Everybody knows Coca-Cola.

It’s a worldwide brand … but its popularity is massive in Latin America.

In 2020, Latin America made up 28% of all Coca-Cola sales — the highest of any region in the world. This was more than North America … which contributed 18% of the company’s sales.

That popularity is only growing as nonalcoholic beverage sales in the region continue to expand:

In 2020, revenue from the sale of nonalcoholic beverages in South America was $41.2 billion.

By 2026, that figure will reach $61.8 billion — a 50% increase over just six years!

With Coca-Cola being one of the most popular soft drink brands in the region, its primary distribution partner will gain from this massive increase.

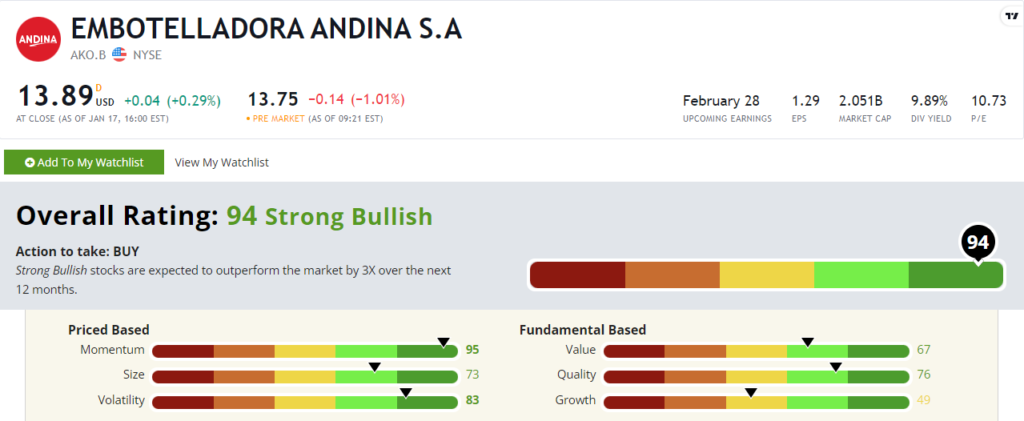

I’m talking about Embotelladora Andina S.A. (NYSE: AKO.B), which boasts an impressive and “Strong Bullish” 94 out of 100 within our proprietary Stock Power Ratings system.

AKO.B produces and distributes Coca-Cola products in Chile, Argentina, Brazil and Paraguay. It covers some of the largest provinces in those countries … such as Buenos Aires in Argentina and Rio de Janeiro in Brazil.

Fun fact: Embotelladora Andina is Spanish for “Andean Bottler,” referencing the Andes Mountains in South America.

Embotelladora stock’s “Strong Bullish” 94 out of 100 rating means we expect it to beat the broader market by 3X in the next 12 months.

AKO.B Stock: Fantastic Price Factor Scores

Embotelladora Andina recently reported a strong quarter.

Highlights include:

- Quarterly net sales of $794.8 million — a 21.5% year-over-year increase!

- For the first nine months of 2022, AKO.B’s net sales were up 26.3% over the same period a year ago.

AKO.B scores a 76 on quality thanks to its positive returns on investment, assets and equity — its industry peers average negative returns.

Embotelladora’s operating margin is 43.4%, compared to the industry average of negative 11%.

AKO.B is also strong on our value factor — where it scores 67.

Its price-to-earnings ratio is less than half the industry average — remember, lower is better here.

This all tells us that AKO.B is a better quality and value stock than its peers.

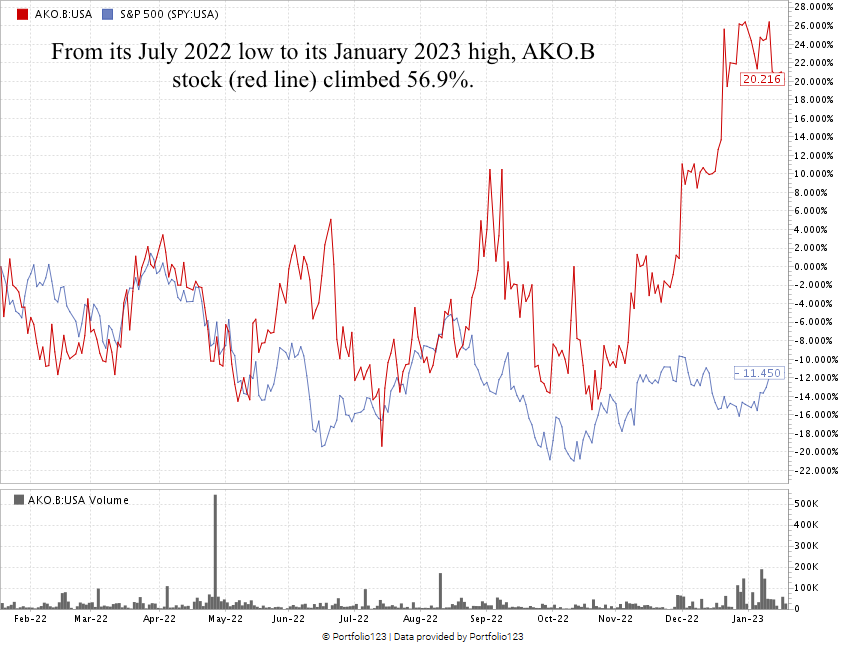

But AKO.B really shines on momentum.

Just look at the chart below.

Created in January 2023.

AKO.B is only trading 6.7% off its 52-week high. From its July 2022 low to that January 2023 high, the stock jumped 56.9% — earning it a 95 on our momentum factor.

That shows the “maximum momentum” we love to see in stocks.

AKO.B scores a 94 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least 3X in the next 12 months.

Coca-Cola is a worldwide brand. Its popularity is huge in Latin America.

Embotelladora is the main distributor of Coca-Cola in some of the largest areas of the region.

These are compelling reasons to add AKO.B to your portfolio.

Bonus: The company’s 15.2% dividend is an annual payout of $2.11 per share that you own.

Stay Tuned: A Steel Stock for Today’s Biggest Mega Trends

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned tomorrow, where I’ll share all the details on a steel producer that’s working within some of the biggest mega trends of 2023.

Until then.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets