The big data explosion is finally here.

We’ve gone from no phones, to flip phones, to iPhones that let you buy groceries, make a stock trade, or even watch a movie on Netflix.

We are all using our phones more often and consuming more and more data.

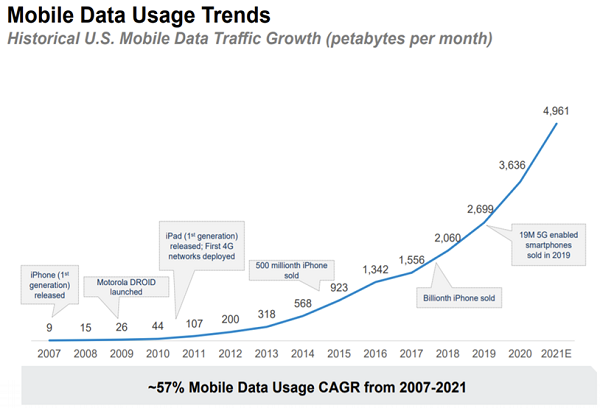

In fact, mobile data usage has increased by nearly 60% per year for the last fifteen years!

Source: AMT Investor Presentation.

It is however the advent of new technologies that have helped improve our access to things that might have once been considered unimaginable.

Enter 5G, which is known as the ‘fifth-generation mobile network’, and the newest technological evolution which will greatly improve speeds (up to 100 times), responsiveness and the ability to connect more devices.

This isn’t just important for letting you stream Netflix shows faster, but is key to helping support innovation happening across the globe, in areas such as autonomous driving, industrial IoT (internet of things), and smart communities.

In the future, everything is going to be transformed by 5G. The pace of technological change in decades past has been fast. The only thing we know for sure is that, in the future, it’s going to be even faster. We’re going to experience a technological shift that will transform people, businesses, and society as a whole.

– Verizon CEO Hans Vestberg

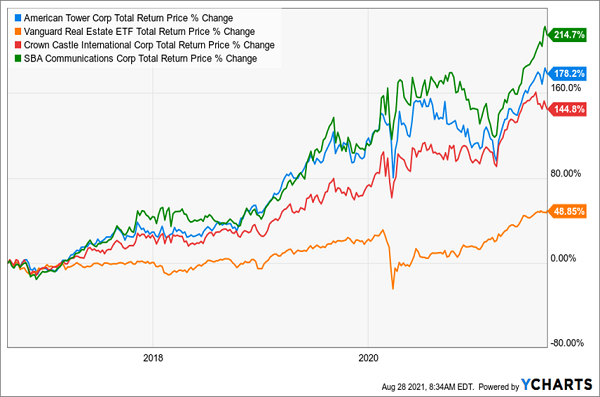

One way that investors can play into this explosion in data and the ultimate rollout of 5G networks is via the three publicly traded cell tower operators, American Tower Corp. (NYSE: AMT), Crown Castle International Corp. (NYSE: CCI), and SBA Communications Corp. (Nasdaq: SBAC).

These companies are basically the landlords for the major telecom companies such as Verizon Communications Inc. (NYSE: VZ), AT&T Inc. (NYSE:T), and T-Mobile US Inc. (Nasdaq: TMUS), leasing space on their towers and collecting rents to help facilitate the buildout of 5G technologies.

All three have outperformed the broader REIT market by a significant amount in recent years, but I still think there is good appreciation potential for all three. Let’s take a closer look.

Note that cell-tower REITs typically haven’t offered significant yields, due to the fact that the stock prices have continued to outpace dividend growth! Thus for anyone that needs to clip a big coupon, these aren’t the best options, but if you’re happy with market-beating total returns via capital appreciation and consistent dividend growth, these REITs will suit you just fine.

5G REIT No. 1: American Tower (AMT)

Dividend Yield: 1.7%

AMT owns over 210,000 vertical towers and leases out space on the towers to telecom providers. Multiple tenants can occupy space on the tower and install their own communication equipment to help connect customers. These leases are long term in nature and provide a reliable and predictable stream of cash flow.

