I live in Florida, a state people flock to for sun, sand and an escape from their everyday lives.

I don’t get the travel bug quite as bad as some of my family back in West Virginia’s coal country.

My wife and I joke that we live on vacation!

But after two years of dealing with at least modest restrictions, tens of millions of Americans will travel for pleasure this summer — even with record-high gasoline prices.

My colleague and Green Zone Fortunes co-editor, Charles Sizemore, is insane. He’s taking his entire family of five to New York next month!

It should be a strong year for the travel industry. And after stocks have sold off to start the year, you might be looking for bear market buying opportunities.

(Note: For those of you looking for stocks to buy, click here to sign up for my upcoming presentation. At 4 p.m. EDT on Thursday, I’ll show you how I have perfected a system that will help me find this bear market’s next 1,000% opportunities.)

This downtrodden market is a chance to buy…

Despite that, I recommend you leave shares of American Airlines Group Inc. (Nasdaq: AAL) at home.

My proprietary Stock Power Ratings system will show you why.

American Airlines Can Meet Demand

American Airlines is the world’s largest airline in terms of passengers carried, fleet size and total passenger miles flown. It’s tied with Delta in terms of total revenue as of 2022.

Depending on where you live, it might be the only airline with regular service to your city.

That size and scope give American Airlines advantages that newer upstarts would need decades to match. And as travel roars back (our recent poll showed that 37% of respondents are getting out there), AAL’s well-established infrastructure helps it meet demand.

Unfortunately, none of this makes AAL a good stock to own right now.

AAL: A Travel Stock to Avoid

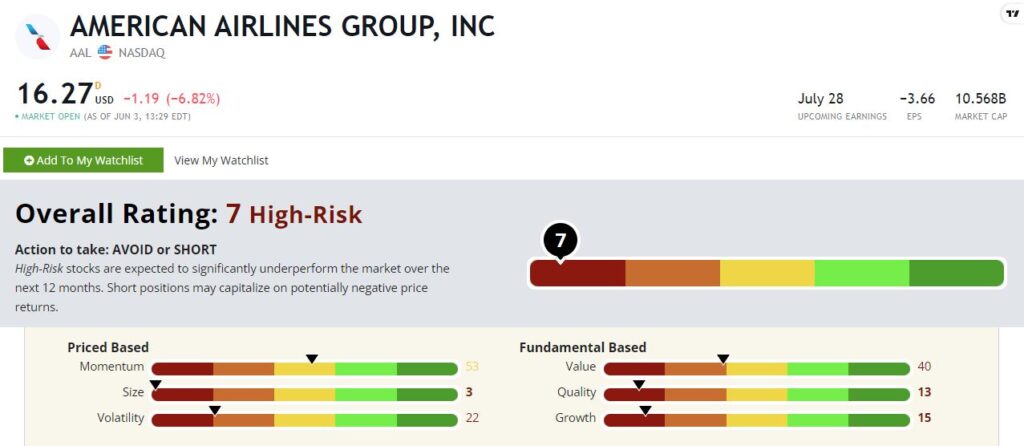

AAL rates a 7 out of 100 on my Stock Power Ratings system, putting it in “High-Risk” territory.

The story doesn’t get better as we dig deeper.

Momentum — American’s highest individual factor rating is momentum, where it rates an average 53. AAL’s momentum is in line with the broader market … in a year when the market has been in deep correction mode.

That’s not a strong endorsement.

Value — AAL rates a 40 on value, suggesting it’s more expensive than the broader market that long-time value investors still consider expensive.

AAL is a pricey stock in an overpriced market.

Volatility — As a general rule, I avoid stocks in the bottom quintile of my volatility factor. The most-volatile fifth (rated between 0 and 20) of all stocks are where I find the “high-beta bombs” that can wreck a portfolio.

AAL isn’t far from high-beta territory with a volatility factor rating of 22. I wouldn’t bank on that number improving much (if at all), due to American’s cyclical profitability.

Growth — Air travel is a mature and cyclical industry. All of this was true before the pandemic turned the world upside down. AAL rates an uninspiring 15 here.

Quality — Not only is this a mature industry, it’s also brutally competitive with perpetual labor conflicts and commodity price risk exposure. It’s a rough industry to navigate in the best of times.

My quality factor is based on profitability and balance sheet strength. AAL has neither on a consistent basis. It rates a 13 on my quality factor.

Size — To top it off, American Airlines is a large stock with a market cap (current share prices times number of outstanding shares) of over $10 billion.

We can’t even depend on a small-cap bounce with AAL. It rates a 3 on my size factor.

Takeaway for AAL + a 1,000% Opportunity

As I said before: I expect this to be a great summer for travel.

But my proprietary Stock Power Ratings system is sending a clear signal:

Stay away from American Airlines’ stock!

As I mentioned before, this bear market is an opportunity to buy.

My Stock Power Ratings system offers a way to find stocks that are set to crush the market by up to 3X over the next couple of years.

But the core of this system drives a brand-new strategy I have for this bear market.

It will help me find opportunities to 10X your money as certain stocks get set to rocket 1,000% higher out of the bear market. I’m talking about a chance to turn $10,000 into $100,000 in just 12 months.

This is my most powerful profit-producing system to date.

And I will reveal all the details on Thursday at 4 p.m. EDT.

Click here to put your name on the VIP guest list.

I can’t wait to show you more on Thursday.

To good profits,

Adam O’Dell

Chief Investment Strategist