On Wednesday, electric carmaker Tesla Inc. beat analyst’s projections and reported a third quarter profit with adjusted earnings per share of $1.86, which smashed loss projections of $0.42 per share. But is this the new trend, or just a market blip?

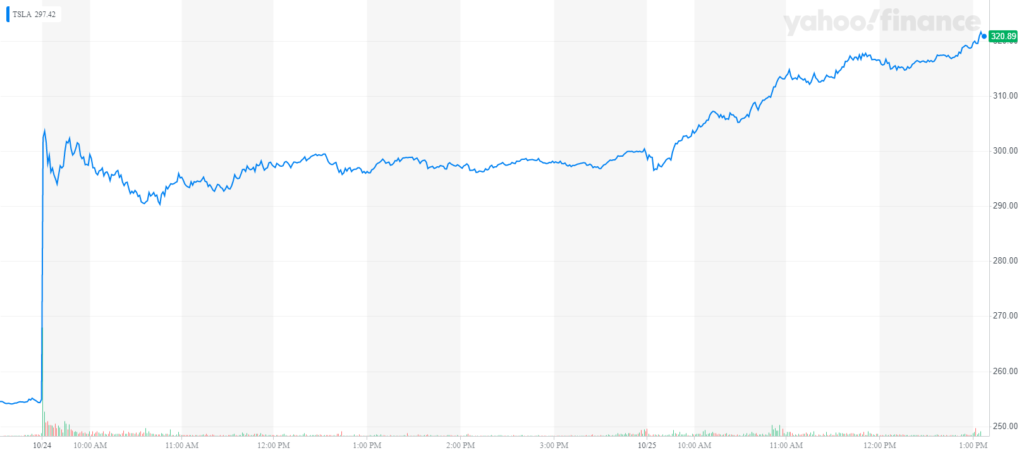

Shares of Tesla jumped as much as 20% following the news Wednesday and settled to 17% gains on Thursday. The stock continued to rise on Friday and was up another 7.1%, or $21.84, to $321.52 around 1:10 p.m. on the East Coast.

The driver behind the stronger earnings report in the third quarter was deliveries of the company’s Model 3.

According to the company’s report, Model 3 deliveries topped 79,000 — 2,000 more than 2019’s second quarter. It was the highest delivery quarter of the model in the last year.

As for its secondary segments — solar, charging stations, etc. — Tesla reported increases across the board in the third quarter. The company deployed 43 megawatts of solar, a 48% increase over the previous quarter.

But, the big question here is whether Tesla’s profitability is sustainable?

You have to consider the company has struggled to turn a profit in any quarter over the last five years.

You also have to remember the company recently experienced significant layoffs and other cost-cutting measures for things like materials, which means less spending and more profit.

In May, the company responded to weak demand by slashing its prices for the third time in three months. The company is also dropping the price of its Model S and Model X by at least $3,000.

And strong demand hasn’t always been the norm. In the first quarter of 2019, the company delivered around 63,000 vehicles, a 31% drop from the previous quarter.

Tesla has also stopped hard-selling its Model 3 sedan, priced at $35,000, because the margins aren’t working for the car.

The problem is most of those measures don’t sustain profits over a long-term. Essentially, you can only cut so much fat before you start getting to the bone.

“Cost control can help a quarter, but we struggle to understand how spending doesn’t have to go up to support Tesla’s growth ambitions,” said RBC analyst Joseph Spak, in a note reported by MarketWatch.

And, as Tesla continues to ramp up production of its Gigafactory in Shanghai, those profits will likely continue to take a hit over the next two quarters.

“Tesla already hinted that margins could start to take a step back in 4Q19 as China factory comes online. This could accelerate in 1H20 as China continues to ramp. And recall on the 2Q19 call, Elon indicated demand to start 2020 could be ‘tough,'” Spak wrote.

And, despite the third-quarter beat, it is ever more likely the company will have an overall annual loss, which it has reported since its IPO in 2010. Over that time, Tesla as amassed more than $5.5 billion in losses.

Another incoming headwind is growing competition as more automakers introduce new electric models themselves.

So, in terms of sustainable profitability, the outlook for Tesla is not good, to say the least.