I’m a tech stock bull — particularly companies that are investing in the 5G revolution.

Despite the global coronavirus pandemic and the political uncertainty, I have long believed that companies investing in 5G will see massive growth.

This revolution will be groundbreaking for every industry.

Manufacturing will transform as communications within production lines see dramatic improvement.

Watching movies, streaming music and even driving will look completely different.

While the U.S. continues to lag a bit in the development of 5G connections, the revolution is taking hold in other countries.

Using Money & Markets Chief Investment Strategist Adam O’Dell’s Green Zone Ratings system, I’ve found a company on the cusp of a huge breakout in the 5G market.

We believe it will outperform the overall market by three times in the next 12 months.

I’ll share it with you shortly.

But first, I’ll show you why the growth of 5G in a certain sector means I’m strong bullish on this company.

Asia Is the Key to 5G Stock Growth

According to the research group GMSA, the 5G revolution is picking up pace, regardless of the impacts of the coronavirus.

5G is already taking off in Asia.

Across the continent, nine markets have already launched commercial mobile 5G services, and 12 more are on pace to do so in short order.

5G should contribute an economic value of nearly $890 billion to the Asia Pacific region by 2034.

And, while China is growing leaps and bounds above all other countries in terms of 5G development, another country in Asia that shows massive 5G growth potential is South Korea.

South Korea 5G Connections to Explode

In the next five years, the country is set to grow its 5G connections by more than 737%.

That’s huge.

One company stands to rake in the benefits of that huge growth … one that will outperform the rest of the market by 3X in the next 12 months.

All South Korea 5G Roads Lead Here

The largest mobile phone service provider in South Korea is SK Telecom Co. Ltd. (NYSE: SKM).

In 2019, the company had 46.4% penetration in the South Korean market. (Its next competitor had just 31.6%.)

SK Telecom Subscribers Jump 10%

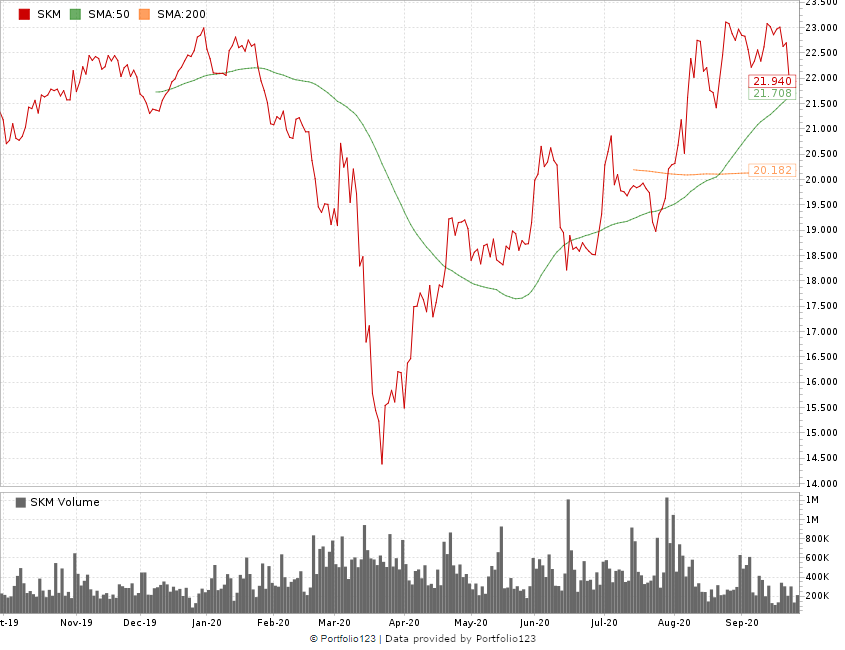

The company’s share price jumped from a low of $14.39 in March 2020 to nearly $22 … an increase of 52.4%.

SK Telecom Stock Close to New Highs

And, as you can see, the stock recently hit a “golden cross.” That happens when a stock’s 50-day moving average (the green line above) crosses above its 200-day moving average (the orange line).

That indicates a short-term price breakout … which has already started.

Fun Fact: Analysts have set a high price target for SK Telecom of $34.35 per share … a 56.5% increase over its current price.

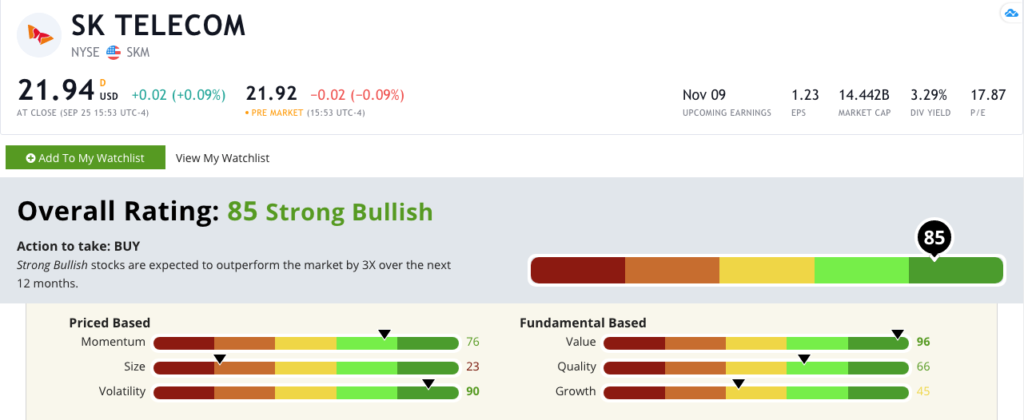

SK Telecom (NYSE: SKM) Green Zone Rating on September, 28, 2020.

You can see why we are “strong bullish” on the stock by looking at Adam’s Green Zone Ratings system, which rates SK Telecom an 85 overall:

- Value — The company rates a 96 on value. It beats the telecommunications average in price to sales, price to book and price to cash flow. Remember, low-valuation stocks tend to outperform those of high valuation.

- Volatility — SK Telecom rates a 90 on volatility. Its shares have a beta of 0.96. For reference, anything under 1 is considered low volatility. Companies with low-volatility share prices tend to outperform those with higher volatility.

What to Do With SK Telecom

With an overall rating of 85, we are “strong bullish” on SK Telecom and believe the 5G stock will outperform the rest of the market by three times over the next 12 months.

The fact that SK Telecom continues to build out its 5G network and remains a powerhouse in South Korea should convince you of the same.

SK Telecom 5G Subscriptions Jump

The bottom line: Asia is a hotbed for 5G development. Those companies that get in and grow quickly are poised to grow at a rapid pace.

SK Telecom has already laid the foundation for that growth in South Korea and has become the biggest 5G player in that market.

Combining strong value and low volatility with that foundation puts SK Telecom on the fast track to big profits from 5G.

Jump into the opportunity now to take advantage of massive gains.

Until next time…

Safe trading,

Matt Clark

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He’s the host of our podcast, The Bull & The Bear, as well as the Marijuana Market Update. Before joining the team, he spent 25 years as an investigative journalist and editor — covering everything from politics to business.