Investors are piling into sectors that were beaten down by the coronavirus lockdown, and some of the biggest gains over the past week have occurred in airline stocks. So is it the right time to join them?

Individual airline stocks have recently started to surge off March lows as companies continue to develop a post-coronavirus plan that meets increased demand for travel.

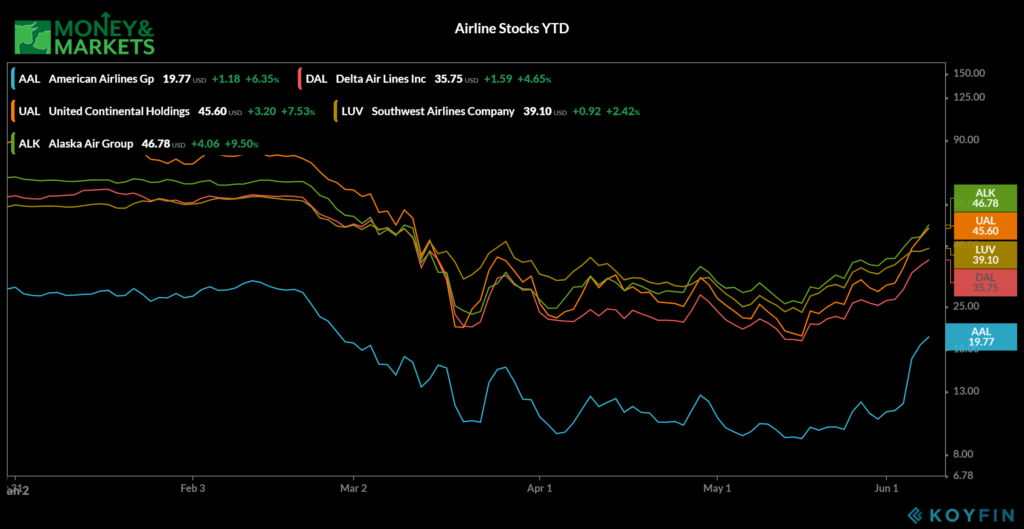

Shares of Delta Air Lines Inc. (NYSE: DAL), American Airlines Group Inc. (Nasdaq: AAL) and United Airlines Holdings Inc. (Nasdaq: UAL) were all trading at least 4% higher again Monday morning as exuberant investors continue to fuel the rally higher.

Should You Invest in Airline Stocks Right Now?

Banyan Hill’s Brian Christopher

Banyan Hill Publishing’s Brian Christopher attributes a lot of this run-up to the increased demand to get out of the house after being under “stay at home” orders for so long.

“People have been cooped up,” said Christopher, Editor of Profit Line. “The uptick in airline stocks is really a function of human nature. We want to get out and about. And some of us are willing to fly.”

And airlines are answering the call. American Airlines announced last week it plans to fly more than 55% of its domestic flights normally scheduled in July, which is way up from 20% in May. American’s daily passengers have surged from 32,000 in April to more than 110,000 in May, according to NPR.

American Airline’s stock has seen significant gains since bottoming out at $8.25 in mid-May. Shares rallied 41% Thursday after the news of increased capacity broke.

If you need more proof of squirrelly consumers needing more to consume, look no further than Sin City, Christopher argues.

“Las Vegas just reopened. Initial news coverage confirmed people’s desire to leave the house. We saw video of packed casinos. The more people that visit Las Vegas and the more stories they come home with, the more people will want to travel there,” Christopher explained. “That will be good for airlines.”

And it won’t just be Las Vegas that sees the benefit of more consumer traffic. As more people get in the air and tell their friends and family about the positive experiences, it will only increase demand for travel to other parts of the country.

No longer will people be limited to Zoom calls and FaceTime, and instead will take the risk and hop on a plane.

“It’s an iterative process,” Christopher said. “The more good experiences people have on airlines, the more comfortable they’ll be with flying.”

Of course a lot of the success of airline stocks hinges on the coronavirus outbreak, and surging demand for air travel could lead to further spread of COVID-19.

“Whether that will contribute to another wave of coronavirus is something we can’t know,” Christopher said. “That could make this a short-term trade, but upside remains right now.”

Christopher recently touted Alaska Air Group Inc. (NYSE: ALK) as a good buy to his Profit Line subscribers.

There are other headwinds to keep an eye on when it comes to airline stocks, though. How long it takes for certain companies to recover from the economic lockdown is a major.

Just last month, American announced it is reducing management and support staff by around 30%, which is about 5,000 jobs. United Airlines is also aiming to reduce staff by 30%. Many of these larger airlines are starting with voluntary separation packages before layoffs.

A key date to keep an eye on is Sept. 30. The CARES Act set aside $25 billion in federal coronavirus relief for airlines, but any company taking bailout money is not allowed to lay off or cut pay of employees until then.

While demand for air travel is rising, it is still well below last year’s numbers. Traffic through TSA checkpoints was down 85% year over year in the past few weeks, and that could improve to minus-70% by July, according to The Motley Fool.

So as airline stocks have experienced a bit of a rally as travel demand increases, watch for any developments on the coronavirus and recovery fronts. While everything is on the rise now, don’t forget how quickly the industry was hammered when the outbreak first started gaining traction.