“I did read that. I thought about you, B.O.”

While other people may be known for their hobbies, or their families, my publisher thought of me when a Vanguard fund re-opened.

I’ve yapped about the Vanguard Dividend Growth Fund (VDIGX) before. I rarely mention (let alone endorse) mutual funds. But VDIGX is notable for two reasons:

- I plow 100% of my 401(K) contributions into this fund, and

- It’s a pretty good option as far as retirement plans go.

Why this fund? Because in my “Brett Inc.” company plan, I have a set list of Vanguard funds to choose from. This is “set and forget” money so my goal is to maximize long-term returns. The best way to do this, of course, is to buy dividend growth stocks.

My own portfolio dedicated to this approach has earned 17% per year. I’ll share the details with you in a minute. First, let’s give some credit to VDIGX.

As far as 401(K) options go, it is a good one. The fund outperformed the S&P 77% to 68% over the last five years. It really shines in turbulent years like this one, rallying 23% year-to-date.

As we discussed at the outset, VDIGX just re-opened itself to new money for the first time in three years. But unless you also have a Vanguard 401(K), I think you can do better than VDIGX. Much better, actually. Here’s how.

For 17% Returns Per Year, Buy the Fastest Growing Dividends

Dividends drive the stock market. While current yields provide a big part of today’s return, it is the growth of these dividends that determines tomorrow’s return.

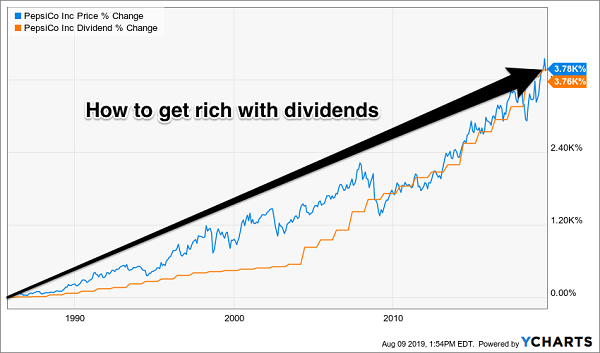

Let’s spy on VDIGX’s holdings to see how this works. Its number five position, PepsiCo (PEP), has made its investors rich thanks to its ability to grow its dividend. Check out the orange staircase below–that’s the payout that PepsiCo hikes every year. Its stock price (blue line below) is attracted to the payout curve like a magnet. Here’s their relationship since the beverage maker began paying a dividend:

Every Pepsi Payout Refreshes the World

PepsiCo’s payout growth has slowed in recent years (no surprise, it’s already filled the world with sugar water). Its last dividend raise was only 3%! That’s the junk food equivalent of pedestrian 3% annual price returns.

I wish Don Kilbride, VDIGX’s manager, would trade-in this dog. It’s weighing down my 401(K) returns. PepsiCo’s best years of payout growth are behind it.

Same goes for many Dividend Aristocrats, the stocks that have hiked their dividends for 25 or more consecutive years. They are treated like royalty, so their valuations are always high and their current yields low. It doesn’t make sense to reward past accomplishments since the stock market is a forward–looking vehicle.

The advantage of handpicking your own stocks is that you can look ahead rather than behind. Show me a company poised to grow its dividend by 17% per year (trust me, they exist) and I’ll show you a stock that’s likely to rise by 17% each and every year!

How to Identify Tomorrow’s Big Payout Raises

Forecasting payouts, of course, is work. So let’s start with a shortcut.

The best forward-looking dividend growth tool that I am aware of is Reality Shares’ DIVCON system. It ranks the dividend payers among the 1,200 largest U.S. companies across a variety of fundamental factors, including profitability, earnings growth, cash flow and leverage. As I write, these are DIVCON’s five favorite stocks:

Sometimes, stock prices “run away” from their payouts. This is a good thing for existing shareholders, of course, though maybe not for new investors who haven’t yet bought in. Let’s take DIVCON’s favorite play, HEICO Corp (HEI/A). While its dividend has “only” appreciated 95% over the past five years, its stock price has soared 377%.

That’s a Heico of a Return

I am sure Heico shareholders are not arguing about the outperformance. However, second-place Landstar System (LSTR) may be due to catch up. The firm has raised its dividend by 164% over the last five years yet its stock price has “only” rallied 72%.

This is where the human element can really add additional value. It’s easy for you and me to quickly see the potential for Landstar.

Plus the screens and machines don’t see everything. This is often where we can find the best dividend deals. Let me show you one more example before we dive into my seven favorite dividend plays today.

“Special” dividends usually fly under Wall Street’s radar. They are technically one-time payouts, so we won’t see them reflected in a stock’s stated yield. But we can identify when these special payouts are made regularly and take advantage of broader income ignorance about them.

Let’s take insurer Progressive (PGR). Its published yield is a sleepy 0.5%. But over the last 12 months, the firm has actually dished out a 3.3% yield (based on its current share price). Its dividend is quietly going parabolic, and its share price can’t keep up.

Progressive’s Payout (Orange) Goes Parabolic

This is the type of dividend stock that you should be considering if you want stocks to make you rich. In fact, safe dividend payers like this can easily double your money every four years or so. That’s what 17% yearly returns will do for you.

7 More Stocks for 17% Returns Per Year, Forever

I use computers, screens, tools and my own head to uncover dividend moonshots that will easily pay you 17% per year. That’s enough to double your money in just over 4 years.

Imagine, turning a retirement “pot” of $250,000 into $500,000 … or … $500,000 into $1,000,000 … and on it goes.

Please click here to learn the names of my seven favorite dividend stocks with 100%+ upside. I’ll share their names, tickers and my full research with you including my recommended buy-up-to prices.

To learn more about generating monthly dividends as high as 8%, click here.

• This article was originally published by Contrarian Outlook. You can learn more about Brett Owens and Contrarian Income Report right here.