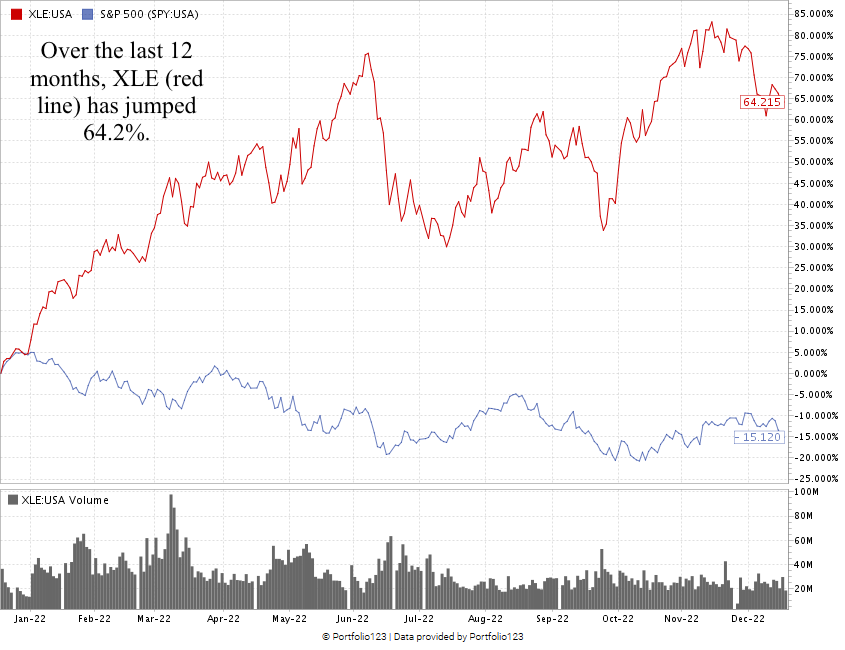

Over the last 12 months, energy stocks are head and shoulders above the rest of the market.

The energy sector has blown away the broader S&P 500. Just look at the chart below:

Created in December 2022.

The Energy Select SPDR Fund (NYSE: XLE), a fund that tracks the overall sector, is up more than 64% over the last 12 months.

The broader S&P 500 (blue line in the chart above), on the other hand, is down 15.1% over the same time.

Using Adam O’Dell’s proprietary Stock Power Ratings system, I’ve identified the five energy stocks to watch now.

5 Energy Stocks for 2023

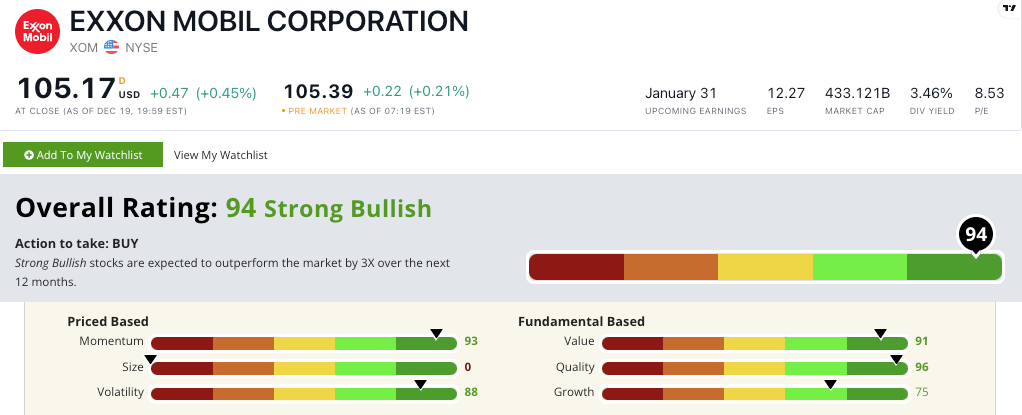

1. ExxonMobil (NYSE: XOM)

ExxonMobil is one of the world’s largest publicly traded oil and gas companies.

The company operates in more than 70 countries and has a market capitalization of over $433 billion.

ExxonMobil is a diversified energy company, with operations in upstream, downstream and chemical businesses.

And ExxonMobil looks like a strong energy stock for your investing in 2023.

XOM scores a “Strong Bullish” 94 out of 100 on our Stock Power Ratings system. We expect it to beat the broader market by 3X in the next 12 months.

It scores the highest on our quality factor.

XOM’s returns on assets, equity and investment are all higher than the integrated oil and gas industry average.

