Adobe Inc. (Nasdaq: ADBE) offers a wide range of software for anyone looking to flex their creativity.

Photographers, video game developers, video editors and many other creative types have made Adobe a front-runner in its industry.

However, because this company hasn’t had the best year, it’s become a stock to avoid.

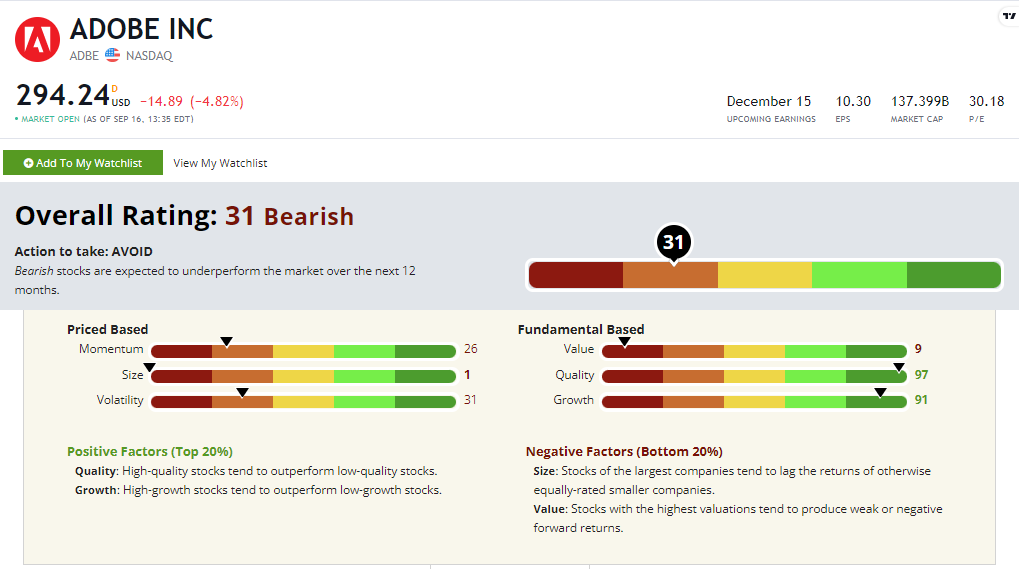

Let’s see why ADBE scores a “Bearish” 31 out of 100 on our proprietary Stock Power Ratings system.

Adobe’s Background

Adobe Inc. is a California-based developer of printing, publishing and graphics software founded in 1982.

While employed at Xerox Corporation, computer scientists John Warnock and Charles Geschke developed a page-description language known as PostScript.

This software could translate and generate almost any symbol onto any computer.

After Xerox declined to bring the technology to market, Warnock and Geshcke founded their own company to support the service and named it after a creek near their homes.

This led to innovations such as Adobe Photoshop, Illustrator and Premiere — just to name a few.

ADBE’s Stock Power Ratings Breakdown

For a “Bearish” stock, we’ll take a tougher look at ADBE’s factors in the red.

- Size — With a market cap of $139.8 billion, ADBE scores a 1 on our size metric.

- Momentum — Year to date, the stock is down almost 50%, and that’s hurting its momentum factor score. ADBE scores a 26

- Volatility — ADBE fell 25.1% on September 12. This steep drop consequently earned Adobe a 31 on volatility.

- Value — ADBE scores a 9 on our value metric, and I’m going to dive deeper into that in a second.

Let’s zoom in on our value and momentum factors to see why this stock is “Bearish.”

ADBE’s Momentum

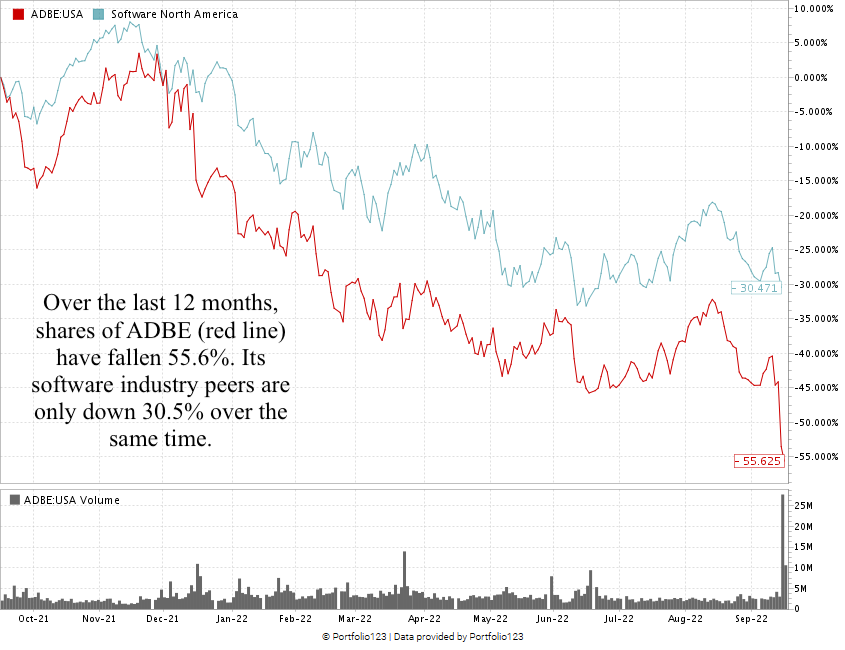

In a year where the software industry has taken a dive, ADBE lost almost twice its value (55% versus 30%) compared to its peers.

We want to see positive upward momentum when looking for stocks to buy. Seeing a stock moving in the opposite direction is a bad sign.

ADBE’s steep 12-month fall led to its bearish 26 out of 100 on our momentum factor.

ADBE’s Value

Source: Portfolio 123.

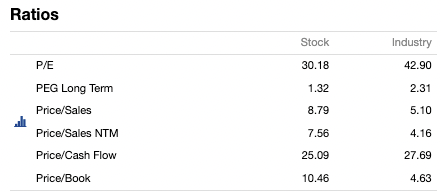

Adobe’s price-to-sales (P/S) ratio is a huge factor when it comes to understanding its value.

Its P/S ratio is 8.8 compared to the software industry average of 5.1.

Another ratio to look at is the stock’s price-to-book (P/B) value compared to its industry average.

ADBE’s 10.46 P/B ratio is more than double its peers’ 4.63.

Both of these factors suggest ADBE stock is overvalued.

The Bottom Line

Adobe scores a “Bearish” 31 out of 100 on our Stock Power Ratings system. This means we expect it to underperform the market over the next 12 months.

However, “Strong Bullish” stocks are no anomaly right now.

We expect those stocks to beat the broader market by 3X in the next 12 months!

To get one top-rated stock within our Stock Power Ratings system every weekday, check out Matt Clark’s Stock Power Daily.

Monday through Friday, he gives you one stock that scores 80 or above on our system and tells you why you should add it to your portfolio — for free!

Want Even More From Stock Power Ratings? Try Green Zone Fortunes

Before investing in Adobe stock, we have something better.

Our team has identified mega trends in the market and ways you can capitalize on these trends for profits in your portfolio.

With our top-notch stock research service, Green Zone Fortunes, you get access to the best of the best stocks in the market based on these mega trends.