Editor’s Note: With artificial intelligence (AI) gearing up for its next phase, we thought it was prudent to run the numbers again in one of Chad’s pieces from earlier this year.

Data centers play a critical role in delivering the AI tech we use every day. But Nvidia, the arguable king of AI, is worried about one thing that could derail the AI train.

Adam will tell you exactly what that is on Tuesday at 1 p.m. ET. That’s one day before Nvidia releases its latest earnings alongside a warning about the future of AI. Click here to make sure you don’t miss Adam’s message.

I had to bust out the calculator after reading an incredible number.

Statista reports we create an estimated 328 million terabytes of data every day.

That’s the equivalent of texting a small picture of your grandkids or pets 656 million times … every day.

With the onset of artificial intelligence (AI), I don’t think that number is going down any time soon.

Think about it. Do you see yourself texting, browsing or streaming less in the coming years?

As much as I’d love to throw my phone in the ocean at times, I know that embracing innovative tech like AI is the smarter move.

Because as I mentioned earlier this year, AI is this generation’s internet. It’s creating incredible early investing opportunities, and I expect that will continue as we find new ways to implement the tech.

Getting back to that incredible stat I led off with … data storage is critical for AI. Large language models can process terabytes of information in the blink of an eye — as long as the data is easy to access.

That’s where data centers come in…

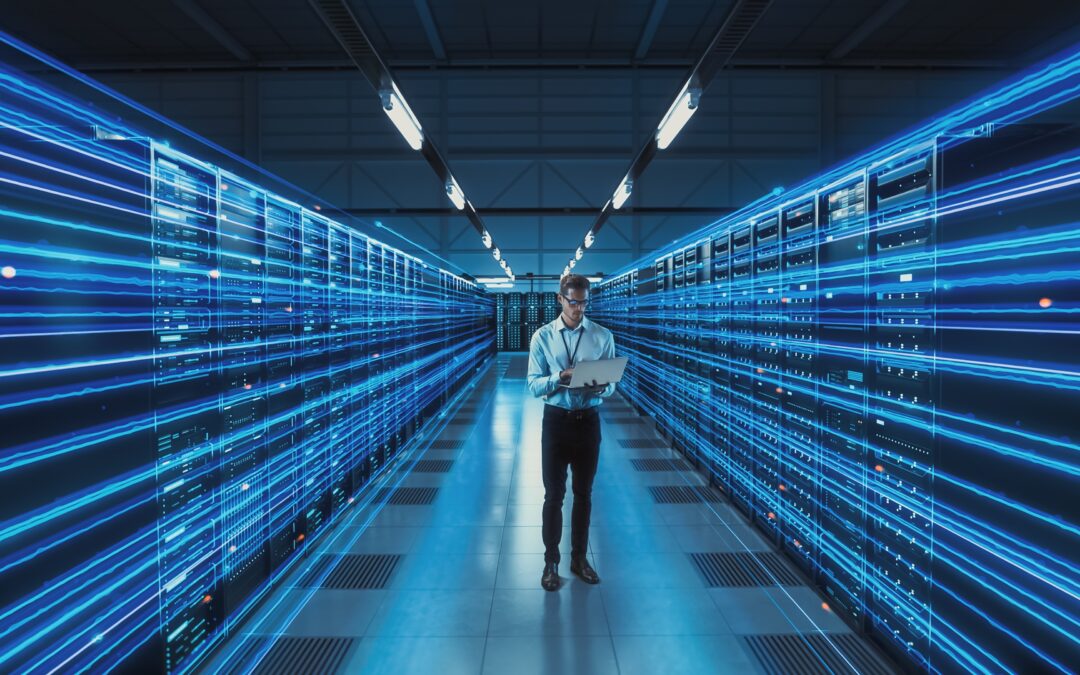

Why Data Centers?

Data centers are digital filing cabinets. They securely house all of the world’s information and applications for easy access when needed.

I won’t get too technical here, but the modern data center is a complex network of physical assets (servers, routers, cooling units, power supply units, etc.) and virtual assets in the cloud.

Did you fill out a form on your doctor’s web portal? That information is now securely stored in a data center.

Looked up someone on Facebook? Yup, you guessed it. Facebook’s parent company, Meta, has a global network of data centers.

Brightlio estimates there are almost 11,000 data centers around the world as of December 2023.

And with the onset of AI, we’ll need faster and cheaper ways to move information around — which means more data centers.

Can you see the investing potential here?

Let’s see what Adam O’Dell Green Zone Power Ratings says.

ETF X-Ray Reveals Data Center Stock to Buy

I enlisted the help of Chief Research Analyst Matt Clark to help me find potential data center stocks to follow the AI mega trend.

As you may know, exchange-traded funds (ETFs) offer a chance to invest in a broad idea, sector or mega trend without having to be too picky about individual stocks.

But as Matt’s ETF x-rays have shown you, that’s sometimes not the best approach. While you get to buy a basket of stocks, some of those assets drag the broader fund’s performance down.

To explore this idea, Matt ran the numbers on the iShares U.S. Digital Infrastructure and Real Estate ETF (NYSE: IDGT), an ETF that tracks American data center and digital infrastructure stocks.

Here’s how the fund’s average ratings look in Adam’s system:

- Overall — 37 out of 100.

- Momentum — 52.

- Size — 30.

- Volatility — 44.

- Value — 28.

- Quality — 54.

- Growth — 51.

With a “Bearish” 37 out of 100 overall average rating, IDGT is expected to underperform the broader market over the next 12 months.

Digging into individual stocks within the fund shows us why.

Stocks like UNIT (4), EXTR (2) and MRVL (2) are dragging IDGT down, while solid ratings on CLFD (82), MSI (80), NTAP (70) and ANET (60) means those stocks should offset the laggards.

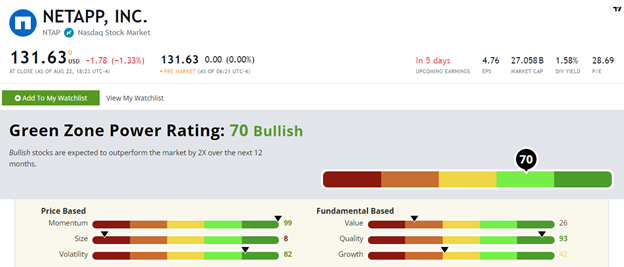

Let’s look a little closer at a stock that rates well in IDGT: NetApp Inc. (Nasdaq: NTAP)…

NTAP’s Green Zone Power Ratings in August 2024.

With a “Bullish” 70 out of 100, NTAP is expected to 2X the broader market over the next 12 months.

NTAP provides data infrastructure, including software, to manage and store data. It partnered with Nvidia to use flash storage to streamline massive amounts of data used in AI and deep learning applications. It’s a fancy way of saying NTAP provides data center power from what looks like nothing more than a large bookshelf.

Source: Nvidia.

The stock has gained 72% over the last year, almost tripling the S&P 500’s 25% gain. That’s why NTAP boasts a near-perfect 99 on Adam’s Momentum factor.

With strong ratings on Volatility and Quality, this should be a steady stock to ride the AI mega trend as it continues to develop.

If you’re looking for a different way to follow AI, data centers look promising. But as you can see from this ETF x-ray, it pays to get picky…

Until next time,

Chad Stone

Managing Editor, Money & Markets