After living in South Florida for 10 years, I’ve developed ground rules to survive the blistering summer heat as best I can:

- Start early. If you want to do something outside, get up and get out.

- Channel your inner camel and drink tons of water.

- Invest in sun hats and a good reflective sun umbrella. I’ll trade looking goofy for not being cooked alive.

- Get your A/C serviced before it’s too late. (Learned this one the hard way!)

With these guidelines, I’ve managed to find a sweaty summer groove.

Speaking of sweat … this is setting up to be the most punishing summer ever. The world just recorded its hottest day on average, and scientists expect it to only get worse as global warming and the El Niño weather phenomenon converge.

And that’s got me thinking about ways to use Adam O’Dell’s proprietary Green Zone Power Ratings system to find stocks that could benefit during the heat wave and beyond.

So find some shade and read on…

A Cool Start

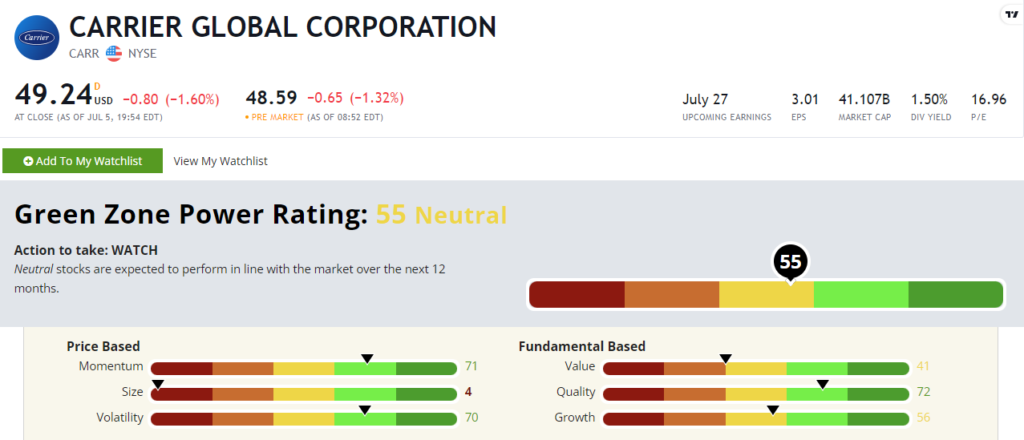

What better place to start than one of America’s largest heating and air conditioning companies, and one that’s headquartered right up the road from me: Carrier Global Corp. (NYSE: CARR).

But if you’re looking to crush the market with an HVAC stock, CARR is a pass, according to Green Zone Power Ratings.

Carrier stock rates a “Neutral” 55 out of 100 in Adam’s system. Neutral stocks are set to follow the market — up or down — over the next 12 months.

CARR has gained more than 35% since this time last year, which shows why it scores a 71 on the Momentum factor.

But there are signs Carrier’s rally is petering out. A low Value score of 41 shows that investors have bid up CARR’s price beyond its true value.

And while it posted revenue growth of 13% to $5.2 billion for the first quarter compared to first-quarter 2022, net income and net profit margins fell more than 70%. That’s reflected in CARR’s 56 rating on Growth.

After looking over CARR’s Green Zone Power Ratings, I’m putting this one on my watchlist. A hot summer should be a nice tailwind, but maybe there’s a better play out there

Energy Co. Runs Out of Steam

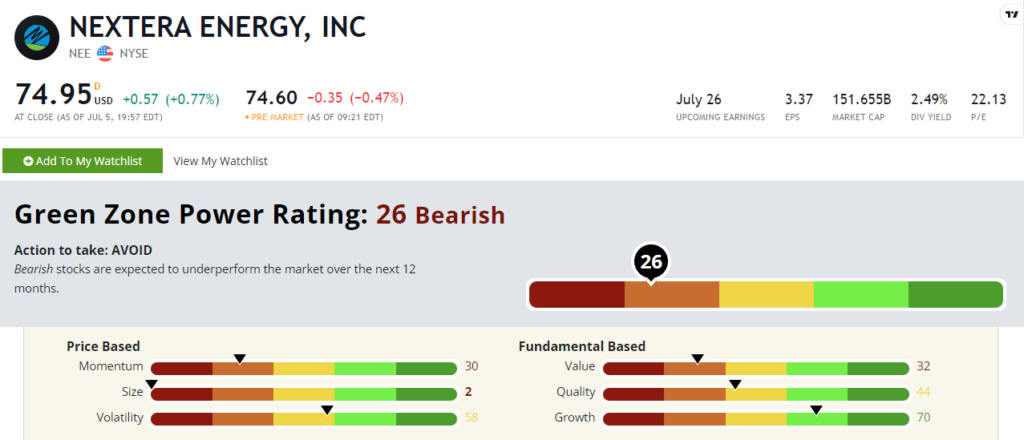

Moving on to another company that’s in my backyard, let’s look at NextEra Energy Inc. (NYSE: NEE).

