If this were any “normal” time, we’d be able to buy safe bonds and collect enough income on our nest egg to fund our retirements. Unfortunately, this is the “new normal” where the Fed is not the friend of us current and hopeful retirees.

Fed Chair Jerome Powell is afraid for his job, which means he’s going to cut rates and keep them low for a long time. This means we must look beyond traditional bonds for meaningful income.

What about blue chip dividend-paying stocks? Well, an 11-year stock market rally has ruined that idea. Anyone putting new money in a pricey dividend aristocrat is “buying and hoping” that the stock continues to levitate while the firm dishes its dividend.

And about that dividend. Blue chips don’t pay more than 2% or, at most, 3% today. On a $1 million portfolio that’s less than $30,000 in annual income. Not enough to retire on.

Fortunately, there’s a better way. I’ve developed the Perfect Income Portfolio to safely double, triple and even quadruple the payouts on your 2% payers. You can turn these misers into 6%, 7% and even 8% yields (for $80,000 on that million bucks) without doing anything risky.

And oh by the way, you can grow your capital base, too. Whether it’s $250,000, a million or $2.5 million (or anywhere lower, higher or in between) you can bank these big yields and enjoy price appreciation to boot.

How do I know? Because we’ve done it. In the four years I’ve been managing our Perfect Income Portfolio, our investors have enjoyed 11.4% returns per year since inception. This means they’ve collected their 6%, 7% and 8%-plus cash yields while enjoying additional price appreciation on their investments.

Our “secret” has been three safe-yet-lesser-known income vehicles. Their obscurity creates opportunity for us contrarian income seekers. I’ll explain by showing you how we buy bonds for less than their face value.

Perfect Income Vehicle No. 1: Buy $1 in Bonds for Less

Many investors believe bond ETFs are a convenient way to add a basket of bonds to their portfolio. Problem is, they’re not getting any deals buying them.

ETFs never trade at discounts. Their sponsors simply issue more shares to capitalize on any increased demand, which means anyone who buys one of these popular vehicles always pays list price.

But we don’t have to pay full price for a bond — ever. Which is why we should look past ETFs and consider underappreciated closed-end funds (CEFs) instead.

The “closed” in CEF means that the fund’s pool of shares is fixed. Which is why these vehicles can have wild price swings above and below the values of their actual assets (good for us contrarian income seekers — we can buy below fair value to maximize our yields and upside).

They are also “closed” in their actual communications with the financial world. Fund information is often limited (sometimes to one-page fact sheets) and it’s difficult to get management to talk to you (also good for us, because it makes bargains more prevalent in this “mysterious” corner of the income world, especially for us persistent types).

Plus, we can hire the best bond managers on the planet to handpick our bond buys for free.

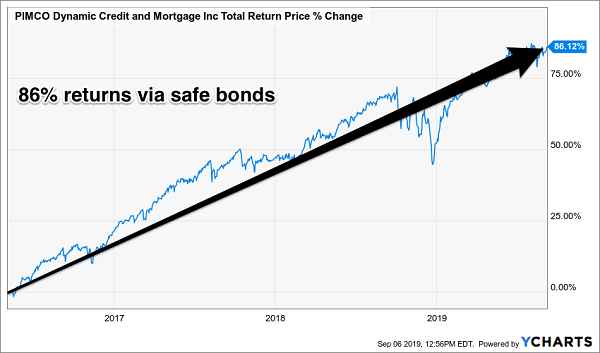

Take the PIMCO Dynamic Credit and Mortgage Income Fund (PCI), the vehicle run by Dan Ivascyn, the heir apparent to “Bond King” Bill Gross.

PCI’s bond holdings are a bit obscure (47% mortgage debt, for example). But there are deals to be had and that’s exactly why we hired Ivascyn to search the globe for us for big fixed-income payments. He’s the man in Bondland and often gets the first phone call on new juicy deals. You and I can’t buy these bonds as individual investors, but the bond god can buy them for us.

My income subscribers have indeed enjoyed 86% total returns (including dividends) courtesy of Ivascyn’s PCI.

It’s Good to Be the (New) King

And they make CEFs in more traditional bond flavors, too. Some provide you with ways to trade in your mere “common” shares for preferred stock that pays more.

Perfect Income Vehicle No. 2: One-Click to Double Your Yields

Not familiar with preferred shares? You’re not alone — most investors only consider common shares of stock when they look for income. But you can double your yields or better and actually reduce your risk by trading in your common shares for preferreds.

A company will issue preferred shares to raise capital, just as it offers bonds. In return it will pay regular dividends on these shares and, as the name suggests, preferred shareholders receive their payouts before common shares.

They typically get paid more and even have a priority claim over common stock on the company’s earnings and assets in case something bad happens, like bankruptcy. They are “preferred” over common stock and come after secured debt in the bankruptcy pecking order.

So far, so good. The tradeoff? Less upside. But in today’s expensive stock market that may not be a bad substitution to make. Let’s walk through a sample common-for-preferred exchange that would nearly double your current dividends with a simple trade-in.

As I write, the common shares from JPMorgan (JPM) pay 2.8%. But the firm recently issued Series DD preferreds paying 5.75%. JPMorgan shareholders looking for more income may be happy to make this trade-off.

