In the latest Marijuana Market Update, I discuss:

- A new player in the cannabis ETF market.

- A reader question about cannabis stock Trulieve.

Check out the video below.

New Cannabis ETF: BUDX

Let’s start with exchange-traded funds (ETFs).

The market is packed with ETFs that cover just about every industry, sector and index out there.

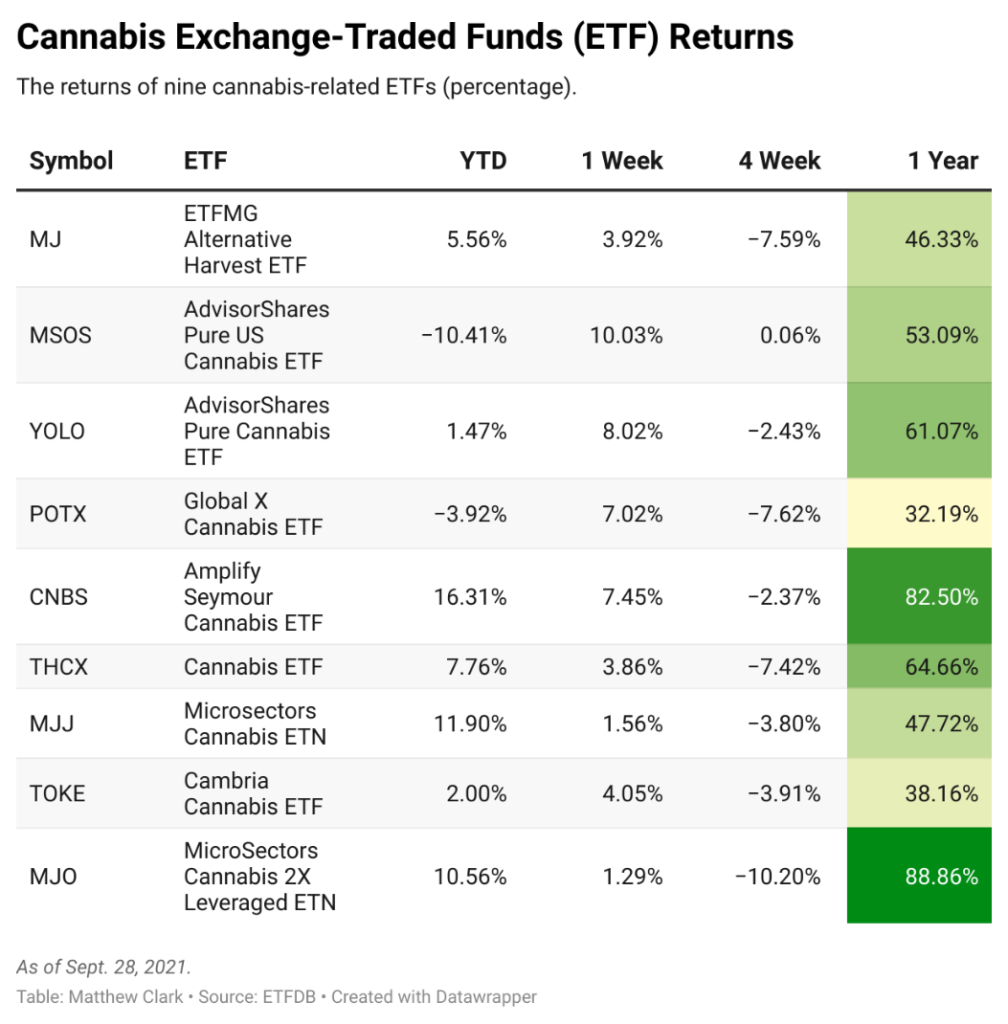

However, the market for cannabis ETFs is small. There are seven well-known cannabis-related ETFs and two exchange-traded notes, or ETNs.

ETFs are great vehicles to give investors broad exposure to a category without trying to put each individual stock in their portfolio. ETFs also come with a 90% return rule, in which they pay 90% of their profits back to shareholders in the form of dividend payments.

And this week, the cannabis market has a brand-new ETF.

On Monday, Foothill Capital Management converted its Cannabis Growth Fund (CANIX) mutual fund into an ETF known as the Cannabis Growth ETF (NYSE: BUDX).

You might wonder why Foothill would make this change.

The answer is simple.

The CANIX mutual fund had a 1-year return rate of 94.5% for the 12-month period ending June 30. However, the fund only had $5.05 million in assets under management, according to its fact sheet.

So, the returns were solid, but its fund flows were low.

By converting to an ETF, Foothill Capital can attempt to replicate its high return percentage and bring an intraday trading product to market.

Plus, the new ETF product comes with a low operating expense fee of 0.79%. That is in line with or slightly higher than the expense ratios of the other nine ETFs and ETNs on the market.

The one thing that stands out here is the return of the CANIX mutual fund compared to other cannabis ETFs.

You can see the returns of the nine cannabis ETFs and ETNs I mentioned in the table below.

