Today, let’s talk about getting the best of both worlds.

For some, an example is working from home. You get to stay home and make money at the same time.

When investing, the best of both worlds is a growing stock with a strong dividend.

It’s rare, but I used Chief Investment Strategist Adam O’Dell’s six-factor Green Zone Ratings system to find a company that is exactly that.

I’ll get to that in a bit.

First, let’s look at the growing sector this company is in to find out why this stock will beat overall market gains by three times over the next 12 months.

Semiconductor Sector Forges Ahead

Every smart device you have in your home (smartphones, tablets, computers and even smart televisions) have one thing in common.

They all connect to the internet.

In order to do that, these devices need circuits that can send and receive radio waves. And those circuits can’t work without semiconductors.

With the surge of 5G technology, every device that runs on the 5G network needs new semiconductors.

Semiconductor companies stand to gain a significant amount of sales and customer base as the 5G revolution continues to grow.

Global Semiconductor Industry to Jump 34% by 2024

With that kind of a rise in the industry, companies that supply semiconductors and products that support their use will see a big boom in revenue … and share price.

AVGO: This 5G Dividend Stock Leads the Pack

One of the biggest players in the semiconductor space is Broadcom Inc. (Nasdaq: AVGO).

It has a market cap of $185.7 billion and develops software and hardware devices that connect using Bluetooth®, the internet and cellular signals.

Its revenue was $20.8 billion in 2018, but it is forecasted to reach more than $27 billion by 2022.

Broadcom Inc. Revenue to Grow 31% by 2022

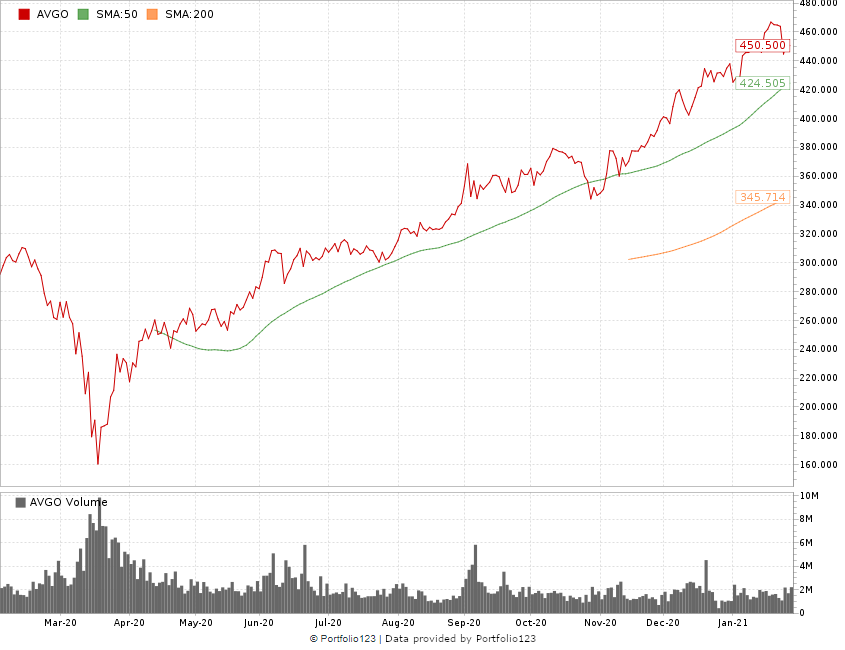

Strong sales projections have benefitted Broadcom’s stock price.

The stock hit a low of around $160 in March 2020 during the COVID-19 crash but to the price is above $460 per share now.

