I don’t watch a lot of television — especially over the last several weeks.

I can only take so much political advertising.

Aside from relentless campaign ads, I’ve noticed smartphone and wireless companies are pushing 5G more and more.

It’s all well and good, but we aren’t there yet.

A lot of infrastructure needs to be built before we truly have nationwide 5G coverage.

However, that’s not stopping smartphone manufacturers from selling their brand new “5G-capable” products in time for the holiday shopping season.

Those ads got me thinking about the big technology boom on the horizon.

One that smart investors like you can make a killing getting into.

Using Chief Investment Strategist Adam O’Dell’s six-factor Green Zone Ratings system, I’ve found a high-momentum 5G stock that will position you ahead of the curve in this upcoming boom.

But before I tell you about that, let’s see why one specific sector is on the verge of a massive breakout.

The Money Isn’t Necessarily in 5G Stocks

I’ve talked about the 5G revolution before.

It’s coming … there’s no doubt about it.

There’s one sector that will drive the pace of this revolution — semiconductors.

Semiconductors are microchips that help make things like smartphones and tablets 5G compatible.

And the industry is rapidly moving upward:

Semiconductor Industry Revenue to Hit New Highs

What’s more, is that World Semiconductor Trade Statistics (WSTS) projects a 6.2% growth in global semiconductor industry revenue in 2021.

I’ve found one company, using Adam’s Green Zone Ratings system, that we expect to outperform the rest of the market by 3X.

This Company Has Massive Momentum Appeal

Adam has a very simple philosophy when looking for stocks to add to his portfolio: “Buy high, sell higher.”

This Momentum Principle is at the core of Adam’s investing philosophy. In fact, he’s putting the finishing touches on a book that will walk you through using momentum to find more winning stocks. Keep an eye out for more information soon here on Money & Markets.

You can see how the Momentum Principle works in my recent YouTube video. Watch it here.

The key is to find a stock already in an upward price trend.

Using this strategy, I found United Microelectronics Corp. (NYSE: UMC).

It’s a Taiwan-based semiconductor foundry — it manufactures microchips for other companies who, in turn, place those chips in products.

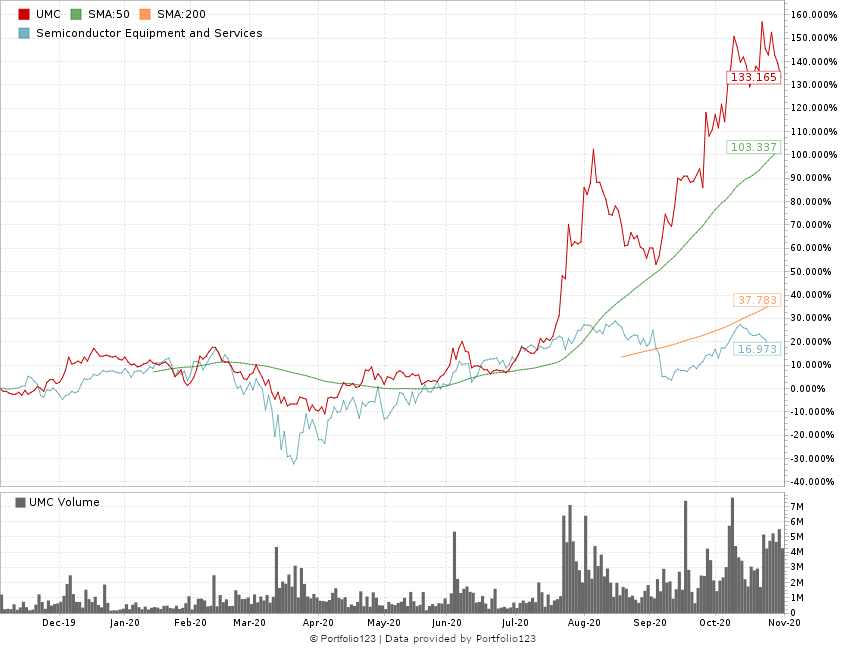

UMC Shares Rocket Up 161%

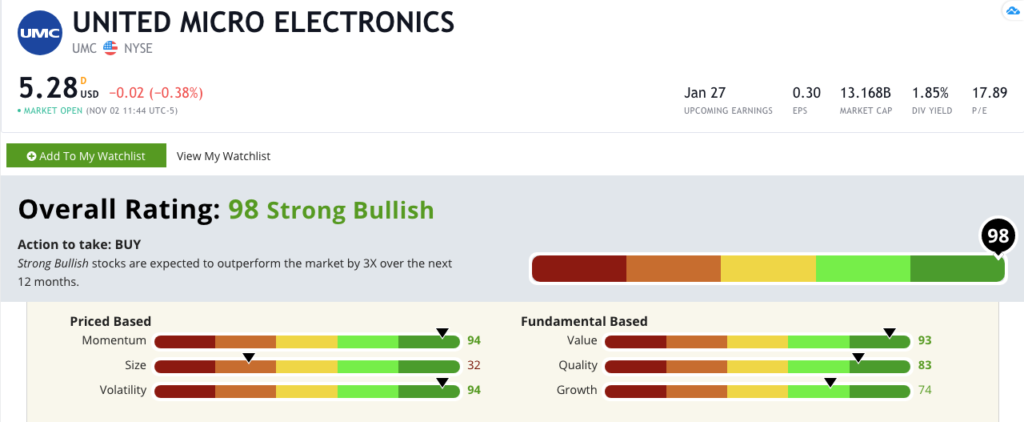

UMC’s Green Zone Rating on November 2, 2020.

UMC is one of the largest semiconductor foundries in the world.

Since 2017, the company has held around 7% of the global market revenue share.

I think that it’s only going to grow.

The company has a one-year annual sales growth rate of 27%, and its sales have increased steadily in each of the last six quarters.

UMC Is a Near Perfect 5G Stock

Looking at Adam’s six-factor Green Zone Ratings system, UMC ranks a 98 overall — meaning only 2% of all other stocks rated are higher.

As you can see, the 5G stock scores high in volatility (94), value (93), quality (83) and growth (74).

But it’s one of the strongest stocks in terms of momentum.

Since hitting a low mark of $2.03 per share in March, UMC shares have rocketed up 161%.

It had a slight pullback in September but soared even higher after a slight drop.

At $5.30 per share, it’s still 51% off the high target for Wall Street analysts, like Morgan Stanley and Goldman Sachs — both of which upgraded UMC to “buy.” That’s a lot of profit for investors like you.

What to Do With UMC

Because it ranks a 98 on the Green Zone Ratings system, we see UMC beating the rest of the market by 3X over the next 12 months.

I think it can do even better.

The bottom line: The 5G revolution is going to ramp into high gear very soon.

Companies like UMC provide an essential piece of 5G infrastructure that every product — from smartphones to tablets — will need to be 5G compatible.

The 5G stock UMC is in a perfect position to grow its market share and grow your gains on this stock by three times.

But only if you act now.

Until next time…

Safe trading,

Matt Clark

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He’s the host of our podcast, The Bull & The Bear, as well as the Marijuana Market Update. Before joining the team, he spent 25 years as an investigative journalist and editor — covering everything from politics to business.