One of the most important decisions you make in retirement is when to claim Social Security.

You can boost your monthly checks by around 30% if you file at age 70. On the other hand, filing at 62 (the earliest eligible age) will cut your benefits permanently by around 25%.

So the longer you wait, the more you get.

In fact, early filers are losing around 9% of benefits on average per month, according to a 2019 United Income study. That’s $111,000 lost over the span of one household’s retirement.

But here’s the catch: The same study found that 96% of households didn’t wait until 70. In fact, 70% of respondents started benefits before age 65.

We might all have the best intentions when it comes to claiming Social Security.

But things change — and life sometimes gets in the way.

The coronavirus pandemic is the latest example of that. The U.S. closed down many businesses for months, causing millions to lose their jobs. Many older Americans were also pushed into early retirement.

The job market is coming back. But some people won’t make as much as they did before.

I’m not trying to scare anyone with the numbers above. I’m just trying to show the reality that many people face in retirement.

So how do you make the most of Social Security if you have to claim earlier than planned?

When You Claim Social Security Doesn’t Decide Your Fate

If you had to claim Social Security before you wanted or planned to, it’s not the end of the world.

The first thing you should do is reassess your budget. Figure out where you can trim spending. That will immediately help your Social Security check go a little further.

Your main goal should be to keep your nest egg intact. Eliminating some discretionary spending means you won’t have to draw as much out of your retirement funds.

This is helpful during a recession because markets still have not recovered to early 2020 levels. The S&P 500 is still around 5% off its February record highs, and the Dow Jones Industrial Average is still around 10% lower.

If you take money out of your 401(k) or individual retirement account (IRA) soon after a crash, you create “realized losses” because that money won’t be able to grow back to where it was.

You also don’t have to stop working if you claim Social Security early. The Social Security Administration isn’t going to swoop in and lock you in your house because you started claiming benefits.

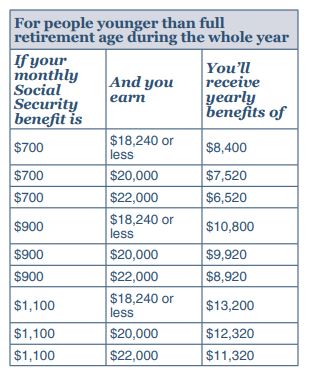

However, your Social Security checks will be reduced before you reach full retirement age if you make too much money. According to the SSA:

If you’re younger than full retirement age, there is a limit to how much you can earn and still receive full Social Security benefits. If you’re younger than full retirement age during all of 2020, we must deduct $1 from your benefits for each $2 you earn above $18,240.

Here is a chart showing how much you will receive depending on income levels:

Source: SSA

And that money doesn’t go away. The SSA will recalculate your benefits once you reach full retirement age to include withheld benefits.

Claiming Social Security earlier than planned is a reality many will face. Having a plan to make the most of it means you’ll be in better financial shape down the road.

• You can find all of the latest and most important news about Social Security here on Money & Markets.