The stock is also a strong value with price-to ratios right in line with its industry peers.

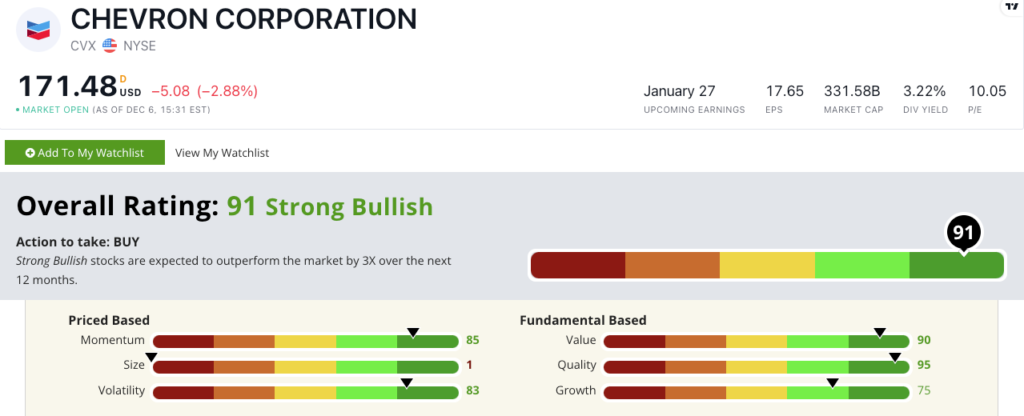

2. Chevron (NYSE: CVX)

Another big oil mega-cap stock is Chevron.

It operates in more than 80 countries and has a market capitalization of over $328 billion.

Chevron is also a diversified energy company, with operations in upstream, downstream and chemical businesses.

And Chevron stock mirrors XOM on many factor ratings.

CVX scores a “Strong Bullish” 91 out of 100 on our Stock Power Ratings system. We expect this energy stock to beat the broader market by 3X in the next 12 months.

Like XOM, Chevron earns its highest factor rating on quality.

CVX also has returns and margins right at, or slightly higher than, the industry average.

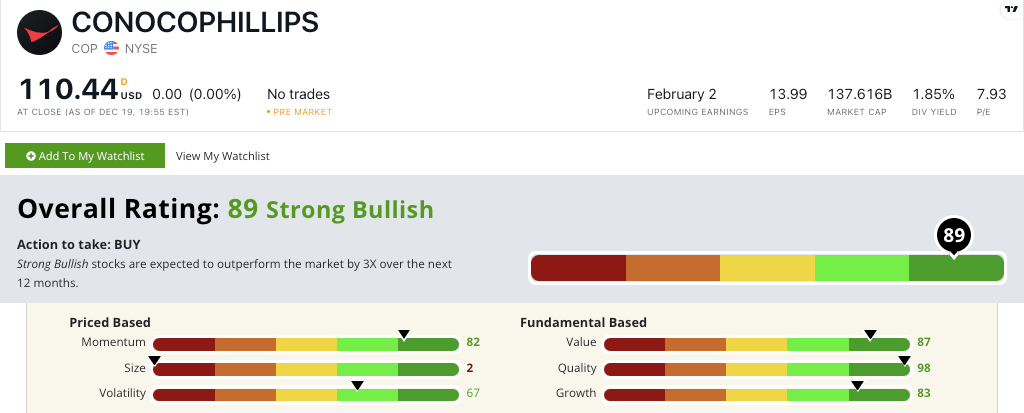

3. ConocoPhillips (NYSE: COP)

I’m spotting a trend here…

ConocoPhillips operates its oil and gas empire in more than 30 countries.

It’s slightly smaller, with a market capitalization over $137 billion.

ConocoPhillips focuses on exploration and production activities in both the upstream and downstream segments of the oil and gas industry.

And COP stock is also “Strong Bullish.”

COP scores an 89 out of 100 on our Stock Power Ratings system. We expect it to beat the broader market by 3X in the next 12 months.

While scoring the highest on our quality factor, COP’s returns on assets, equity and investment are all higher than the industry average.

What’s more, its net and operating margins are also stronger than its industry peers.

