The Magnificent Seven rode the early stages of the AI wave to incredible gains. Now that those stocks’ momentum has cooled off a bit, investors are hunting for the next big winners.

It’s not that the AI mega trend is dying … quite the opposite, in fact. As companies figure out the true potential of this innovative tech, they realize it’s going to take a lot of continued investment to reach that potential.

That’s a boon for other, less-obvious companies working on the fringes of AI — the companies building out the datacenters, establishing the required infrastructure, and generating the power required to run it all.

And one just landed on my “New Bulls” list this week…

A New “AI Bull”

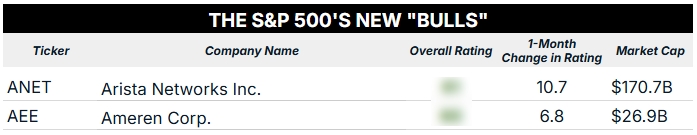

Last week’s weaker market action only produced two “New Bulls” within the S&P 500. As always, these stocks passed two simple screens to land on this list:

- The stock must currently rate 60 or higher (that is, “Bullish” or “Strong Bullish”),

- The stock must have been rated less than 60 for each of the last four weeks.

Here are the stocks that passed the test:

Looking more closely at Arista Networks Inc. (ANET), it’s clear that this cloud computing stock is benefiting from the widening of the AI tech trade.

As investors’ rabid interest in the mega-cap “Magnificent Seven” cools off, stocks like ANET should benefit.

Arista’s bread and butter is building out and maintaining large-scale networks for datacenters and cloud computing services. In layman’s terms, Arista helps massive tech companies get data where it needs to go … and fast!

In late July, Arista announced it was expanding its AI capabilities and had acquired the VeloCloud SD-WAN portfolio from Broadcom. This acquisition will make it easier to maintain these critical networks and keep AI data moving at lightning-fast speeds.

Investors have responded by pushing ANET stock 14% higher over the last month, which has in turn improved its Momentum rating in my Green Zone Power Rating system to 81 out of 100 and helped it establish a “Bullish” rating overall.

This is just one of many companies that investors are showing interest in as AI’s influence widens, and I’m confident that more stocks will join in on this bullish momentum as the next phase of AI continues.

We’ve already made hay investing in similar stocks in my Green Zone Fortunes model portfolio. And I’m confident there is more runway ahead for our positions in the coming months and years.

If you’d like to see the exact stocks I’ve recommended, and also gain full access to my rating system to look up any of the tickers you see in these “New Bull” lists, click here to see how you can join up for a nominal fee now.

Now let’s look outside the S&P 500…

Flying Under the Radar

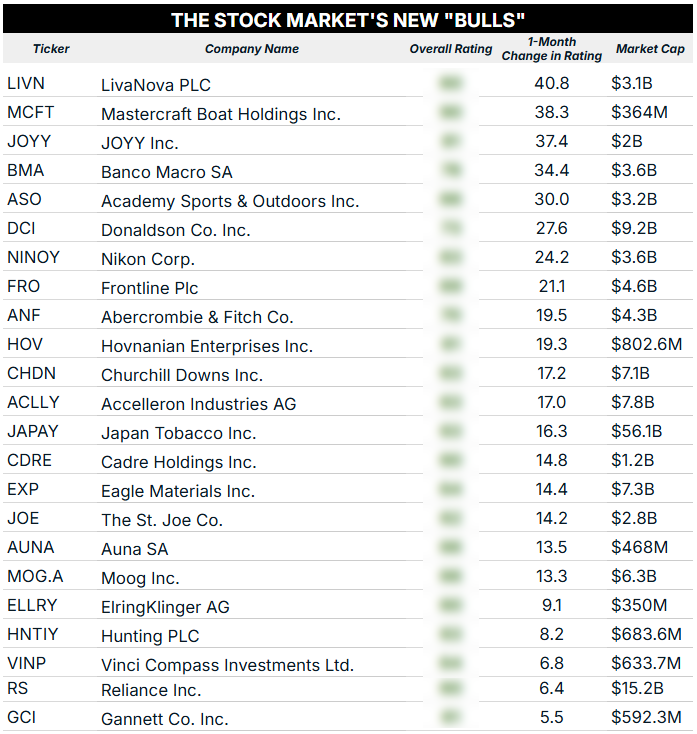

We have 23 stocks from outside the S&P 500 index that passed my “New Bulls” screen this week:

Once again, I’m encouraged by the variety of stocks here…

We have stocks across multiple industries and sectors, as well as a good mix of American and foreign stocks.

We’ve also got some stocks that are completely flying under the radar! Mastercraft Boat Holdings Inc. (MCFT), a small boat manufacturer based in Vonore, Tennessee, has enjoyed a 24% gain in its stock price over the last year, handily beating the S&P’s 17% rise.

The stock popped 10% last week alone, after the company reported adjusted earnings per share of $0.40, more than doubling the $0.18 analysts expected. That’s also a complete reversal of its -$0.04 EPS from the same quarter a year ago.

MCFT has given back some of those gains since the earnings pop, which isn’t uncommon. But its overall standing in my Green Zone Power Rating system has improved an incredible 38 points in the last month, telling me to expect more outperformance ahead.

And that’s just one stock on the list!

To good profits,

Editor, What My System Says Today