Meanwhile, Bank of America (BAC) common pays 2.6% today. But BofA just issued some preferreds that pay a fat 5.88%. That’s a 194% potential income raise for shareholders who want to trade in their garden-variety shares. But how exactly do we buy these as individual investors? Which series are we looking for again?

A big problem with preferred shares is that they are complicated to purchase without the help of a human broker. So, many investors attempt to streamline their online buys and simply purchase ETFs (exchange-traded funds) that specialize in preferreds, such as the PowerShares Preferred Portfolio (PGX) and the iShares S&P Preferred Stock Index Fund (PFF).

After all, these funds pay up to 5.8% and, in theory, they diversify your credit risk. Unfortunately, many ETF buyers have little understanding of preferred shares, let alone how a particular fund invests in them. Should we entrust the selection of preferred shares to a mere formula baked into an ETF?

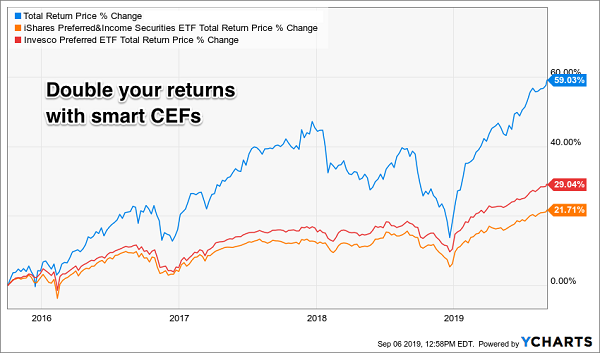

Again, no. Another problem with the ETF model is that it doesn’t account for credit risk as accurately as an expert human can. Which means a better idea is — you guessed it— to find an active manager to handpick your preferred your portfolio. Buying a discounted closed-end fund (CEF) is the best way to do this.

Here’s a Perfect Income Portfolio favorite outperforming its more popular ETF cousins since we bought the CEF in late 2015:

Why We Prefer CEFs

When we’re shopping in the preferred aisle, it’s a “no brainer” to go with the CEF concierge service. They yield more, they appreciate in price more and again, the money manager is free when we buy at a discount.

Perfect Income Vehicle No. 3: Doubling Your Money with Dividends

We’re going to switch gears and jump into stocks. But don’t worry, these aren’t the overpriced, underpaying blue chips that the Wall Street fanboys push. No, these are hidden gems that get no coverage from the (lame) mainstream financial media.

We can thank the giant firms that manage most of the investment money in the U.S. for these bargains being available. Think Wells Fargo, Morgan Stanley, Merrill Lynch, your neighborhood Edward Jones and even Fidelity, Schwab and Vanguard.

These firms serve hundreds of thousands of clients, with millions and millions of dollars, around the country and the world. They offer the same approaches for people of similar situations, which means they can only buy stocks which there are “enough of” (have enough liquidity) for everyone.

That means one simple thing. The familiar names can’t recommend our high-income producers to you. Instead, they stick you in pretty much what everyone has.

Apple has a market value of just over $1 trillion again, as of today, and shares yield just 1.5%. Convenience, familiarity and liquidity come at the expense of the stock’s current payout.

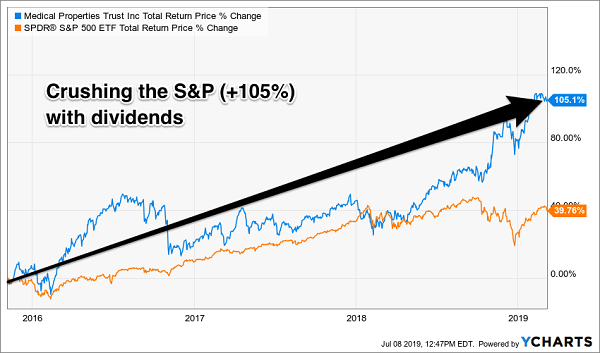

Let’s contrast Apple with hospital landlord Medical Properties Trust (MPW). The firm pays a generous 5.4% on capital you invest today, 3.5 times as much as Apple. And its focus, the hospital, is arguably even more indispensable than the iPhone (which does have competition from Samsung and others).

But MPW the stock isn’t large enough for the big pension funds to buy or for the brand-name money managers to pile into. With a modest market cap of $7 billion, MPW is plenty liquid for you and me — and exclusive enough to provide us with this generous yield premium.

Plus, just like Apple, it raises its dividend every year. And dividend growth is, over the long haul, the main driver of higher stock prices. We added MPW to our Perfect Income Portfolio stock in November 2015 and received three dividend raises over the ensuing three-and-a-half years. The result? We enjoyed 105% total returns and really crushed the broader S&P 500:

Perfect Income Vehicle No. 3: Dividends with 100%-plus Upside

The Perfect Income Portfolio also adds years to our lives. We don’t need stock prices to stay high to retire. Most investors who sell shares for income spend their days staring at every tick of the markets.

You can live better than this, generate more income and even enjoy more upside by employing our contrarian approach to the yield markets. We live off dividends alone, and we buy issues when they are out-of-favor (like right now) so that our payouts and upside are both maximized.

To learn more about generating monthly dividends as high as 8%, click here.

• This article was originally published by Contrarian Outlook. You can learn more about Brett Owens and Contrarian Income Report right here.