Why NEE? One of its subsidiaries, Florida Power & Light, is working overtime this summer to make sure businesses and households alike get the power they need to keep those A/Cs running. I’m already seeing the damage as my power bill climbs in tandem with the blistering temperatures.

But Green Zone Power Ratings shows that may not be enough for NEE…

NextEra stocks rates a “Bearish” 26 in Adam’s system, which means it should underperform the broader market from here.

This is a massive company. Its market cap is just under $150 billion, which is why it rates a 2 out of 100 on Adam’s Size factor. Large stocks historically underperform smaller stocks with similar ratings on the five other factors in Green Zone Power Ratings.

And after NEE soared almost 100% higher during the COVID bull market, the bottom has fallen out again. Year to date, it’s down 11% while the broader S&P 500 has gained 15%. We like to find stocks with a confirmed uptrend before buying. NEE isn’t that with its 30 rating on Momentum.

(If you want to learn about Adam’s highest-conviction energy stock recommendations, click here.)

That’s two stocks that Green Zone Power Ratings says to pass on for now.

Let’s move further south to find a stock for the summer heat wave.

1 Stock Is Still Strong Bullish

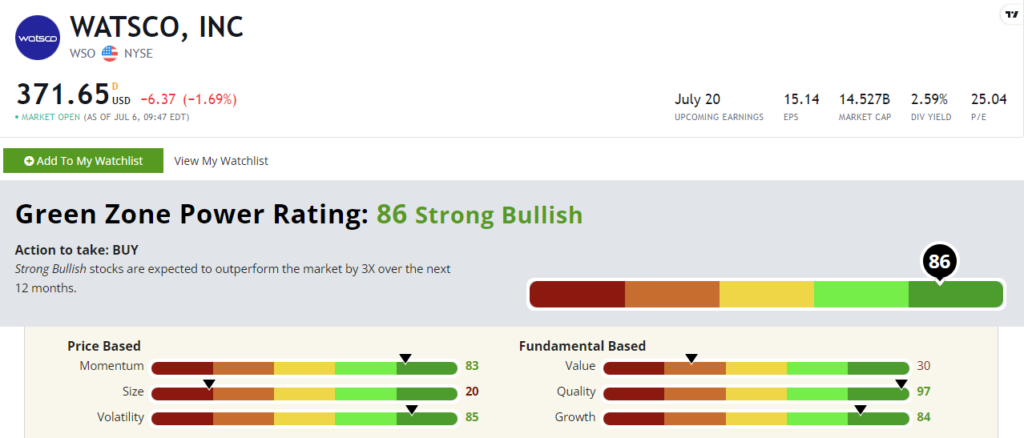

Watsco Inc. (NYSE: WSO), a Miami-based HVAC and refrigeration distributor, was not the first stock to pop into my head when I started researching for this piece.

Our chief research analyst, Matt Clark, wrote about WSO almost a year ago when it showed up on his Green Zone Power Ratings scan.

And it’s still in the “Strong Bullish” zone of Adam’s system.

With a rating of 86 out of 100, Watsco stock is expected to outperform the broader market by 3X over the next year.

WSO still sports strong ratings on the Quality (97) and Growth (84) factors. That means it’s bringing in revenues and maintaining a strong balance sheet to support its stock price.

But I want to focus on Watsco’s Momentum and Volatility. Since Matt wrote about WSO back in August 2022, the stock has steadily climbed more than 28% higher.

How did the S&P 500 do over that time frame? It gained 6%.

That means WSO crushed the broader market by more than 4X!

Do you need more proof that Green Zone Power Ratings works?

Until next time,

Chad Stone

Managing Editor, Money & Markets

P.S. NextEra is just one of almost 2,000 companies that have landed on Adam’s “Blacklist” of stocks that rate poorly in Green Zone Power Ratings.

These are the stocks that are set to underperform the broader market … the stocks you don’t want in your portfolio. Click here to see how you can gain access to the full list.

The best part is that Adam updates this database every week so that you know when new stocks turn “Bearish” or “High-Risk.”

Click here so that you can protect your portfolio from the next NEE.