If you’ve been to the grocery store, you’ve noticed higher prices.

The latest inflation data showed that food prices in every section are higher.

The Bureau of Labor Statistics reported that in the past 12 months:

- Products made with grains are 16.4% more expensive than last year.

- Dairy is up 16.2%.

- Meat, up 10.6%.

- Fruit and vegetable prices rose 9.4%.

Given the hikes, it might be surprising to learn that farmers are also feeling the pain of inflation.

Farmers Are Pessimistic From Inflation Pressure

Farmer sentiment is measured with the Purdue University-CME Group Ag Economy Barometer Index.

This is a monthly telephone survey of 400 farmers.

In September, sentiment fell compared to August, “primarily the result of producers’ weaker perception of current conditions.”

The Barometer is down 10% compared to a year ago, while farmers’ view of current conditions is down 22%.

This is more than an opinion poll.

When farmers are pessimistic, they spend less on their farms.

The Barometer includes many subcomponents.

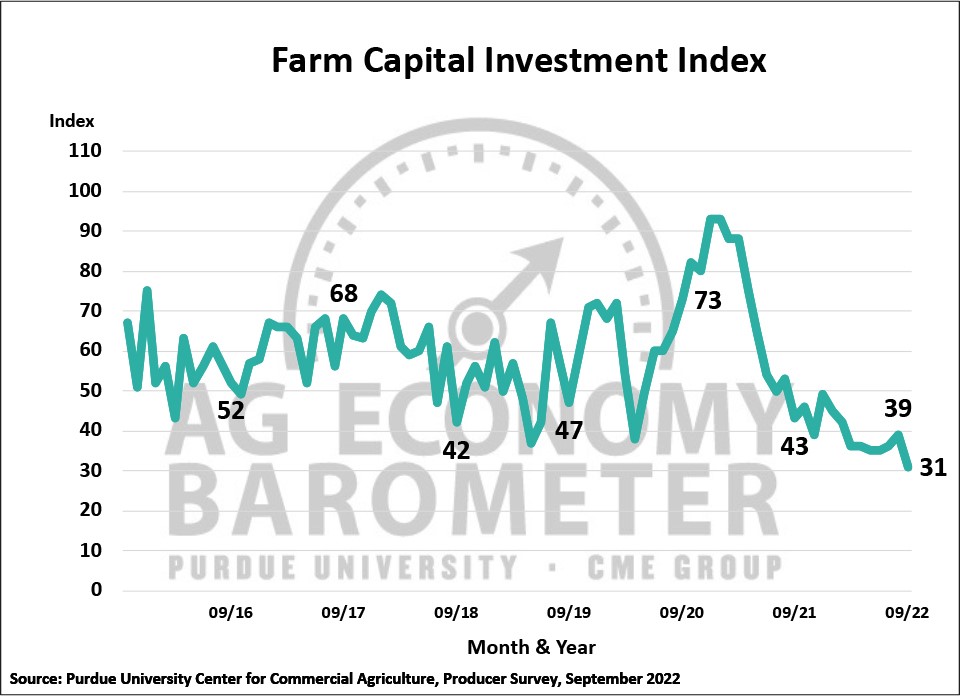

The Farm Capital Investment Index highlights plans for equipment purchases or new buildings.

The latest survey shows this index is at a record low.

Farmers said they don’t believe now is a good time to make large investments.

Almost half of the farmers (47%) plan to buy less equipment next year.

Over half (56%) plan to spend less on new farm buildings or grain bins.

Farm Investments Halt With the Fed Hike

The most commonly cited reason for low investments is high prices.

Farmers are concerned about the increases in prices for farm machinery and new construction.

In addition, interest rates are becoming a factor in their decision-making process.

The survey mentioned rising rates prevented 21% of farmers from making investments.

Farmers tend to rely on loans at some point in the year.

They may need operating loans in the spring to plant.

Or they may need bridge loans later in the year while waiting to sell.

Interest rate changes have a rapid impact on this community.

Bottom line: Federal Reserve rate hikes are slowing investment in the agricultural sector.

This may be the first step in the slowdown the Fed is engineering.

Click here to join True Options Masters.