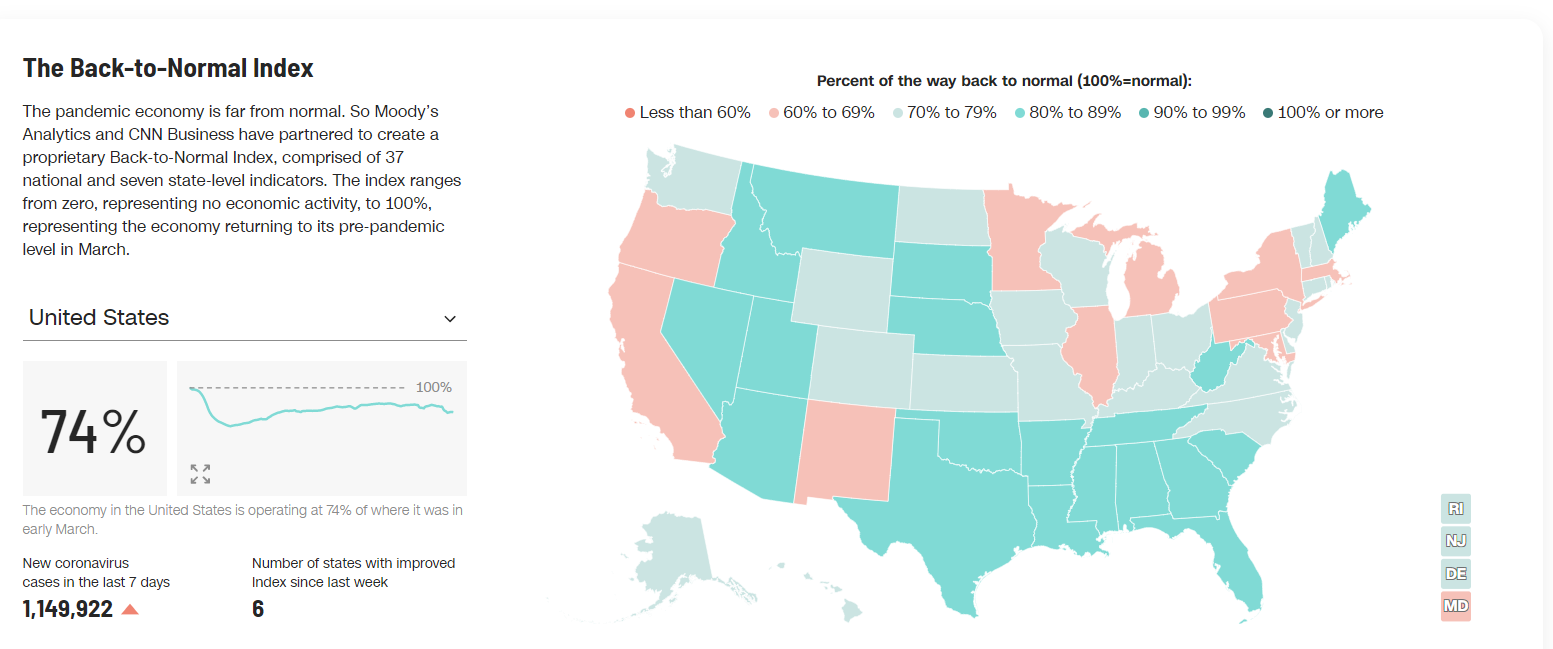

Based on some data, the United States is making great progress in getting back to normal.

CNN’s back-to-normal index stands at 74%. But, as the map below shows, the recovery is uneven.

Source: CNN.

Unequal Economic Recovery Has Leaders

This map holds information that might be surprising to some. South Dakota and Florida lead the recovery, with each state being more than 85% back to normal.

These two states have attracted a great deal of media attention for outbreaks. Less often mentioned is the fact that the states have been aggressively reopening businesses.

Lagging states include California and New York, which are just two-thirds of the way back to normal by CNN’s measure. Other laggards include Illinois and Pennsylvania.

