NextEra Energy Inc. (NYSE: NEE) is one of the top energy companies in the world. How does NextEra Energy stock rate?

Today, we are going to look at the company’s history, give you reasons why you should or should not invest and dive into our proprietary Stock Power Ratings system to learn more about NEE.

If you’re thinking about investing in NextEra Energy stock for 2023, here’s what you need to know.

NEE’s History and Structure

NextEra Energy was founded in 1984 as a subsidiary of Florida Power & Light.

The company provides electricity to customers throughout the United States and Canada, with operations primarily located in Florida and Texas.

In addition to its regulated electric utility business, NextEra also owns and operates non-regulated businesses including power generation, transmission and fuel supply.

This diversified portfolio makes it one of the largest energy companies in North America.

Is NextEra Stock a Buy?

NextEra has experienced significant growth due to its strategic investments into renewable energy sources such as solar and wind power.

These investments have helped it lead the way towards a more sustainable future while also providing investors with strong returns on their investments.

The company is also well-positioned to take advantage of any new regulations or incentives that may be passed by governments looking to move toward clean energy sources.

Additionally, NextEra has consistently increased its dividend payments over the past few years — making it an attractive option for income seekers.

Risks Involved With Investing in NextEra Stock

While there are many benefits associated with investing in NextEra stock, there are also risks involved.

For example, changes in government policies could significantly impact its overall business strategy as well as its stock price.

Additionally, volatility within energy markets can cause significant fluctuations in share prices — which could be detrimental for investors who don’t have a long-term time horizon for holding NextEra stock.

Finally, investing in stocks always carries some risk regardless of how strong or stable the company may be — so investors should always exercise caution when investing their hard earned money into any type of security or asset class.

NEE Stock Power Ratings

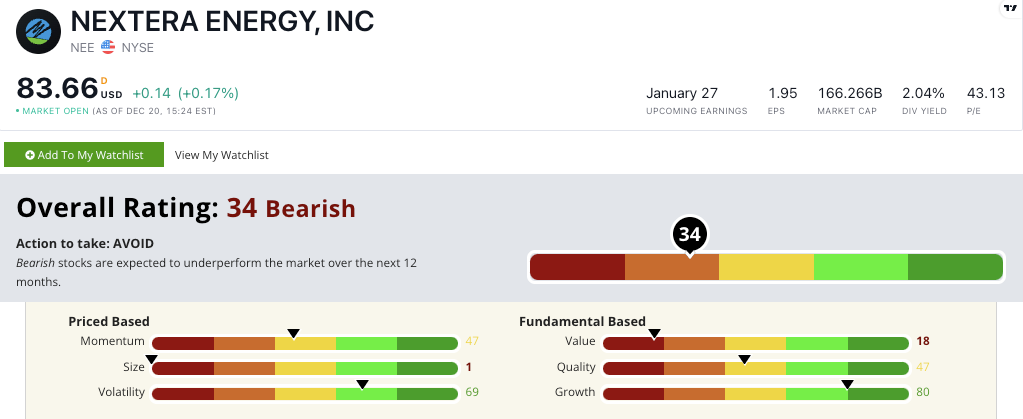

NEE stock scores a 34 out of 100 on our proprietary Stock Power Ratings system.

This means we are “Bearish” on the stock and expect it to underperform the market over the next 12 months.

NEE earns an 80 on our growth factor.

This is in large part due to a one-year annual sales growth rate of 24.5% and a prior quarter earnings-per-share growth rate of 278.2%.

However, NEE takes a hit on our value factor … scoring an 18.

Its price-to-earnings ratio is three times higher than its industry average and its price-to-cash flow ratio is more than double the average.

The bottom line: Investing in NextEra Energy stock can be an attractive option for those looking for both short-term profits and long-term value appreciation potential from an established company that is at the forefront of renewable energy technology development and implementation.

However, there are risks associated with any investment so it’s important that you do your research. Check our Stock Power Ratings system before making any decisions about where you should invest your money now or in the future.