At some point, the global markets will return to normal and that’s why you need to know the three stocks set to surge in 2020.

The coronavirus wreaked havoc on global markets, pushing them deep in to bear market territory and economies at or near recession levels.

Social distancing, work-from-home measures and overall fear pushed investors out of the stock market and into things like gold and bonds.

But markets are cyclical and will rebound.

When they do, you want to know the three stocks set to surge in 2020.

For this, you want to seek out stocks that pay a dividend — and a good one. Additionally, you want to find companies with large market capitalization because those companies can weather market turmoil better than most.

Then, you need to see what the company’s price is compared to its cash flow. The lower, the better.

3 Stocks Set to Surge in 2020

1. American International Group

Market Capitalization: $23 billion

Dividend Yield: 4.82%

Price to Cash Flow: 2.31

One of the world’s biggest insurance and financial services is the American International Group (NYSE: AIG).

It operates in more than 130 countries and serves commercial and individual clients.

For most of 2019, AIG was cruising along, trading relatively flat to its 52-week high of more than $58 per share.

However, when the coronavirus took its toll on the market, AIG tumbled nearly 65% in the share price. It has since started to rebound along with the rest of the equities, but it still has a long way to reach that $53 mark.

Because it’s in insurance and finance, companies like AIG generate a lot of cash. Its price to cash flow is 2.3, meaning it is bringing in enough to continue paying a strong dividend.

Its last dividend payment was $0.32 per share in March 2020, giving it an annual yield of 4.82% — which is really strong.

AIG also has strong value. Its price to earnings is 7.2 and its price to sales is 0.5. Couple that with a price to book of 0.4 and AIG remains currently very undervalued by investors.

However, a strong cash ratio makes American International Group one of the three stocks set to surge in 2020.

2. Best Buy Co.

Market Capitalization: $17 billion

Dividend Yield: 3.33%

Price to Cash Flow: 6.84

Best Buy Co. (NYSE: BBY) is one of the biggest retailers for consumer technology products.

On top of that, the company also has a wide range of repair services for the products it sells.