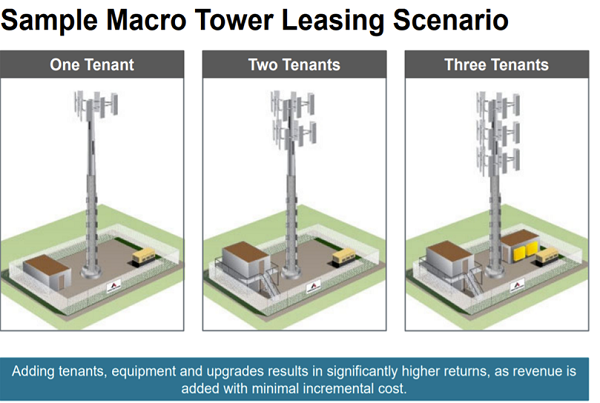

One of the things I love about the tower business is that the returns on investment for one tower keep expanding as more tenants are added. Building out a tower with one tenant isn’t all that profitable for AMT, as it only results in a 3% return on investment (ROI). But, AMT can keep adding new tenants, increasing its revenues and its ROI. With three tenants, AMT earns a 24% ROI!

Source: AMT Investor Presentation.

With the advent of 5G, AMT has seen even stronger demand for space on its towers, as wireless carriers continue to invest in 5G buildouts. An important note is that in order to achieve the full effects that 5G offers, the networks need to be denser, meaning more access points for the network on the towers.

If you have a new iPhone 12 or any 5G capable phone, you probably haven’t noticed much in terms of drastic speed improvements. It’s because the 5G buildout is still early in its infancy.

And we believe that substantial further densification efforts will be necessary to augment existing 4G deployments and upcoming 5G rollouts. Just like in the United States, as higher band spectrum is deployed for 5G, networks will need to become denser to provide a true 5G experience.

– AMT CEO Tom Bartlett, Q2 Earnings Call

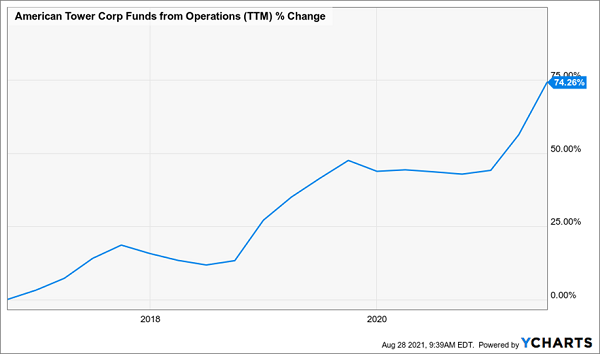

AMT has shown strong, consistent growth over time, and I think these trends only grow stronger from here as telcos continue to invest in building out their 5G capabilities. Note that AMT is highly diversified internationally too, with 43% of revenues derived from outside the US.

AMT Is Diversified

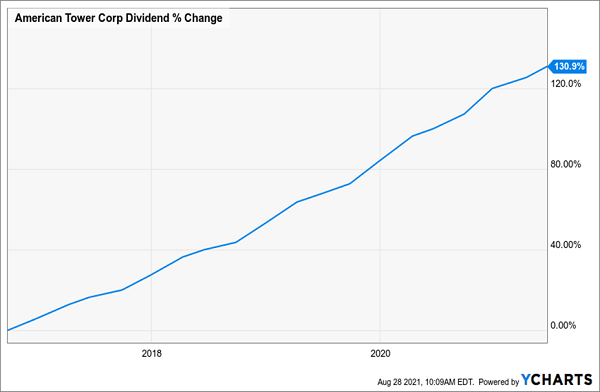

Valuation-wise, AMT trades at roughly 28 times Funds from Operations which is above longer-term company averages, but roughly in line with other competitors such as Crown Castle and SBA. They offer a 1.8% yield and the dividend has grown by over 130% in the past five years.

AMT’s Dividend Keeps Growing

5G REIT No. 2: Crown Castle (CCI)

Dividend Yield: 2.7%

CCI is another cell tower REIT that has 40,000 cell towers and 80,000 on-air small-cell nodes.

Small cells are antennas that are typically deployed on streetlights or utility poles. They work in tandem with towers to help offload data and improve connectivity and density!