Assuming BUDX has the same holdings as its CANIX predecessor, the 94.5% one-year return is higher than the 82.5% of the Amplify Seymour Cannabis ETF (NYSE: CNBS).

It’s also higher than the MicroSectors Cannabis 2X Leveraged ETNs (NYSE: MJO) 88.9%.

Remember, an ETN is more like a bond that you can hold to maturity or buy and sell at will. It’s different from an ETF that way.

An ETN does not buy or sell underlying assets like an ETF, so investors don’t pay taxes until they sell it. This provides long-term capital gains as opposed to short-term gains.

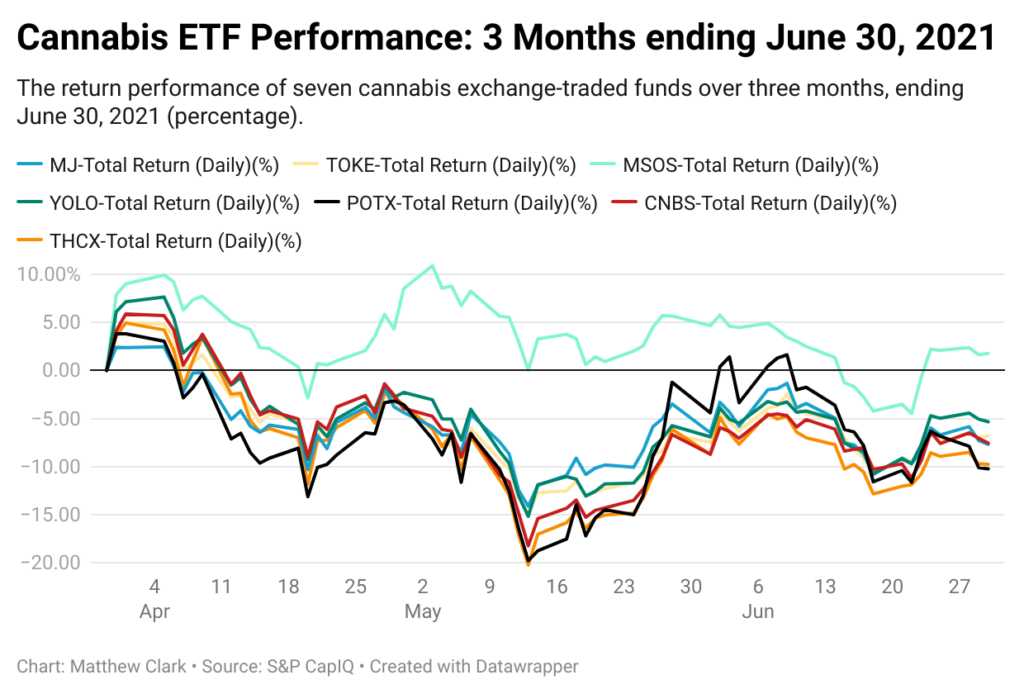

If I take out the two ETNs and just compare the remaining seven ETFs, you can see in the chart above that the ETFs move in lockstep, for the most part.

BUDX boasts a stronger return over the three months ending June 30, 2021. Only the AdvisorShares Pure US Cannabis ETF (NYSE: MSOS) — which only invests in U.S.-based cannabis stocks — made a positive return (1.78%) during that time.

According to its website, BUDX’s returns during that time frame were 31.25%.

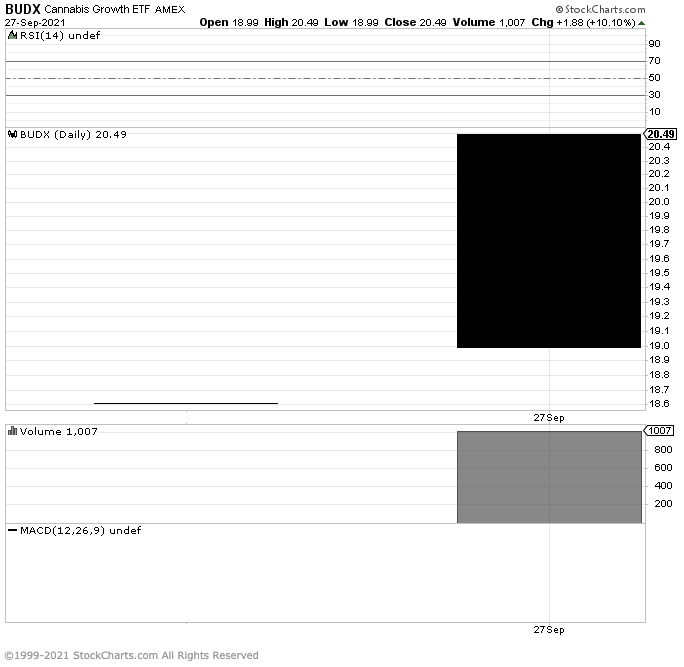

BUDX: First Day of Trading

BUDX only started trading on Monday, but you can see the upward movement in the stock in the chart above.

