Interest rates on 10-year Treasurys topped 1%, raising concerns that inflation is returning.

Interest can be considered as compensation for a loan. The lender should receive a return on their investment, compensation for any loss of buying power due to inflation and a provision for risk of default.

Many consider Treasury notes issued by the U.S. government to be free of default risk. Interest on Treasurys includes only a return on investment and a factor to overcome losses due to inflation.

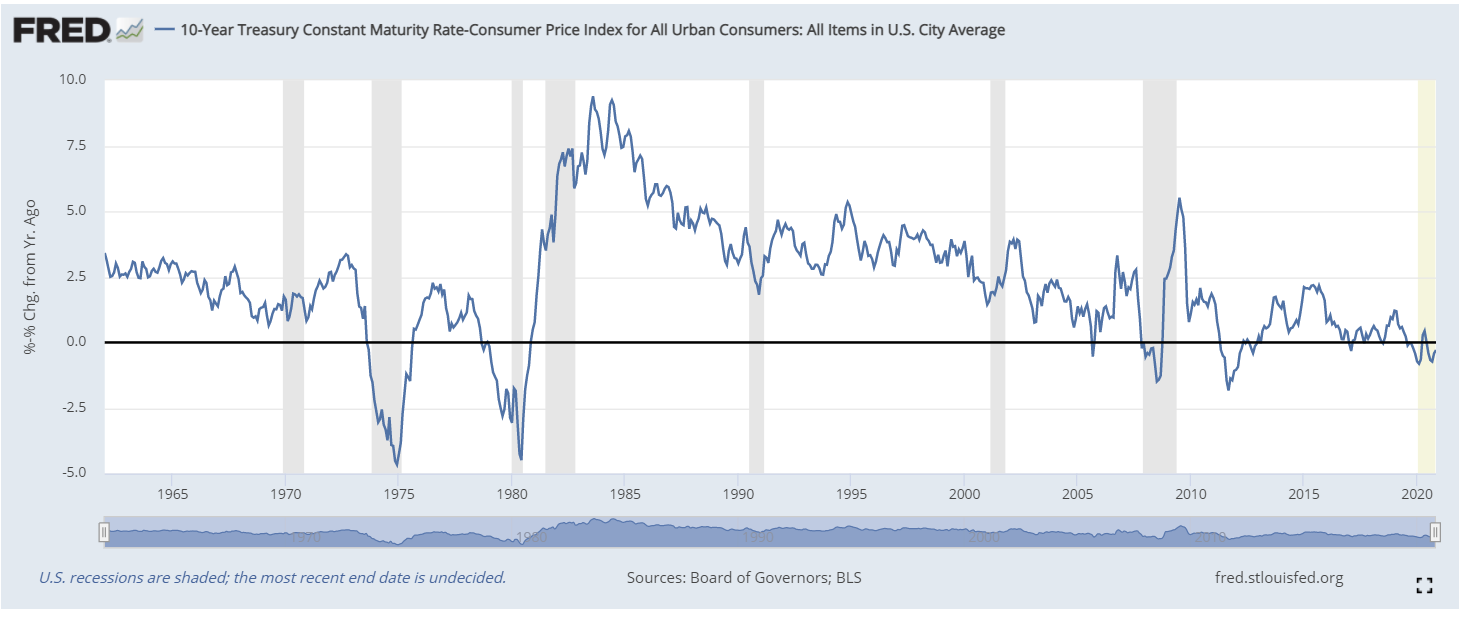

Returns on investment are found by subtracting the rate of inflation from the current yield — known as the “real rate.” With inflation above 1%, the real rate for 10-years is negative.

The history of real rates is in the chart below.

10-Year Treasury Real Rates

Source: Federal Reserve.

Treasurys Could Signal Inflation

Negative real rates carry important implications.

Foreign investors may not find Treasurys to be attractive with negative rates. The risks of inflation are real, and that means investors would suffer a loss of buying power when the 10-year reaches maturity.

Under normal market conditions, rates would rise to allay these fears. In the current market environment, rates are unlikely to rise. The Federal Reserve is likely to intervene to hold rates at low levels.

But, the Fed cannot stop inflation. Negative rates could lead to a weaker dollar as dollar holdings, in general, lose their appeal to foreign investors. A weaker dollar could make commodities more expensive — leading to higher inflation and even more negative rates. That’s exactly what happened in the 1970s and early 1980s.

Negative rates don’t always signal inflation, but they did in the 1970s. At that time, the United States experienced a rare bout of double-digit inflation as oil prices surged.

With oil prices rising, real rates in negative territory and Democrats controlling Washington, it’s possible to see a repeat of the 1970s.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.