Pension Partners’ Charlie Bilello says there are five different types of stock market bounces, and if you can tell the good kind from the bad, you’ll do just fine. For those of you who can’t, here’s a quick and handy little guide to hopefully get you over the hump.

At the beginning of the week, the stock market had gotten so bad in October that all of the year’s gains had been wiped out. And then on Tuesday, the buying began before spilling over into Wednesday. As of Thursday afternoon, the markets are modestly up again with the S&P 500 and Dow Jones both up .8 percent, and the Nasdaq surging 1.5 percent shortly after lunch time on the East Coast.

So what kind of bounce is this?

Per MarketWatch:

The Last Hurrah

Bulls are hoping that this isn’t the one. The textbook example of this took place in 2007, when the August low turned into a 15% bounce for the S&P that took the index back to record highs in October. Stocks didn’t hit another high again until 2013, suffering a nasty 57% bruising along the way.

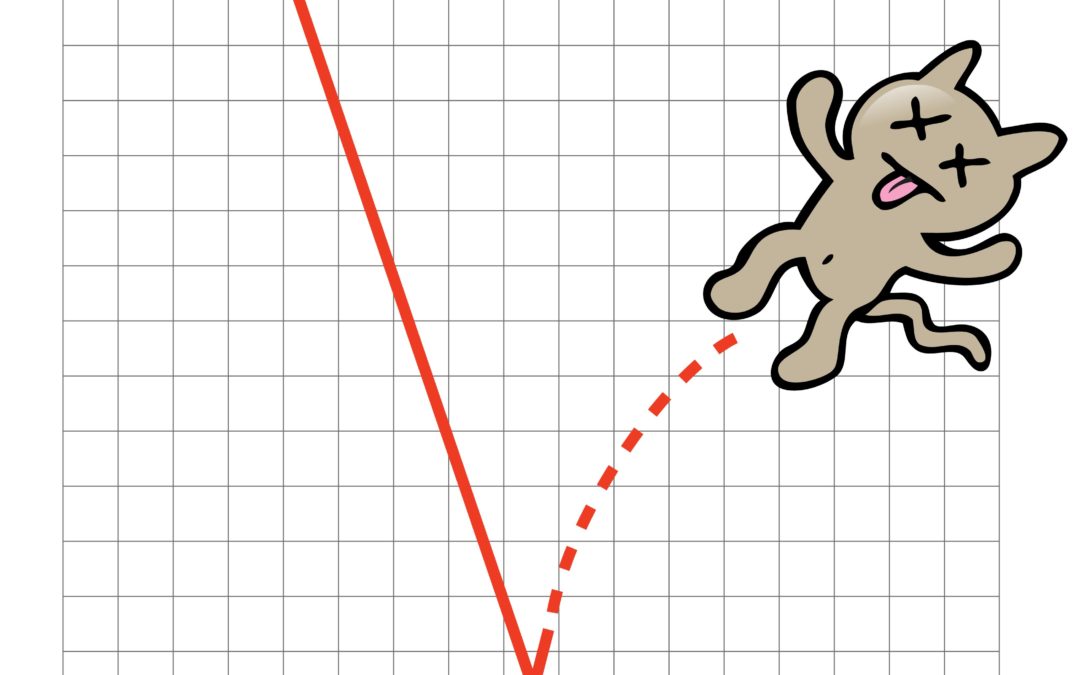

The Dead Cat

The bane of day traders everywhere — every one of them has endured a dead-cat misfire at some point. Bilello pointed, as an example, to January 2008, when the S&P dropped to “oversold extreme” levels and bounced 13% from its early-year low to a May high, “fooling many into believing that the cat who bounced after hitting the ground was alive and well.” Less than a year later, and the broad market gauge had lost more than half its value.

The Falling Knife

This one is no walk in the park, either. The idea here, of course, is that trying to time a market rebound can be brutal. “What they never tell you is how to differentiate between a falling knife and one that has already hit the ground,” Bilello wrote. He used an example from Sept. 29, 2008, when the S&P was at “oversold extreme” and was down 30% from its October 2007 high. Worst must be over, right? It fell another 32% over the next two months amid daily “oversold extreme” readings.

The Holy Grail

Sorry, guys, but this one’s off the table. These are those wonderful gifts that arrive at the end of bear markets and enrich those savvy — or lucky — enough to get in on the upside action. “In March 2009, we saw a series of these extremes,” Bilello said, “after which the market never looked back.”

The BTFD

Anybody who’s paid any attention to the market action over the past decade knows all about the “buy the f—ing dip” approach. It’s been one of the most effective strategies during this bull market, where nearly every decline has been met with an immediate return to new highs. Until now.

So which one does Bilello believe we should expect from here?

“The best we can say is that extreme oversold conditions tend to lead to above-average forward returns with a higher probability of a positive outcome than other periods,” he wrote. “But these are just probabilities — there are many, many exceptions. Will the current reading fall into the ‘tend to’ category or the ‘exception’ category?”