Retirement planning is difficult. It’s even more difficult if you follow standard rules of thumb from financial advisers.

One rule of thumb is you need to save an amount equal to 10 times your income. That sounds like a great goal. But depending on your expenses, where you live and countless other factors, you might need more … or less.

Another rule of thumb is that you should withdraw 4% of your balance every year in retirement. But this ignores the reality that expenses are unpredictable. You might need more than 4% one year, which can throw off your plan.

Advisers also say you should reduce exposure to stocks as you age. The rule of thumb is that fixed income allocation should equal your age. At 70, you’d have 70% in bonds and 30% in stocks. By 80, you’d lower your stock market allocation to 20%. This rule is especially dangerous because it comes from a different era.

Ten-year Treasury notes offered a yield of 15.8% in 1981. As yields fell to less than 1% in 2020, bond prices rose. The combination of high yields and rising prices delivered gains to bondholders. Treasury returns averaged 8.2% a year over that period.

Financial advisers target 10% a year. That’s easy to do when the risk-free rate is over 8%. Bonds deserved a large allocation in the 40-year bond bull market from 1981 to 2021.

But, over the next 40 years, bonds are unlikely to deliver 8% a year. Rates are rising now, not falling. Allocating too much to bonds may destroy your retirement dreams.

Now, to be clear, large allocations to fixed-income investments with portfolios above $2 million can provide a decent income for many. However, if you want both income and to fund bigger dreams, you need growth.

With smaller portfolios, the math is even more tilted away from fixed income. For example, if you have $100,000 and put 80% in bonds, you may generate about $4,000 in income. The $20,000 in stocks might generate another $2,000 on average. Combined, $6,000 won’t give most people the retirement of their dreams.

So that’s why going overweight on a fixed income doesn’t work for most individual investors.

To add to the damage, some financial advisers aren’t updating their models. They like the numbers they see with old data. Updating them means they’ll need to prepare new charts. That requires approval from their compliance office … and it’s a lot of work for them.

However, retirees can’t afford to take the easy path. We can’t assume the economy of the last 40 years will be the same as what’s coming.

We need to stay focused on the future. That often means looking past outdated rules and taking a more contrarian approach.

If we can’t count on high income from bonds, we need to reconsider stocks. And contrary to popular belief, retirees need to consider aggressive stocks if they want to secure and sustain their wealth.

Today, I’ll share the perfect retirement stock on my radar that challenges what any typical adviser would tell you … and how you can easily find other stocks like it to build your portfolio.

It Pays to Think Smaller

Retirees often hear they should buy safe stocks — usually large-cap stocks. Some advisers say the stock should pay a dividend, too. (That dividend requirement is nonsense. A 3% dividend means nothing if the stock falls 50%. But that’s a tale for another day.)

Today, I offer an alternative. I think small-cap, nondividend-paying stocks could be the best choice for retirees and those nearing retirement.

