Mergers and acquisitions are key in the tech industry.

A big tech firm acquiring a small tech firm can help the larger company gain greater market share, access new technology and diversify its revenue streams.

Simply put, M&A in tech is essential to keep companies from getting stagnant in a sector that changes by the minute.

It adds intellectual property and talent with the stroke of a pen rather than years of development and hiring.

Plus, you can acquire new technology that’s already been refined and developed instead of dropping tons of cash to essentially reinvent the wheel.

But M&A in 2024 looks way different than the past…

Today, I’m going to share with you a massive trend in tech investment that is solidifying a subsector of the market.

The Days of Tech Megadeals Are Done

Higher interest rates and a more stringent regulatory environment have put the clamps down on tech acquisitions.

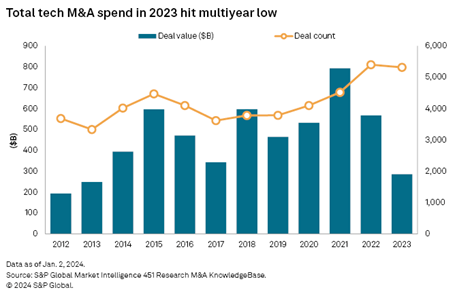

Last year marked a low point in the amount of money tech firms spent acquiring smaller companies. For the first time in a decade, total tech M&A spending dipped below $300 billion:

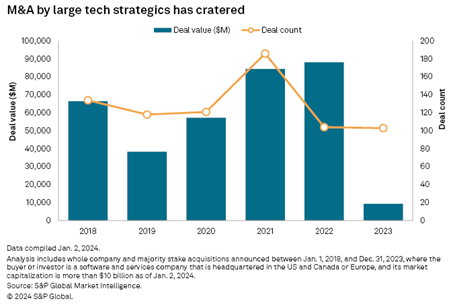

If you drill down to large tech companies (think Meta Platforms, Salesforce, Alphabet and Apple), the numbers are more compelling:

Companies with market caps of $10 billion or more combined to make just four deals in 2023, compared to 18 in 2022.

That’s because the tech world is focused more on making itself profitable and less on growth through acquisitions while interest rates remain elevated.

Even though overall tech M&A was down significantly in 2023, one subsector reached record levels.

And that trend is continuing in 2024…

The AI Mergers and Acquisition Gold Rush Is Here

Earlier this week, I talked about what Amazon.com Inc’s (Nasdaq: AMZN) recent $2.75 billion investment in AI start-up Anthropic meant for the artificial intelligence (AI) mega trend going forward.

Anthropic’s generative AI model, Claude, competes with Microsoft-backed OpenAI and Google’s Gemini.

All of these companies — Amazon, Microsoft, Google, Apple and Meta — are pushing to incorporate AI into their products so as not to fall behind in a market estimated to hit trillions in sales in the next 10 years.

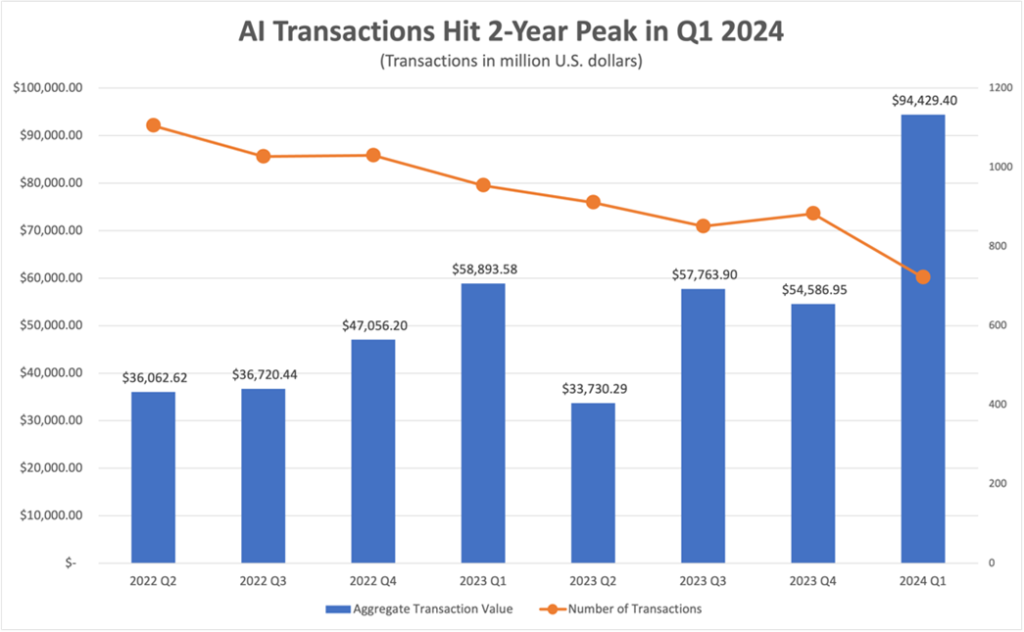

This speaks to a larger trend of tech companies piling cash to invest in AI:

In the first quarter of 2024, transactions related to AI hit $94.4 billion — this includes M&A and rounds of funding.

And this was just after overall tech spending hit a 10-year low.

This wave of AI investment is more than tech companies throwing money into hype. Wall Street is taking notice.

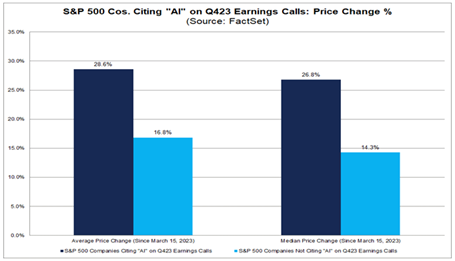

According to FactSet, 179 S&P 500 companies cited “AI” in their Q4 2023 earnings call transcripts. That’s more than twice the five-year average of 73 and the 10-year average of 45.

Something even more interesting:

The companies citing “AI” in their earnings calls had an average share price gain of 28.6%. The average for those not mentioning “AI” was just 16.8%.

Bottom line: After a spending drought, tech companies are pouring significant money into AI now.

And the stocks of companies citing “AI” in earnings reports have outperformed those that didn’t.

It’s a clear indication that, in 2024, the rush of investing and stock gains will be rooted in AI.

On Monday, I said:

If there was a better time to spot a trend and invest in it before it rockets to new highs, I don’t know when it was.

You can find out how any of these stocks rate by looking them up for free in Adam O’Dell’s proprietary Green Zone Power Ratings system here. Just type in a ticker and you’re off to the AI races.

Of course, you could also follow Adam’s guidance into his top recommended stocks for the AI mega trend. He’s just recommended three stocks in Green Zone Fortunes, so now is the perfect time to start your AI stock portfolio.

He believes the time to buy these stocks is NOW… before the AI gold rush peaks and massive potential gains are off the table.

Click here to see how you can follow his guidance into his top AI stocks now.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets