There are a lot of trade-offs when it comes to investing in certain assets.

Much of the time, a stock that comes with a solid dividend payout doesn’t wow us with its market performance.

But our unlikely dividend stock of the week bucks that trend a bit.

I say “unlikely” because pharmacies and other retail stocks aren’t all that generous as dividend payers. But at current prices, CVS Health Corporation (NYSE: CVS) yields a competitive 3.5%.

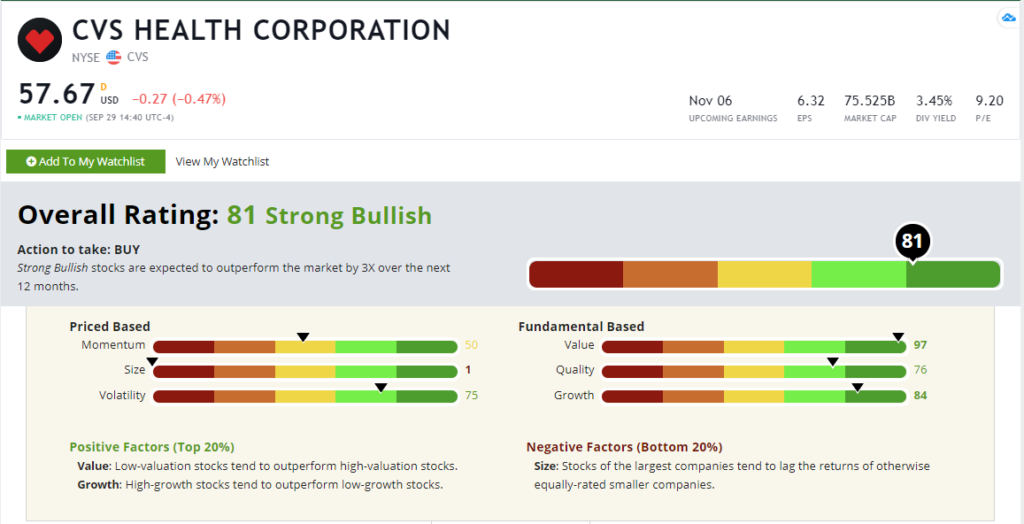

And CVS lands in the “strong bullish” tier of our Green Zone Ratings system. That means it is positioned to outgain the overall market by three times over the next 12 months.

So, in CVS stock, we get the best of both worlds. It’s a competitive dividend in a stock that is also well positioned to deliver market-crushing returns.

Before we dig deeper into the financials, let’s cover some basics.

CVS is a pharmacy chain founded in 1963. But the company does more than just refill prescriptions. CVS also provides affordable and convenient health care via its in-store clinics. If, like me, you dread wasting an entire afternoon in the doctor’s office, you can get basic care at your local pharmacy. You’ll be in and out in a fraction of the time at a competitive rate.

CVS is also active in the benefits space. Its CVS Caremark provides prescription benefits management services.

The stock pays a $0.50 quarterly dividend and has maintained this payout since 2017. But given that CVS only pays out about 31% of its profits as dividends, there is ample room for additional dividend growth.

CVS’ Dividend and Stock Rating

CVS rates an 81 in our Green Zone ratings system, which puts it in the top 19% of all stocks in our universe. Historically, stocks with ratings over 80 have, on average, outperformed the S&P 500 by three times over the following 12 months. Let’s break it down further.

CVS Health Corp. (NYSE: CVS) Green Zone Rating on September 29, 2020.

Value — CVS rates highest on Value, coming in at 97. By our value composite, which includes multiple valuation metrics such as the price-to-earnings ratio, only 3% of the stocks in our universe are cheaper. In the age of Amazon, retail-oriented stocks are cheap.

Growth — Perhaps surprisingly, CVS also rates highly on Growth, coming in at 84. In this market, investors are willing to pay large premiums for growing companies. CVS is a clear exception here, which makes it interesting.

Quality — And CVS rates a 76 in Quality. Our quality composite weighs more heavily on profitability and debt management. Given how difficult this environment has been for brick-and-mortar stores, CVS’ resilience here is commendable.

Volatility — Low-volatility stocks tend to outperform high-volatility stocks over time, so a high rating here signifies low volatility. CVS scores a 75, so it’s less volatile than only a quarter of its peers.

Momentum — CVS takes a bit of a hit on Momentum. But it still rates in the middle of the pack, at 50. This should come as little surprise; CVS isn’t a tech stock. Tech has dominated the momentum trade this year. And few stocks outside of the tech or green energy sectors have caught investors’ attention.

Size — Finally, CVS is a large $74 billion company by market cap and rates at just a 1 on Size. Smaller companies tend to outperform over time.

Bottom line: So, there you have it. CVS is a cheap stock with a competitive dividend that rates highly in our system. Invest accordingly!

Money & Markets contributor Charles Sizemore specializes in income and retirement topics. Charles is a regular on The Bull & The Bear podcast. He is also a frequent guest on CNBC, Bloomberg and Fox Business.

Follow Charles on Twitter @CharlesSizemore.