This episode of The Bull & The Bear is all about a retail stock to buy with great momentum heading into the holiday season.

The U.S. economy is still having a hard time getting back to pre-COVID-19 levels.

Millions of Americans remain out of work and, with the holiday season fast approaching, pennies will be pinched in households across the country.

But I’ve found two things that, as a smart investor, you need to know:

- A fast-approaching trend that will change the course for one sector.

- A huge momentum stock that will help you beat the market by 3X over the next 12 months.

The trend is related to retail — a sector that has taken a beating since March after coronavirus lockdowns halted brick-and-mortar sales traffic.

Retail is starting to make a comeback … and one segment of retail in particular … is going to have a massive fourth quarter.

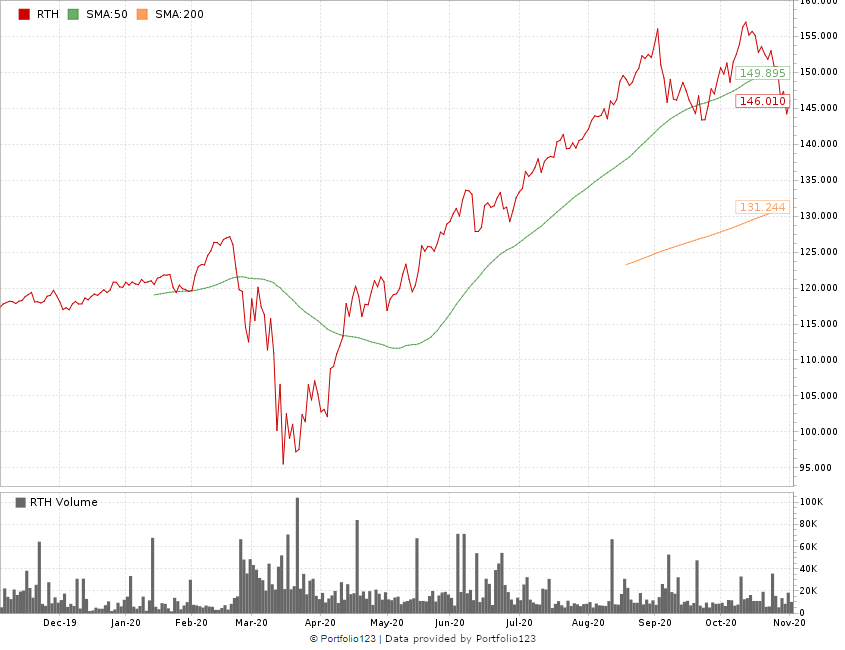

The VanEck Vectors Retail ETF (Nasdaq: RTH) — an exchange-traded fund (ETF) tracking retail stocks— jumped more than 52% since reaching a low in March 2020.

After a dip in late September, the ETF has risen almost 2% to its current price, indicating its back on the upswing.

The ETF holds companies like Amazon.com Inc. (Nasdaq: AMZN), Costco Wholesale Corp. (Nasdaq: COST) and Dollar General Corp. (NYSE: DG).

Retail ETF Moves 52% Higher off March 2020 Lows

In this episode of The Bull & The Bear, I’m going to tell you about one discount retail stock with incredible momentum in Chief Investment Strategist Adam O’Dell’s six-factor Green Zone Ratings system.

This stock:

- Ranks a 99 overall on Adam’s system.

- Ranks a 100 on value.

- Ranks a 98 on quality.

- Ranks a 95 on momentum.

I’ll take a deep dive into the company and tell you why it’s a strong buy for investors.

You’ll get insight on what you should do with this stock — if you are thinking about buying or already have it in your portfolio.

Remember, knowing the data and the details about a specific company helps you determine whether it is worth investing in.

That’s why we do the work for you by looking at these specific stocks and give our analysis on each one.

The Bull & The Bear

Led by Adam and a team of finance journalists, traders and experts, Money & Markets gives you the information you need to protect your nest egg, grow your wealth and safeguard your financial well-being.

You can listen to The Bull & The Bear on Apple Podcasts, Spotify, Amazon and Google Podcasts. Make sure to subscribe and leave us a review.

Be sure to also subscribe to our YouTube channel for more videos and information.

Have something you want us to talk about? Email us at thebullandthebear@moneyandmarkets.com and give us your thoughts.

Check out moneyandmarkets.com and sign up for our free newsletters that deliver you the most important and unbiased financial news, commentary and actionable advice.

Also, follow us on:

Safe trading,

Matt Clark

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He’s the host of our podcast, The Bull & The Bear, as well as the Marijuana Market Update. Before joining the team, he spent 25 years as an investigative journalist and editor — covering everything from politics to business.