Crown Castle has taken a bit of a more diversified approach to AMT, which is heavily focused on towers. Crown Castle has invested heavily in fiber networks to help deploy small cell sites in addition to its portfolio of towers.

CCI’s management believes that its strategy is the right one, although some point to the heavy expenditures that CCI has committed to fiber investments and the lower overall returns relative to towers.

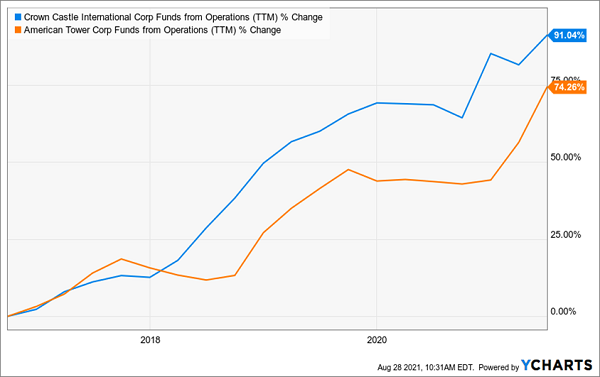

However, based on results, CCI has grown FFO at a better clip than AMT, and recent results show strong 5G related demand.

CCI’s Strategy Is Working

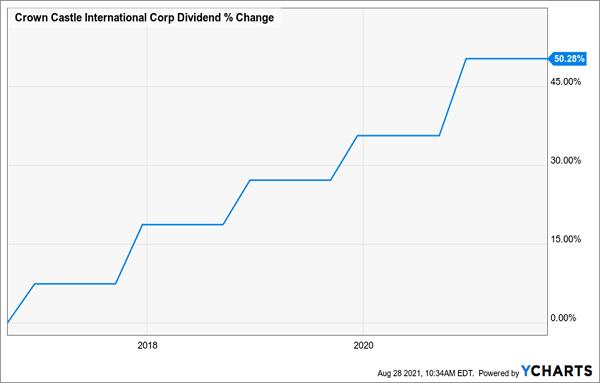

CCI trades at 26.6 times Funds From Operations, a discount in comparison to its closet peer, AMT. It also offers a higher dividend yield at 2.8%, with 50% dividend growth over the past five years.

CCI’s Dividend Is Higher

Consider CCI as a solid, diversified way to play into the future growth of 5G and the need to improve density across networks.

5G REIT No. 3: SBA Communications (SBAC)

Dividend Yield: 0.6%

SBAC is the third-largest U.S. wireless tower operator and more of a domestic tower pure play in comparison to AMT and CCI, with U.S.-based towers accounting for 75% of SBA’s revenue.

Its core revenues are derived from the big four domestic telcos — T, TMUS, VZ, and Dish Network Corp. (Nasdaq: DISH). Those on the street are more optimistic about domestic-based tower exposure, due to the instability of overseas markets.

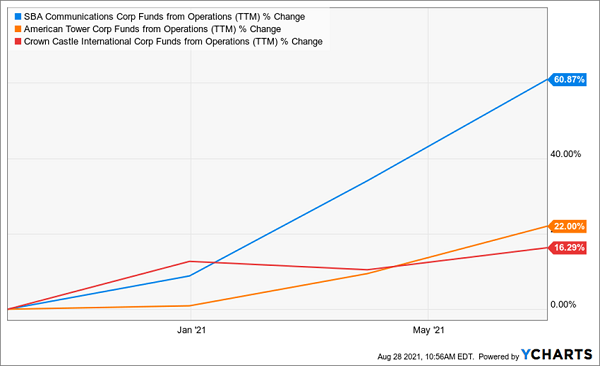

Thus, SBAC is valued at a premium to both AMT and CCI, now trading at over 31 times Funds From Operations. Its recent growth in FFO in comparison to competitors has helped justify this premium.

SBAC Trades at a Premium

It noted on a recent call that it signed more new leasing revenue in Q2 than in any quarter for the past seven years and generated 15% growth in FFO in the second quarter due to the strong demand for tower space.

It does offer the lowest dividend of the group at under 1%, but for investors looking for a solid, domestic-focused 5G growth play, SBAC looks like a solid choice.

To learn more about generating monthly dividends as high as 8%, click here.