“AI” is the buzzword of 2023.

Does that look familiar? It’s the same exact lead-in I wrote when I started these Green Zone Power Ratings-focused pieces back in May.

And it still holds true.

Meta Platforms just released its own artificial intelligence (AI) assistant to compete with ChatGPT and Google’s Bard…

Investors piled into Arm Holdings’ initial public offering earlier this month in hopes that the chipmaker would follow NVIDIA’s AI success…

And the European Central Bank is even considering AI’s potential as a tool to better understand its inflation mess.

It’s clear that companies and organizations are working hard to maximize this innovative technology’s potential.

As investors, we want to buy the next breakthrough before it’s a household name. We’re looking for the next AAPL, AMZN or NFLX.

With that as a framework, I wanted to revisit that piece I wrote back in May and see how some of those stocks look within Green Zone Power Ratings to see how things have changed (if they have).

Let’s get into it…

AI Blue Chips

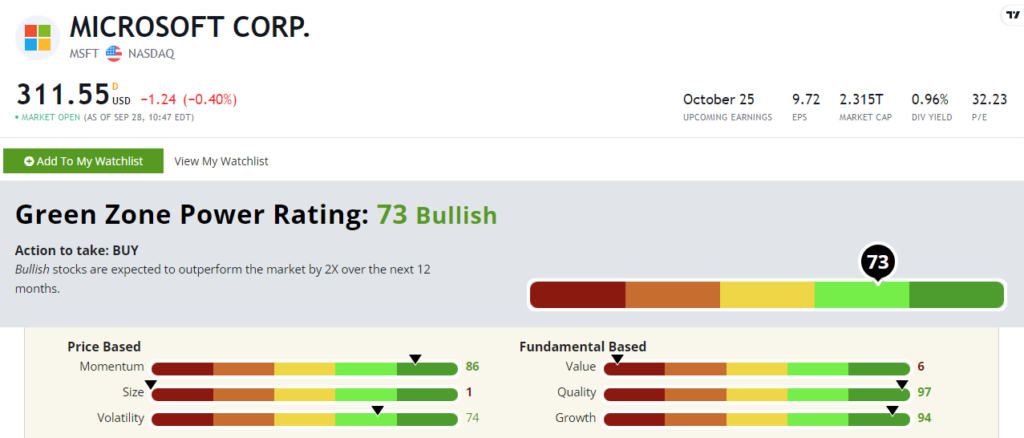

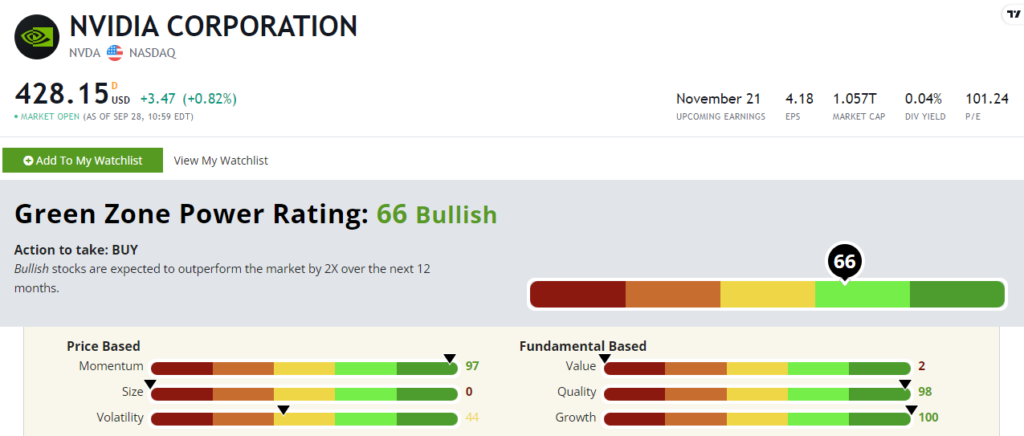

Microsoft Corp. (Nasdaq: MSFT) and NVIDIA Corp. (Nasdaq: NVDA) are leading the AI charge. I call them the “AI blue chips” because I believe their well-established core businesses and strong brands allow them to invest heavily in innovative tech. MSFT and NVDA aren’t going anywhere if AI doesn’t live up to the hype.