As a country, full recovery depends on those laggards. The states that remain the farthest from normal are among the largest in terms of economic output.

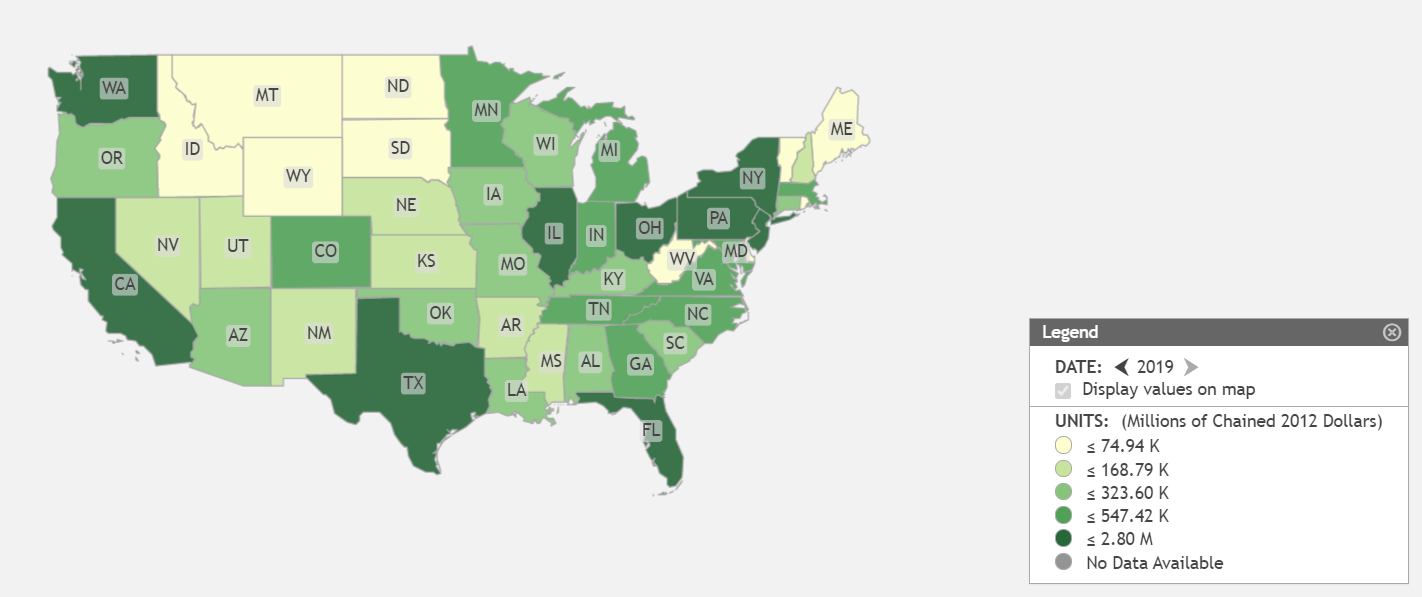

2019 Total Real GDP by State

Source: Federal Reserve.

Full Return Hinges on Laggards

In terms of GDP, California is the largest state. It accounts for nearly 15% of the country’s GDP. Texas ranks a distant second at about 9%.

Together, California, New York, Illinois and Pennsylvania represent almost one-third of the country’s GDP. All four are far behind the leaders on the road to recovery.

As a whole, the U.S. cannot get back to its pre-recession level without these four states. Yet these states have strict restrictions on businesses, and all except New York have below-average vaccination rates.

This represents a significant challenge for the economy and the stock market. The pace of recovery in the largest states could determine the trend in the stock market, and the uptrend in the stock market depends on getting back to normal.

It’s possible that larger states — which have stumbled thus far — could turn around in the short run. If they do, the high valuations of the stock market are justified.

Given the record so far, investors should consider the risk that New York and California will continue to weigh on the economy in 2021 and begin taking profits.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.