AVGO Stock Up 188% Off March Lows

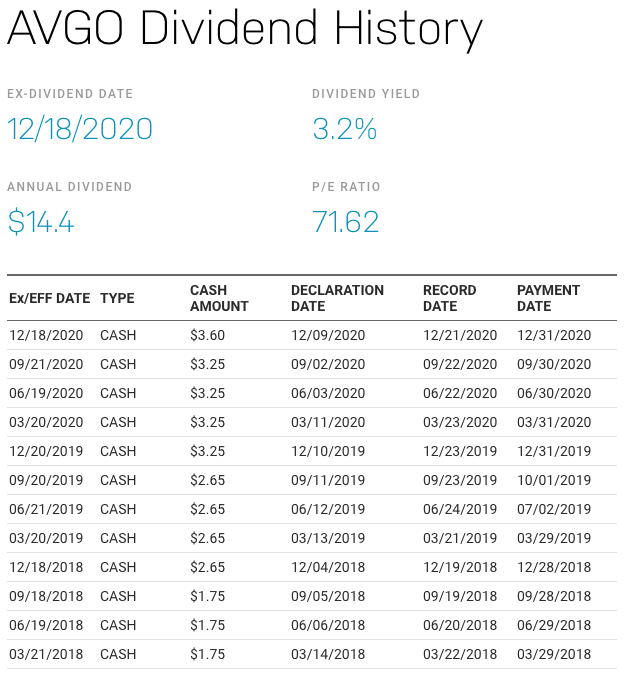

Now, the “best of both worlds” factor here is Broadcom should capitalize on the rise in the semiconductor market while paying a handsome dividend.

The company has a 3.2% dividend yield, and they have consistently raised their dividend payout over the last decade.

Broadcom Paid at Least a $3.25 Dividend in Each Quarter of 2020

While the stock is a little pricey, that dividend payout is handsome, especially when compared to yields on bonds.

AVGO’s Green Zone Story

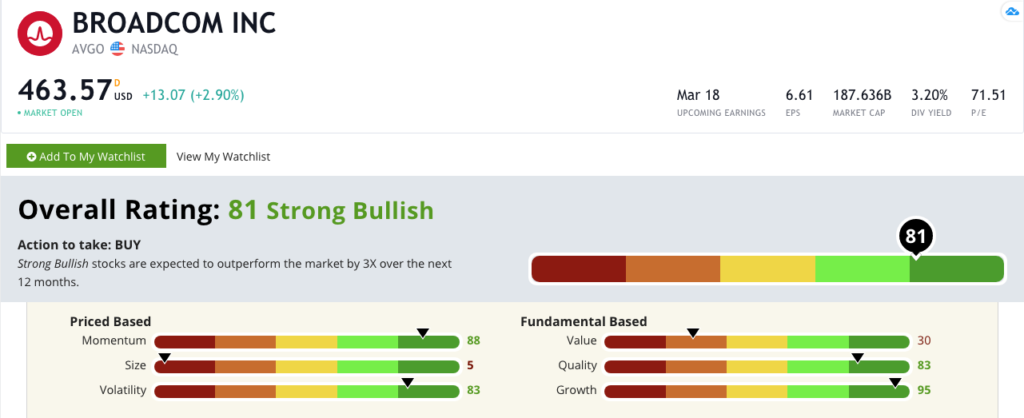

Adam’s six-factor Green Zone Rating system ranks Broadcom Inc. at 81 — meaning only 19% of all other stocks we rank are higher.

Broadcom Inc.’s Green Zone Rating on 2/1/2021.

Broadcom’s recent and projected sales growth ranks it a 95 on the growth factor. But it also ranks high in these:

- Momentum (88) — It has a strong, confirmed uptrend in stock price.

- Quality (83) — The company has solid cash flow and very good returns on investment, equity and assets.

- Volatility (83) — Its upward momentum shows little signs of pulling back.

It’s hurt a little on its size score (5), but that’s because it has a market cap of $187.6 billion. Broadcom’s value rank is a 30 due to a 71.5 price-to-earnings ratio.

Bottom line: Broadcom is a 5G dividend stock in a position to give you returns three times better than the rest of the market over the next 12 months.

Couple that with a healthy quarterly payout, and you truly get the best of both worlds.

Until next time…

Safe trading,

Matt Clark

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He’s the host of our podcast, The Bull & The Bear, as well as the Marijuana Market Update. Before joining the team, he spent 25 years as an investigative journalist and editor — covering everything from politics to business.