And it looks like this summer’s tech-driven stock market rally was a big boost to both stock’s Green Zone Power Ratings.

MSFT stayed in the system’s “Bullish” zone, improving from 62 overall to 73.

Its Momentum score jumped 20 points to 86. The stock is up almost 12% over the last six months. The broader S&P 500 has gained 8% over the same time frame.

In its June quarterly call, it reported $56.1 billion in revenue, an 8.8% increase year over year. Net income also rose almost 20%. That shows in part why MSFT rates a 94 on Growth.

NVDA’s Green Zone Power Ratings also improved since I wrote about it in May. It now sits at a “Bullish” 66 out of 100, improving from a “Neutral” 56.

I highlighted NVIDIA’s Momentum last time around, and it’s still in the top 3% of all stocks we rate on that factor. While the stock has pulled back a bit since hitting a peak earlier this month, it’s still up a massive 61% over the last six months!

Both of these AI blue chips rate poorly on Value. It’s clear that investors are OK with paying a premium for AI innovation and the stock price growth that comes with it.

For now, it looks like both MSFT and NVDA are set to continue their market outperformance from here, according to Green Zone Power Ratings.

C3.ai Is Still “High-Risk”

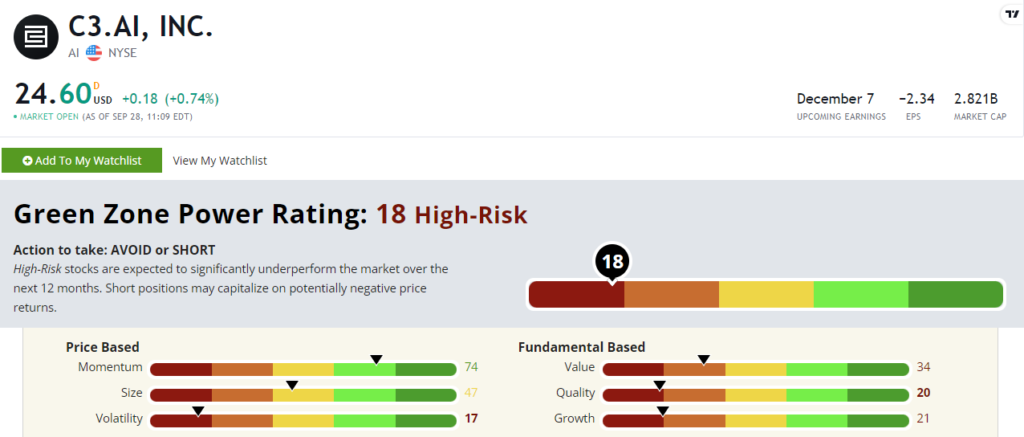

The last AI stock I highlighted back in May was C3.ai Inc. (NYSE: AI).

You’d think that with a ticker like “AI,” this stock would be a no-brainer investment during this mega trend.

But alas, a company needs more than a clever ticker…

And C3.ai stock still rates a “High-Risk” 18 out of 100.

I mentioned that I could see this stock’s rating improve due to it landing some solid contracts with Shell, Koch and the U.S. Air Force. And it did improve, but only by four points since my May story.

This stock’s momentum during the first quarter of the year was solid. Its 74 rating on the Momentum factor is reflected in its market-crushing 123% gain since January 1.

But if you look at the near term, the bottom is starting to fall out. Since hitting a peak in June, AI stock is down 46%…

Those low scores on Value, Quality and Growth are dragging the stock price back to earth.

If you’re looking for a long-term AI stock to buy, Green Zone Power Ratings says C3.ai is a pass for now.

1 More AI Application

I mentioned some of the ways organizations are exploring the use cases for AI at the top of this story. And we here at Money & Markets are doing our own research and development on that front.

Our chief investment strategist, Adam O’Dell, is using AI in his brand-new Infinite Momentum Alert stock trading service.

And now he’s working with TradeSmith CEO Keith Kaplan on Project An-E. This trading platform has one goal: Use AI to find stocks with the greatest future potential.

Adam is going to give you some of the details of what they’ve discovered next week in Stock Power Daily.

But if you want to truly see An-E’s AI potential, you need to attend Adam and Keith’s free live event on Tuesday, at 8 p.m. Eastern time. Click here to put your name on the guest list now.

Until next time,

Chad Stone

Managing Editor, Money & Markets