The pandemic has been a boon for all forms of electronic entertainment.

Video games are part of that story. And with cases and hospitalizations rising as we enter the cold and flu season, I think it’s very likely that video game makers have another several strong quarters.

Video game maker Activision Blizzard Inc. (Nasdaq: ATVI) released earnings last week, and they knocked the proverbial cover off the ball.

The company reported revenues of $1.77 billion, easily beating the analyst consensus of $1.67 billion. Earnings per share came in at $0.78 per share, also easily beating the analyst consensus of $0.64.

If you’re not a gamer, or don’t have a kid who is, you may not be familiar with Activision Blizzard’s catalog of game titles. It’s best known for game franchises like World of Warcraft and Call of Duty. Its Call of Duty: Warzone title dethroned Epic Games’ Fortnite as the most played “free” video game among teens in October.

We have to put “free” in quotation marks. While the game is free, players can buy online accessories for their characters. It adds up to a pretty penny.

I can speak with experience here; I lost count of how much I’ve spent buying my children trendy Fortnite “skins.” I’d prefer not to know, but I think it’s well into the multiple hundreds of dollars.

If you’re a parent, you may find yourself in the same situation as me. Because social interactions are still a little tricky in the age of COVID-19, I let my kids spend more time playing video games. But I have a condition: They have to be “social” games where they interact and talk with their friends while playing.

I don’t love the extra screen time. But it creates some sense of normalcy for the kids.

And looking at Activision Blizzard’s stock rating shows it’s in a great position to profit off the trend we are in now.

Activision Blizzard Stock Rating

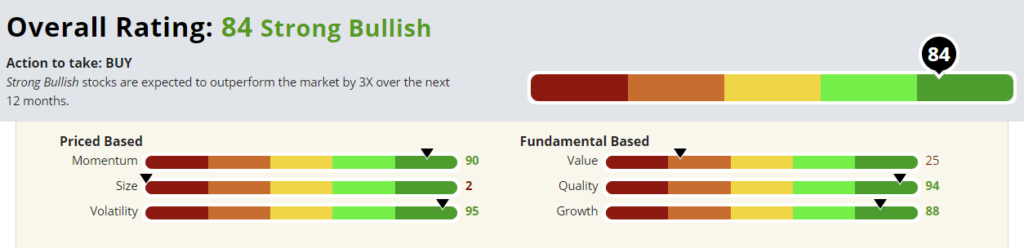

The stock rates an 84 in our Green Zone Ratings system, putting it in “Strong Bullish” territory. Based on our backtesting, we expect Strong Bullish stocks to outperform the market by three times on average.

Activision Blizzard Inc.’s Green Zone Rating on October 30, 2020.

Volatility — Activision Blizzard’s stock rates highest on volatility (which means its volatility is actually low), coming in at 95. Our backtesting has shown that low-volatility stocks tend to outperform high-volatility stocks over time.

Quality — And the company carries a great quality rating at 94. It’s not at all unusual to see overlaps here. High-quality companies are often lower-volatility companies, as investors tend to buy and hold them. We measure quality by a variety of metrics, though most tend to focus on profitability and balance sheet strength. Activision Blizzard enjoys fat profit margins and minimal debt.

Momentum — An object in motion stays in motion. Stocks that are rising tend to attract new buyers, which keeps them rising. This is the reason momentum investing works over time. Activision rates a 90 in momentum. Its shares have been somewhat flattish over the past few months, but the shares have been in a solid uptrend since March of last year.

Growth — Activision Blizzard’s stock also rates highly on growth at 88. And it’s uniquely positioned to grow in this environment.

Value — It’s rare to find cheap stocks that rate exceptionally high in quality, growth and momentum. As a general rule, investors pay top dollar for those kinds of stocks. So, that’s why Activision rates low here at a 25.

Size —This is a large, $58 billion company by market cap, not some hidden gem. Activision rates at a 2 here, so it’s safe to say we’re not looking for a small-cap bounce.

Bottom line: Activision Blizzard is a solid stock to own as we enter what could be a difficult winter.

It’s not cheap, but it’s a solid, high-quality, low-volatility growth stock with decent momentum behind it.

Money & Markets contributor Charles Sizemore specializes in income and retirement topics. Charles is a regular on The Bull & The Bear podcast. He is also a frequent guest on CNBC, Bloomberg and Fox Business.

Follow Charles on Twitter @CharlesSizemore.