Last week, I mentioned that I’d been holding back in our Thursday issue of What My System Says Today…

The key takeaway was that the S&P 500 is not the end-all, be-all. There are so many fantastic stocks to buy out there. Why should they be limited to 500 out of thousands of tickers?

Well, today, I have two “New Bulls” watchlists for you to peruse …

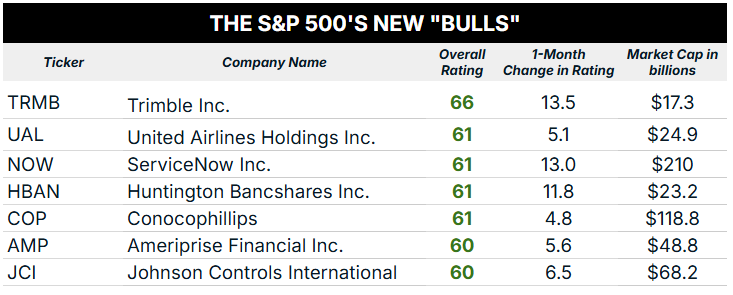

One includes seven stocks from the S&P 500 index.

The other includes no fewer than 52 (!) stocks from outside the index.

Let’s get right to it…

The S&P 500’s “New Bulls”

First, we’ll start with the S&P 500 large-cap stocks we typically do …

These “New Bulls” stocks are now poised to outperform the market by 2X to 3X based on our standard criteria:

- The stock must currently rate 60 or higher (that is, “Bullish” or “Strong Bullish”) in my Green Zone Power Rating system.

- The stock must have been rated less than 60 for each of the last four weeks.

In short, these seven stocks were rated “Neutral” or worse … but now are rated “Bullish” or better:

Let’s have a closer look at these large-cap “New Bulls”…

Stuck in “Neutral”

To start, we have a wide range of sectors and industries showing up on this week’s “New Bulls” list:

- We have the energy sector represented with ConocoPhillips (COP).

- The financial sector also makes an appearance with Regions Financial (RF), Huntington Bancshares (HBAN) and Ameriprise Financial (AMP).

- ServiceNow (NOW) and Trimble Inc. (TRMB) are our newest bulls in the tech sector.

- Johnson Controls International (JCI) comes from the industrials sector.

These are just a selection of the stocks we’re seeing across a wide range of sectors and industry groups …

All told, to see stocks across multiple sectors entering the “Bullish” zone of my Green Zone Power Rating system is encouraging for the broader bull market.

I’ve hammered on it quite a bit recently, but the more trading “breadth” we see across multiple sectors, the better. It means investors are feeling confident in the market and are branching out instead of just buying a “Magnificent Seven” ETF and hoping tech fervor continues. That strategy worked wonders during last year’s NVDA-driven AI bull market, but we’ve seen the Mag 7 hit plenty of headwinds in 2025.

The other thing I will note here is that we have quite a few stocks on this week’s list that have been trading at a “Neutral” rating for a while now. You can see that in the 1-month change in rating column. Stocks like COP, UAL, AMP and JCI, to name a few, have essentially been floating right below the “Bullish” threshold for the last month, just waiting for that bullish pop.

This is where I would say not to be dismissive of a stock just because you see it has a “Neutral” rating, especially in more bullish markets. By definition, these are stocks that are set to track the broader market — so if the S&P 500 goes “up and to the right,” there’s a good chance the stock in question will follow suit.

If you’re a paid-up Green Zone Fortunes member, you can even add stocks to your own watchlist. Look for this button on our homepage:

Go ahead and add some “Neutral” stocks to your own watchlist and see where their ratings go in the following weeks. You might pinpoint one of our “New Bulls” before we do!

And if you want to see how you can access this watchlist feature, as well as my high-conviction monthly stock recommendations and my Green Zone Power Rating system, click here now.

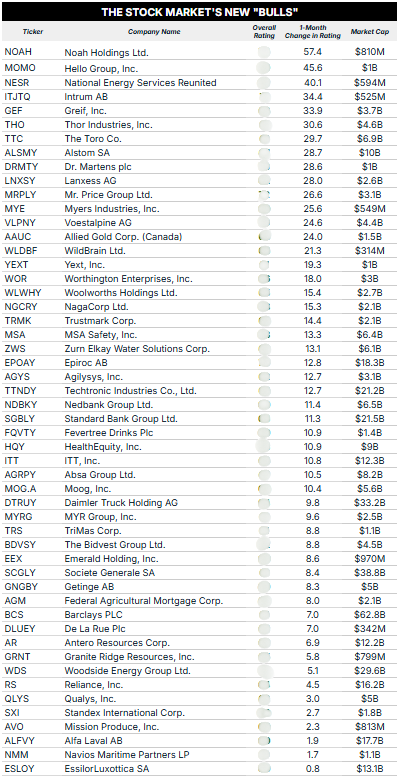

Next, let’s turn our attention to the 52 “New Bulls” that aren’t members of the S&P 500 index…

As you can see, the list is long.

This, we believe, demonstrates two key things:

- There is a trove of high-potential opportunities outside the major large-cap indexes.

- You might, maybe kindly suggest, benefit from the Money & Markets team helping you hand-select some of the best ones.

The list below is sorted by each stock’s rating change over the past month. For instance, Noah Holdings (NOAH) saw its Green Zone Power Rating increase an incredible 57 points over the last four weeks, to a solidly “bullish” rating of 73 currently.

But there’s another, more highly-rated stock on this list that, incidentally, Matt Clark and I just made an official recommendation on in our Green Zone Fortunes PRO service.

See, we’re happy to serve you valuable “watchlists” of stocks in this free publication. But our hand-picked recommendations are reserved for paid-up subscribers.

Click here to learn how you can level up and gain access today.

Now, without further ado … your complete list of 52, outside-the-S&P 500 “New Bulls”:

To good profits,

Editor, What My System Says Today