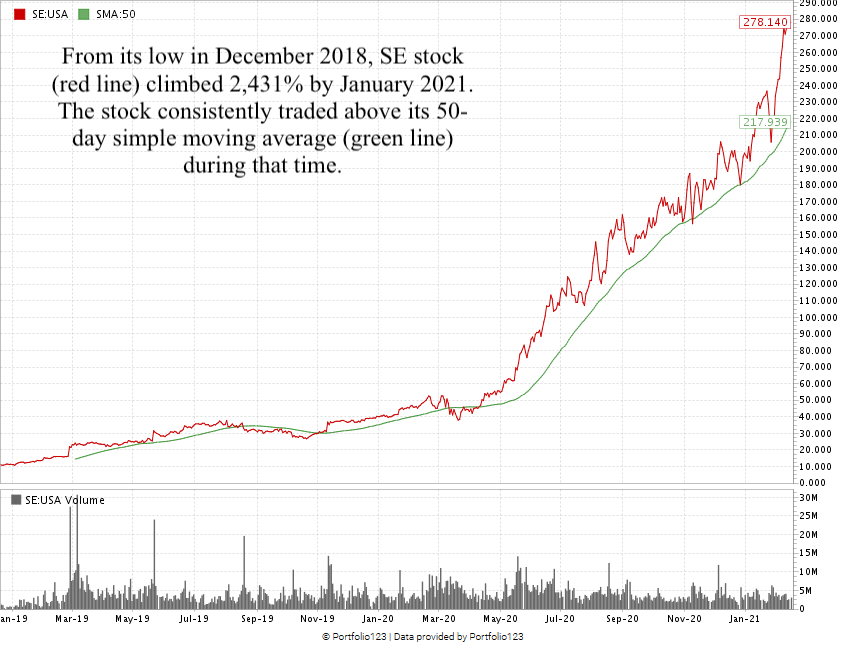

In December 2018, SE traded at just $10.84 per share.

During the market rally from 2018 to 2021, Sea’s share price ripped to $278.14 — a 2,431% climb!

Three mega trends boosted SE to blow past its peers:

- Fintech.

- E-commerce.

- Esports.

I know the market looks ugly right now, but that isn’t permanent.

The power of multi-decade mega trends means bumps in the road — like we see today in the market — won’t keep stocks like SE down for long. And they create opportunities to buy terrific stocks at unbelievable prices.

The key is spotting mega trends that will push stocks even higher once the recovery begins.

Don't Miss This Opportunity!

Bottom line: My colleague Adam O’Dell has identified a strategy to help you find profits as his highest-conviction stocks rip 1,000% higher off a downturn.

He, along with the rest of the Money & Markets team, is putting the finishing touches on a presentation that highlights this powerful strategy. Adam wants to help you turn $10,000 into $100,000 in only one year.

And we’ll have that presentation ready in two days! Click here to sign up to attend this free event on Thursday, June 9. You don’t want to miss it.

Remember, the market won’t be like this forever … and we’re already identifying the next mega trends that will produce more 10X gains in the future!

Click to get ready for Adam’s 1,000% strategy now.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He is a certified Capital Markets & Securities Analyst with the Corporate Finance Institute and a contributor to Seeking Alpha. Prior to joining Money & Markets, he was a journalist/editor for 25 years, covering college sports, business and politics.