It opened the day at around $19 per share and closed at $20.49 — a 7.8% jump up in the first day.

Takeaway: If BUDX can mimic its returns from CANIX, it will be hard to pass up.

We’ll keep an eye on this ETF. It’s certainly one to watch.

Trulieve (TCNNF) Cannabis Stock

Now, on to a reader question.

Edward emailed me to ask:

I have a question on a cannabis stock that I have never heard you talk about. The stock is Trulieve Cannabis Corp. (OTC: TCNNF). I think the stock is out of Canada and is spreading in the U.S.

Matt, with your infinite knowledge, can you expand on this … is it a good buy? — Edward

Thanks for your question, Edward. Be on the lookout for an email from my team. We’ll send you some Money & Markets gear for submitting a question we use here.

Trulieve is a cannabis company with headquarters in Florida. It trades on the Canadian exchange as well as over the counter in the U.S.

It’s a medical cannabis company with 90 of its 100 U.S. dispensaries located in the Sunshine State.

It also operates in California, Connecticut, Massachusetts, Pennsylvania and West Virginia. But its main presence is in Florida.

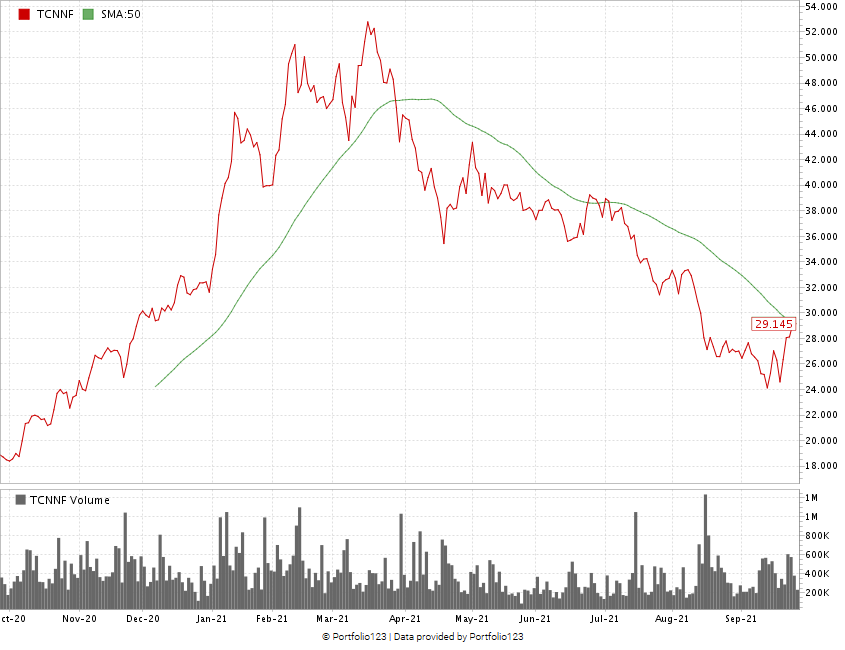

TCNNF Stock Tumbles

The stock tumbled in recent months along with the rest of the cannabis market — falling 44% off its previous high from March 2021.

However, TCNNF is inching higher.

Its valuation (except its price-to-earnings ratio) is on par with the rest of the agriculture industry, and its returns on assets, equity and investments are all positive. It also has positive gross, net and operating margins.

Toss in the fact that it has the strongest medical presence in Florida — a state where only medical marijuana is legal, but its cannabis revenues rank in the top five in the U.S. — and that’s promising news for Trulieve.

Takeaway: In all, I think the stock has decent long-term potential. If it sustains this uptick in price, it would be a good time to buy in.

Thanks again for your question, Edward.

If you do have a question about a cannabis stock or the market, just email me at feedback@moneyandmarkets.com or comment on YouTube. Send us a question or a video of your question or testimonial … we use it … and you can get free Money & Markets swag.

Now, I should mention our exclusive community on YouTube.

We offer exclusive content for members. Just click “Join” on our YouTube page to find out what you can get for as little as $1.99 a month.

Where to Find Us

Coming up this week, we’ll have more on The Bull & The Bear podcast and our Money & Markets Week Ahead, so stay tuned.

Don’t forget to check out our Ask Adam Anything video series, where we ask any question to chief investment strategist Adam O’Dell, and our Investing With Charles series, in which our expert Charles Sizemore and I discuss the trends you write in to ask about.

Also, you can follow me on Twitter (@InvestWithMattC), where I’ll give you even more insights, not just in the cannabis market.

Remember, you can email my team and me at feedback@moneyandmarkets.com — or leave a comment on YouTube. We love to hear from you!

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He is a certified Capital Markets & Securities Analyst with the Corporate Finance Institute and a contributor to Seeking Alpha. Prior to joining Money & Markets, he was a journalist and editor for 25 years, covering college sports, business and politics.