Coming from the wheat fields of Kansas, I never considered Florida an agriculture state.

But folks here in the Sunshine State take few things more seriously than citrus.

From 2020 to 2021, Florida grew more than half of all oranges in the United States.

The chart above shows the amount of fresh fruit we produce worldwide.

Production ballooned from 576.7 million metric tons in 2000 to 887 million in 2020 — a 53.8% increase! And that’s just the start of this rising trend.

Today’s Power Stock grows citrus in Florida: Alico Inc. (Nasdaq: ALCO).

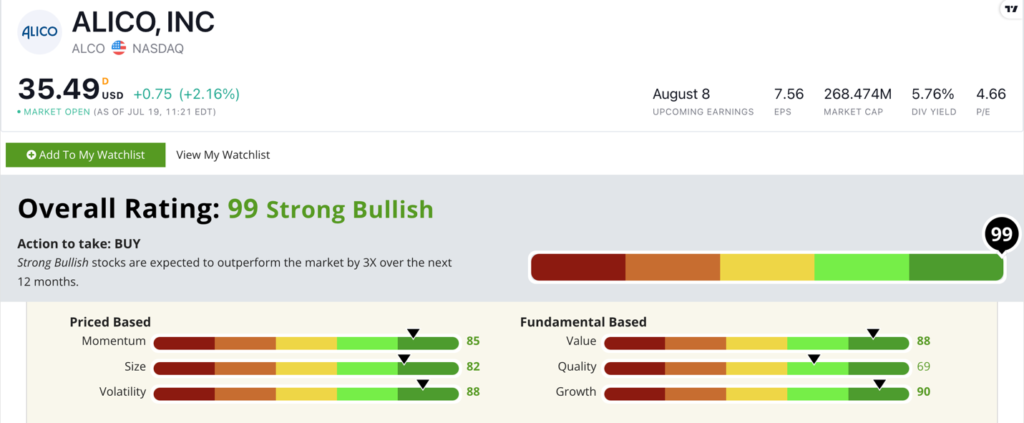

ALCO Stock Power Ratings in July 2022.

Alico’s 83,000 acres of land span eight rural counties in Florida to grow citrus trees.

Fun fact: Ben Hill Griffin Jr. once ran the company. He’s also the namesake of the University of Florida’s football stadium in Gainesville.

ALCO scores a “Strong Bullish” 99 out of 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

ALCO Stock: Green Across the Board

In my research on Alico, I discovered two compelling items:

- In the second quarter of 2022, ALCO generated $50 million in sales — a 233.3% increase from the previous quarter.

- Its earnings per share grew 322.9% from second-quarter 2021 to second-quarter 2022.

ALCO scores in the green on all six factors that make up the Stock Power Ratings system.

When it comes to our fundamental factors, it scores highest on growth and value.

Its price-to-earnings ratio is a reasonable 4.6 — almost four times lower than the agriculture industry average.

ALCO stock hit a 52-week low in February 2022. Two months later, it climbed 35% to a 52-week high.

The stock is up 6.6% over the last 12 months, beating the broader agriculture industry, which is down 2.8% over the same time.

Alico Inc. stock scores a 99 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

Floridians are serious about our citrus.

A leader in citrus production in Florida, Alico agriculture stock is in the perfect position to take advantage of increased global fruit production.

I’m confident you can see now why ALCO is a smart addition to your portfolio.

Bonus: Shareholders earn a 5.8% dividend yield, meaning the company will pay you $2 per share, per year to own the stock.

Stay Tuned: Excellent American Semiconductor Stock

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on a U.S.-based company that makes in-demand computer chips.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Love Stock Power Daily? Don’t forget to check out The Stock Power Podcast, where I dive deep into one of our “Strong Bullish” Power Stocks and tell you why you should consider it for your portfolio.

Best of all? This is a separate stock from the ones I share five days a week in Stock Power Daily!

Check out the podcast on our YouTube channel or your favorite podcast provider.