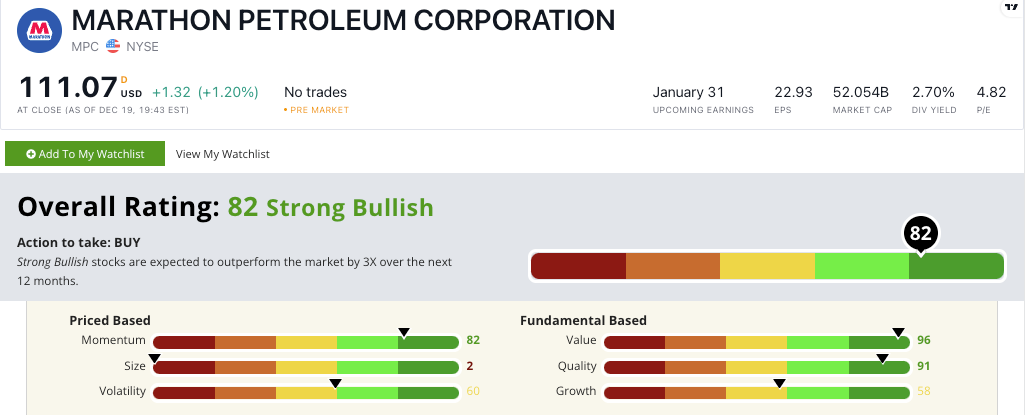

4. Marathon Petroleum (NYSE: MPC)

Keeping with the big oil trend, Marathon Petroleum is a publicly traded oil refining and marketing company with operations in the United States, Canada and the Caribbean.

The company has a market capitalization of over $51 billion.

Marathon Petroleum is one of the largest refiners in the U.S., with the capacity to process more than 2 million barrels per day.

MPC scores a “Strong Bullish” 82 out of 100 on our Stock Power Ratings system. We expect it to beat the broader market by 3X in the next 12 months.

Unlike the previous stocks on our list, MPC earns its highest rating on our value factor.

Its price-to-earnings are less than half its peer average. Its price-to-sales, book and cash flow are all lower than its downstream energy competitors.

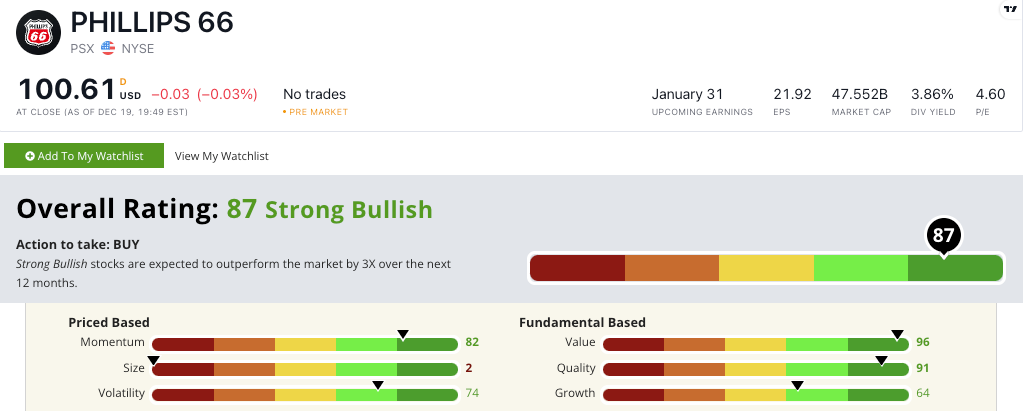

5. Phillips 66 (NYSE: PSX)

Phillips 66, with a market cap of more than $47 billion, refines oil and markets its products in the U.S., Europe, Asia and Australia.

Phillips 66 competes with Marathon on the refining front, but its capacity is at 1 million barrels per day.

PSX scores a “Strong Bullish” 87 out of 100 on our Stock Power Ratings system. We expect it to beat the broader market by 3X in the next 12 months.

Like MPX, Phillips 66 earns its highest factor rating on value.

PSX’s price-to-earnings, price-to-sales and price-to-book value stand well below the downstream energy industry average.

The bottom line: Energy is having a tremendous run … especially oil stocks.

All of these companies rate well on our Stock Power Ratings system.

That’s what makes them the five energy stocks to watch in 2023.

Of course, my colleague Adam O’Dell has something even better for you in the energy sector.

He’s targeting a super bull in oil with one stock.

And he sees it gaining 100% in 100 days once things get underway in earnest.

If you want to know why, click here to sign up for his upcoming presentation.

This is one of your last chances to sign up before he tells all on Wednesday.

So click here to add your name to his guest list now.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He is a certified Capital Markets & Securities Analyst with the Corporate Finance Institute and a contributor to Investing.com. Before joining Money & Markets, he was a journalist/editor for 25 years, covering college sports, business and politics.