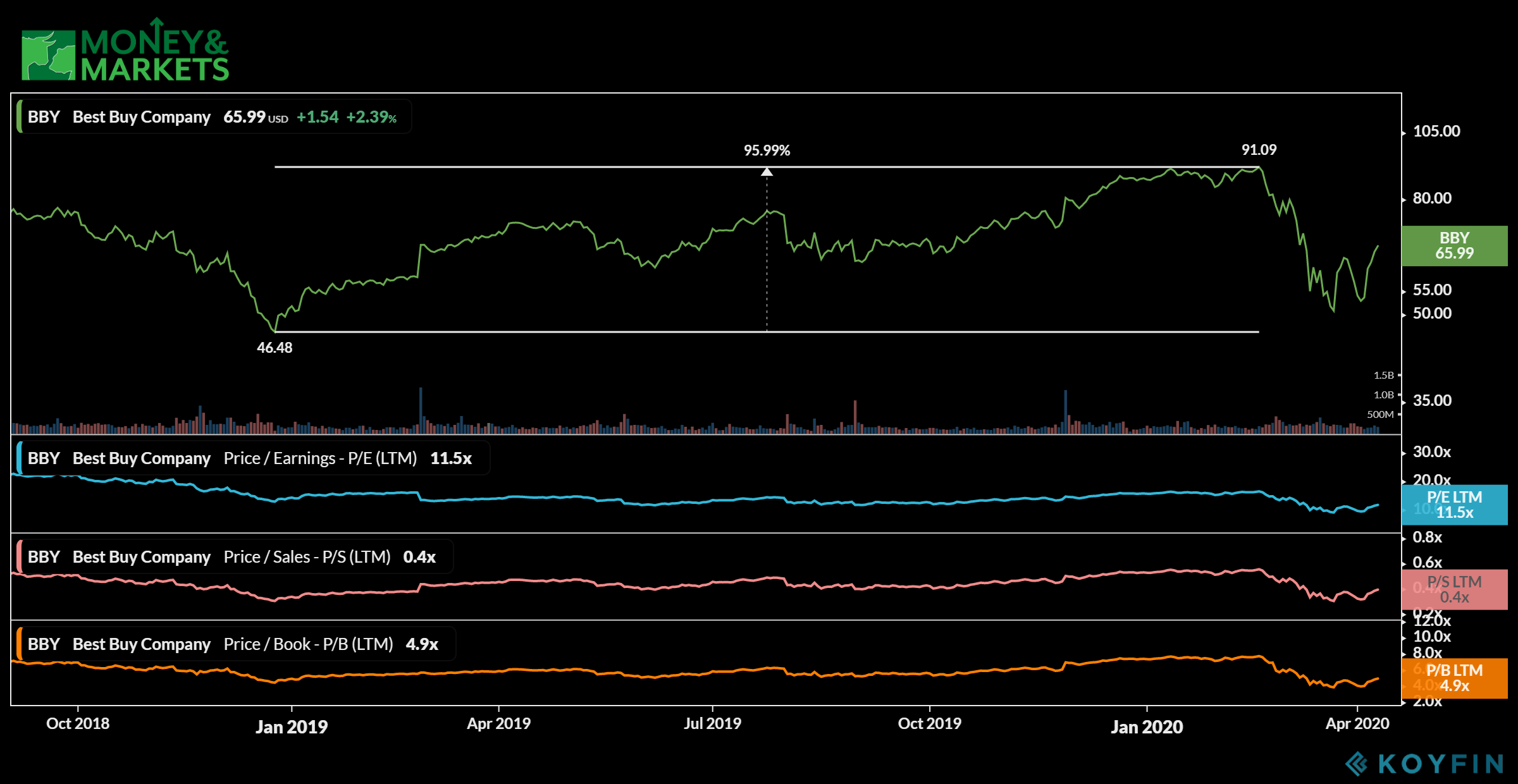

After hitting a 52-week low of $46 per share in December 2018, Best Buy surged to gain more than 95% to a 52-week high of $91 in February 2020.

Like AIG, it suffered a strong decline in March but has also started to rebound. It’s still trading 27% lower than that February high.

Best Buy does have a higher price-to-cash-flow ratio than AIG — 6.84 — but it’s still below the S&P 500 average of 14.

The company’s price to earnings is also a bit higher at 11.5, but still in a good range. Best Buy is currently trading with a price to sales of 0.4 and a price to book of 4.9. That means the value of the stock is still good.

Another strength is its dividend. Its most recent dividend was $0.55 per share, giving it an annual yield of 3.33%. With a strong price to cash flow, that dividend should continue.

That’s what makes Best Buy Co. one of the three stocks set to surge in 2020.

3. Hewlett Packard Enterprise Co.

Market Capitalization: $13 billion

Dividend Yield: 4.56%

Price to Cash Flow: 2.7

The last company on our list is Hewlett Packard Enterprise Co. (NYSE: HPE).

It was a spinoff of the Hewlett-Packard Co. in November 2015. The company deals with software and even financial services. In fact, its financial services division recently launched a $2 billion coronavirus “payment relief” program for its customers.

