The 1980s began in turmoil.

Misery defined politics and the economy.

Inflation and unemployment soared.

Those horrors were forgotten by the end of the decade as financial markets charged higher.

Bull Market Beneath the Turmoil

Stocks and bonds both enjoyed bull markets.

Stocks benefitted from higher earnings and investor outlook about the future.

Optimistic investors are willing to pay more for a dollar of earnings, leading to higher price-to-earnings (P/E) ratios.

Combined with earnings growth, this results in bull markets.

Bonds rose as interest rates fell.

Bonds are issued with a defined interest rate.

If rates fall, that bond’s price rises, as investors pay more for the interest payments.

For example, a $1,000 bond issued at 5% pays $50 a year in income.

If rates fall to 3%, the bond’s price needs to rise to $1,667 to make the $50 in interest.

Today, inflation might hit earnings.

That will create pessimism and lower P/E ratios.

Inflation will also lead to higher interest rates.

But in the long run, stocks and bonds could still rise.

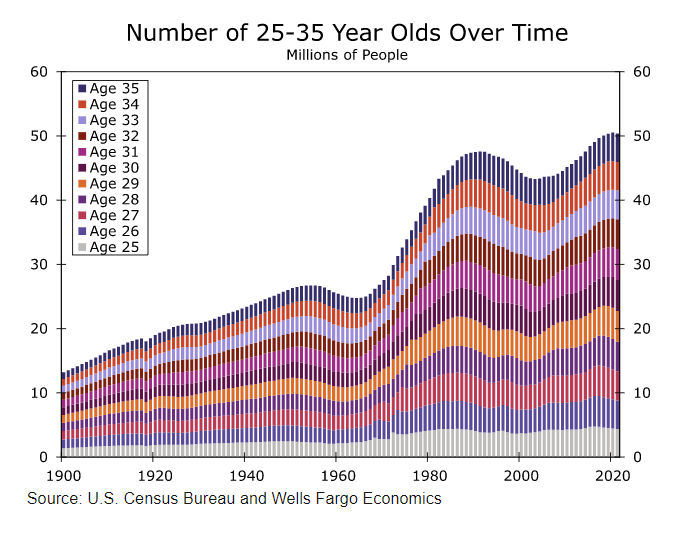

The chart below shows that more young people are entering the job and housing markets than ever.

The previous increase was in the 1980s, and that population boom fueled the bull markets of that era.

Optimism From the Population Boom

Young people fund retirement accounts, and money inflows are the ultimate indicators for trends in the stock market.

They also buy homes and furnish them, which in turn creates jobs.

This chart shows that there is room for optimism.

The dips in the chart coincide with the bear markets in the early 2000s and the 1960s.

The bear market in the 1920s occurred despite bullish demographics, but individuals weren’t investors then.

This time, anyone can participate in the stock market.

Bottom line: There are stories about the underemployed and unemployed young people.

That’s bound to be the case for some in a group of 50 million.

It won’t be news when more than 40 million new households find success and drive the next bull market.

Michael Carr is the editor of True Options Masters, One Trade, Precision Profits and Market Leaders. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Follow him on Twitter @MichaelCarrGuru.