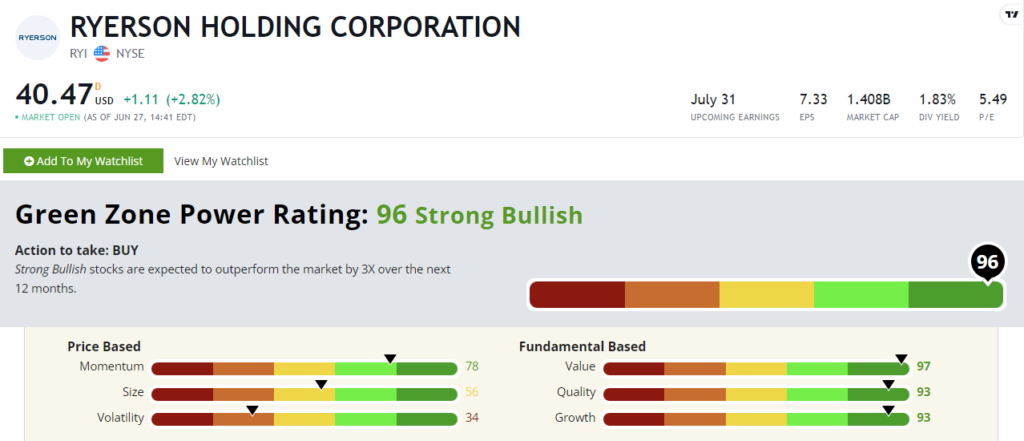

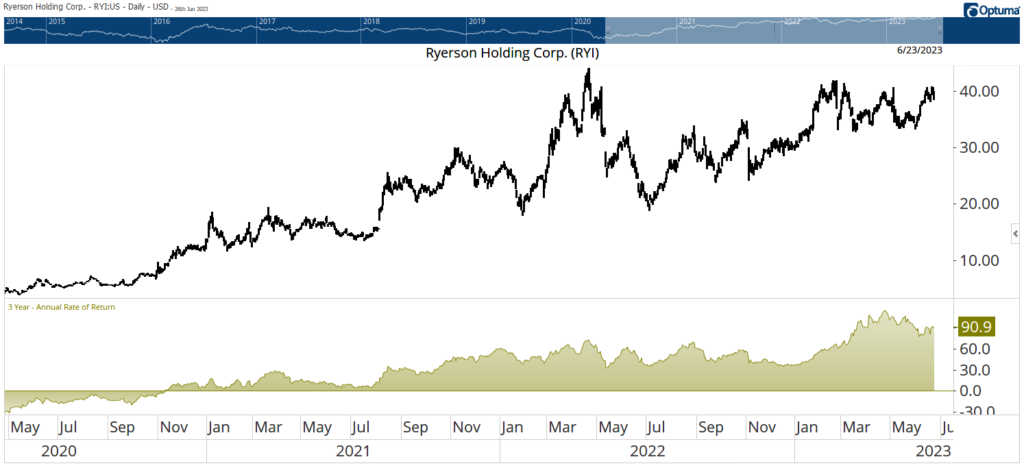

Ryerson Holding Corporation (NYSE: RYI) is an example of the kind of stock that belongs in any retirement account. It’s gained an average of 90.9% a year over the past three years. Take a look at its chart below.

RYI’s Annual Rate of Return Over 3 Years

Today, RYI is a $1.4 billion stock. The company makes metal products and reported revenue of more than $6 billion in the past 12 months. It even pays a dividend now, starting payments in 2021.

This top performer is considered a small-cap stock by many analysts. A cutoff of about $2 billion is common for financial advisers.

Retirement experts might argue that small caps are too risky for retirees. But small caps are capable of delivering the largest gains, even in mundane industries like metal fabrication.

Three years ago, RYI was even smaller. The stock traded at about $4.50 with a market cap of about $200 million. Sales were about $3.5 billion. But the stock was ready to take off. All investors had to do was find it. Of course, easier said than done.

Fortunately, there’s a little-known, free tool that helps me dig up stocks just like RYI…

Score Big Winners With Green Zone Power Ratings

As someone old enough to take a penalty-free withdrawal from my retirement account, I understand the importance of safety.

But I also understand the need for growth. Planning to live a long life forces me to prioritize growth investing, even if that requires ignoring the advice of financial advisers who tell me to stick to the “safe” dividend-paying stocks.

Instead, I’m always watching for the right stocks that can fast-track my path to substantial profits.

Finding stocks ready to deliver large gains isn’t necessarily as hard as it sounds. The Green Zone Power Ratings system can find big winners. Highly rated stocks have historically outperformed the market by 3X over the next 12 months.

The Green Zone Power Ratings dashboard below shows that RYI is a highly-rated bullish stock:

This is just one high-growth stock to consider adding. There are many others that you can easily uncover with a quick search.

To check any stock’s potential to deliver strong returns, just click here to go to the Money & Markets homepage to see how they rate in today’s market.

Until next time,

Mike Carr

Senior Technical Analyst

P.S. Adam O’Dell regularly leverages this system to uncover hidden gem stocks, just like this one, to his Green Zone Fortunes subscribers. Recently, he recommended 11 stocks that rate a 95 and above, concentrated in the best-performing sectors in the market right now.

He’s also recommending his readers avoid a list of nearly 2,000 stocks that rate poorly and are at risk of putting a hole in your retirement portfolio.

You can access this list, and Adam’s 11 new recommendations, with a subscription to Green Zone Fortunes. All the info is right here.