It’s tough to narrow down your shortlist of stocks to invest in. That’s where Green Zone Power Ratings comes in!

Chief Investment Strategist Adam O’Dell’s system helps everyone on the Money & Markets team find the best stocks in all corners of the market.

If a stock is on our shortlist, the first thing we do is find out how it stacks up in Green Zone Power Ratings.

And we’ve made it easy for you to do the same!

Adam began crafting Green Zone Power Ratings long before joining our team as chief investment strategist. He spent years perfecting his algorithms that analyze more than 8,000 stocks.

All that hard work has created stock analysis that’s easy to understand.

The system does all the math for us, but Green Zone Power Ratings boil down to six essential factors:

- Momentum.

- Size.

- Volatility.

- Value.

- Quality.

- Growth.

If you want to learn more about each of these factors, check out my interview with Adam here. You can also check out Matt’s video on the momentum factor here.

How to Use Green Zone Power Ratings

Adam’s Green Zone Power Ratings system is easy to use. Here’s a step-by-step guide using Apple Inc. (Nasdaq: AAPL) stock as an example.

1. The first thing you’ll want to do is go to www.MoneyandMarkets.com. Once you are on our homepage, look for the search bar in the top right corner of the page.

If you are on a mobile device, you can use the search function on the dropdown menu.

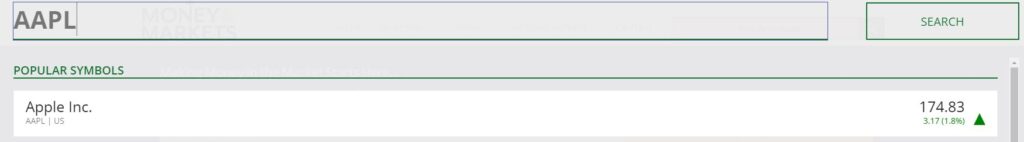

2. Type in a company name (Apple) or stock ticker symbol (AAPL) to find the stock.

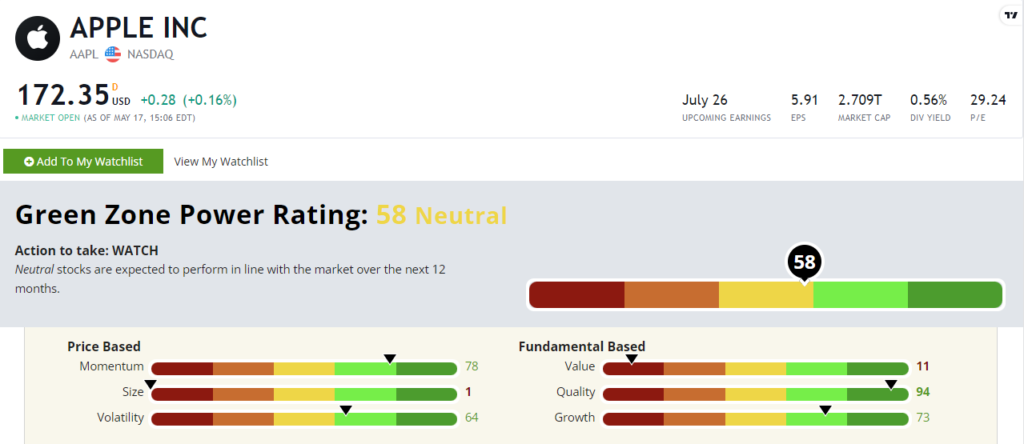

3. Click on the company name under “Popular Symbols” to bring up that stock’s information page. It should look like this:

AAPL’s Green Zone Power Ratings in May 2023.

And just like that, you can see the Green Zone Power Ratings for more than 6,000 stocks!

Each stock earns an overall rating that falls into one of five categories:

- Strong Bullish (81-100).

- Bullish (61-80).

- Neutral (41-60).

- Bearish (21-40).

- High-Risk (0-20).

We’ve also included an “action to take” with each stock depending on where it lands on the spectrum. To learn more about these rankings and what each action means, check out the table below:

This should be enough to get you started with our Green Zone Power Ratings system. We hope you’ll use it to run some of your favorite stocks through the system to see how they stack up.

This should be enough to get you started with our Green Zone Power Ratings system. We hope you’ll use it to run some of your favorite stocks through the system to see how they stack up.

If you have any questions, or if you have a stock that you would love some further analysis on, shoot us an email at Feedback@MoneyandMarkets.com.

Keep your eyes on Money & Markets as we continue to provide you with the keys to safe, profitable investing.

Adam spent years developing the Green Zone Power Ratings system, and he uses it to find his highest-conviction stock recommendations for his Green Zone Fortunes readers every month. If you’d like to see how to gain access to Adam’s model portfolio, monthly stock selections and details on one of the top mega trends he’s tracking now, click here.