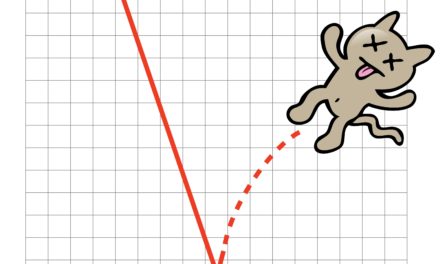

October clocked in as the worst month for the S&P 500 since September of 2011, but a rally on Oct. 29 helped avert an official correction, meaning a slide of 10 percent or more. The Nasdaq also entered correction territory before rebounding to finish 9.9 percent lower than it’s Aug. 29 record high.

But after October’s massive selloff, are investors ready to jump back on the stock market bandwagon after the it posted its best two-day performance since February, rising a total of 2.71 percent Tuesday and Wednesday?

Bloomberg columnist Robert Burgess seems to think so.

Per Bloomberg:

What’s notable is that the gains, in the wake of a nasty sell-off that left equities on the cusp of a correction, aren’t coming with the usual caution from prominent Wall Street strategists about “dead cat bounces.” Instead, they are expressing a remarkable sense of enthusiasm.

First, JPMorgan Chase & Co.’s all-world analyst Marko “Gandalf” Kolanovic issued a report Tuesday talking up the possibility that the October “rolling bear market” turns into a “rolling squeeze higher” into the end of the year. Then on Wednesday, Fundstrat Global Advisors’ Tom Lee — another analyst known for making exceptionally timely calls — went even further. He wrote in a research note that “the potential for a violent upside rally is substantial.”

Much of Kolanovic’s thesis focuses on the likelihood of a surge in company buybacks pushing stocks higher, while Lee is more technical in his assessment.

As Lee points out, returns over the following three and six months — when the markets have become as “oversold” as they are now — have averaged 13 percent and 19 percent, with positive gains in eight of nine cases. Cynics might say that now would be the perfect time to sell given such unbridled optimism among strategists.

China a New Source of Optimism?

There are suddenly better feelings on the stock market regarding China, the world’s second-largest economy, after U.S. President Donald Trump tweeted about a conversation between he and China President Xi Jinping.

“Just had a long and very good conversation with President Xi Jinping of China. We talked about many subjects, with a heavy emphasis on Trade. Those discussions are moving along nicely with meetings scheduled at the G-20 in Argentina. Also had a good discussion with North Korea!” Trump tweeted Thursday morning.

Trump’s tweet undoubtedly helped send the S&P up 18 points, the Down up nearly 200 points and the Nasdaq up 72 points just before lunchtime on the East Coast.

Xi later said he is willing to meet with Trump during the G20 meeting Nov. 30 to Dec. 1 in Buenos Aires, Argentina. If the two sides can come to an agreement regarding trade, a whole lot more people will be jumping back on Wall Street’s bandwagon.

Just had a long and very good conversation with President Xi Jinping of China. We talked about many subjects, with a heavy emphasis on Trade. Those discussions are moving along nicely with meetings being scheduled at the G-20 in Argentina. Also had good discussion on North Korea!

— Donald J. Trump (@realDonaldTrump) November 1, 2018