In this week’s Earnings Edge, we dive back into a market sector that has struggled lately: cannabis stocks.

We look at what you can expect from one-time cannabis giant Tilray Inc. (Nasdaq: TLRY).

Our other stock is more traditional. Acuity Brands Inc. (NYSE: AYI) is a lighting and building management solutions company.

Both are consolidating in price channels and wedges that could be prone to a significant breakout after earnings this week.

Our two stocks last week saw some sharp moves on earnings. Worthington Industries spiked at the open but then gave up those gains later in the day. The stock never broke out, and its price remains in a downward trend channel.

Paychex, on the other hand, popped 4% on earnings, which was more than enough to break to the upside of its downward trend channel. This is exactly what you wanted to see if you are bullish on the stock. From here, look for an uptrend to take place as the stock continues to climb.

We have two more stocks today that will likely be making some big moves after this week’s earnings calls.

Let’s dive in…

Earnings Edge Stock No. 1: Acuity Brands Inc. (NYSE: AYI)

Earnings Announcement Date: Wednesday, before the open.

Expectations: Earnings at $2.88 per share. Revenue at $960 million.

Average Analyst Rating: Outperform.

The industrial company has benefited from the hype of an economic rebound, but investors want to see it show up in Acuity’s growth.

Acuity’s fiscal calendar ends in August each year, and analysts are expecting just a 3% rise in revenues from the 12 months ending in August last year.

That’s not a wide margin, and a hiccup in its latest quarter could put questions marks all around that growth model.

You can see on the price chart how investors have turned cautious on the company for the past six months. The stock has essentially gone nowhere since the end of March.

AYI’s 6-Month Struggle

With a clear sideways price channel in play, we know the limits. The red resistance line marks a key top, and the green support highlights the short-term bottom.

We can expect an even sharper move in the same direction if one of these lines is broken.

That’s because a sideways price channel is a period of uncertainty and consolidation. Investors are nervous and want to see more before they make or break the current price channel.

Earnings this week could tip the scales in either direction. So, we want it on our radar for a potentially big move on the announcement and in the following weeks.

Tilray Inc. (Nasdaq: TLRY)

Earnings Announcement Date: Thursday, before the open.

Expectations: Earnings at a $0.07 loss per share. Revenue at $177 million.

Average Analyst Rating: Hold.

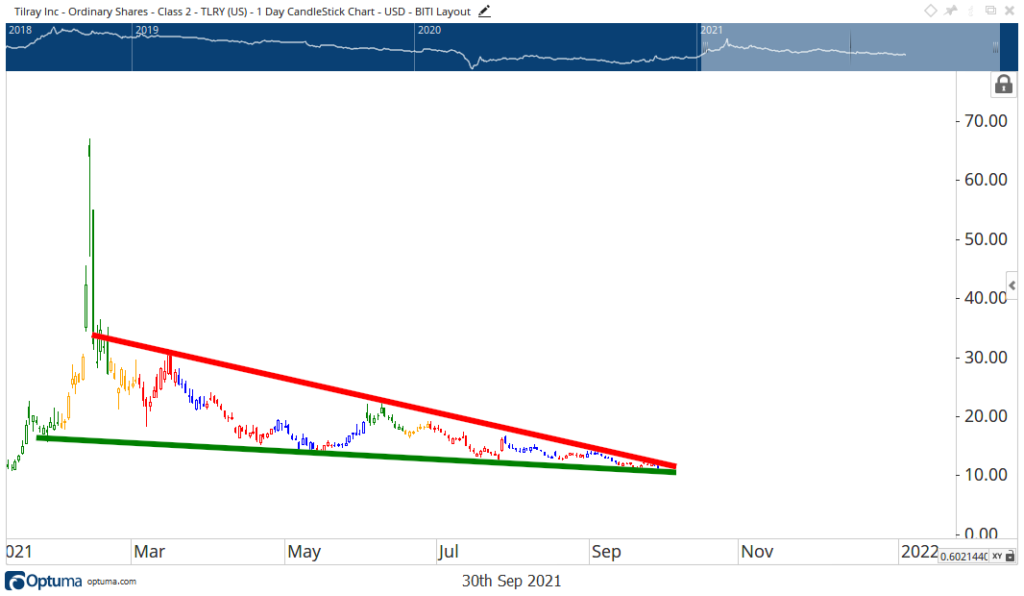

Tilray and other cannabis companies were part of a massive speculative bubble back in 2018.

It was an incredible time for these companies, and while a surge to start 2021 had investors reliving those dreams, it was short-lived.

The stock now trades around $11 a share, about 50% below where it closed on its first day of public trading.

Despite reaching $300 a share in 2018, and over $60 a share in February, the stock is trading at a fraction of those prices today.

TLRY Trends Lower and Lower

You can see the narrow wedge that has formed, as both the red resistance and green support are at a point of convergence.

This is why we are looking at Tilray this week.

I don’t know which way it is going to break, but I do know we can expect a pretty big move.

This wedge pattern is on the brink of a breakout that will send the stock soaring above $20 a share or crashing below $10 a share. And it all begins with earnings this Thursday.

Chad Shoop is an options expert for Banyan Hill Publishing. He is the editor of three leading newsletters: Quick Hit Profits, Automatic Profits Alert and Pure Income. His content is frequently published on Investopedia and Seeking Alpha. Check out his YouTube Channel to see his latest market insights.

Click here to join True Options Masters.