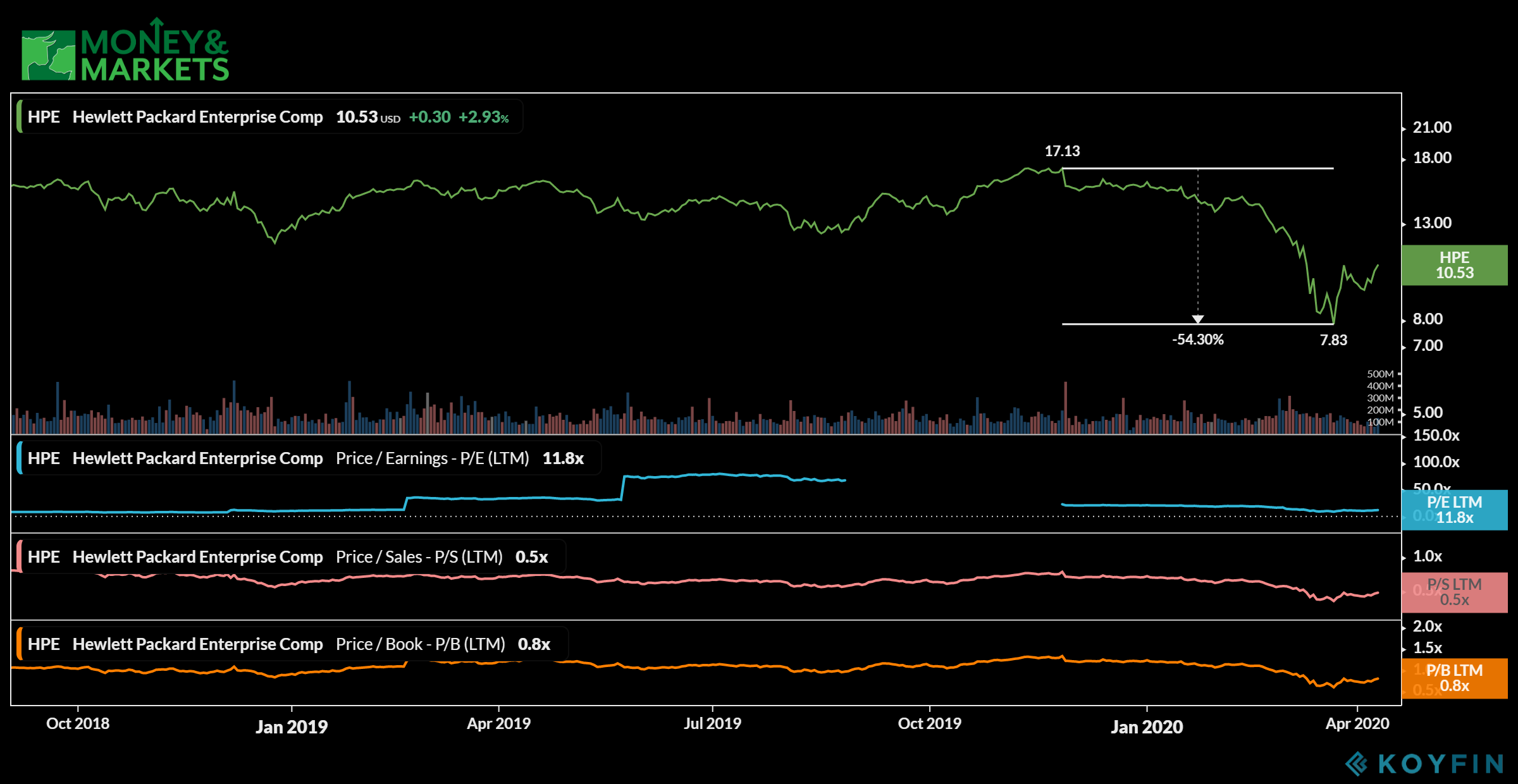

HPE shares hit a high of $17 back in November 2019 but retreated to around $8 per share — a 54% drop — into February 2020.

Since hitting that 52-week low, however, the stock has started to climb back, but its still well-below that 2019 high.

Because of its market diversity, Hewlett Packard has a solid price to cash flow of 2.7. That should help preserve the company’s annual dividend yield of 4.56%.

Its value also gives it room to grow with a price to earnings of 11.8, price to sales at 0.5 and price to book at 0.8.

That value and dividend makes Hewlett Packard Enterprise Co. one of the three stocks set to surge in 2020.

The biggest thing all three of these companies have in common is their strong cash flow. That helps ensure investors will keep getting those dividend payments.

As markets emerge from the coronavirus panic, consumers will start to operate as normal — buying goods and services. Because these are all top companies in their sectors, that should lead to even bigger margins and dividends.

That’s why these are the three stocks set to surge in 2020.