In 2021, Taiwan and China built 20 new semiconductor production facilities.

The United States had just four.

The U.S. government stepped in to encourage American semiconductor manufacturers to compete more with their Asian counterparts:

You can see in the chart above that the global semiconductor market’s value will increase 101.3% from 2020 to 2030.

China and Taiwan have the semiconductor market cornered.

In April 2022, China sold $16.7 billion worth of chips.

North, South and Central America combined sold $11.9 billion.

Last week, the U.S. Senate approved $50 billion in new subsidies to bolster U.S. chipmaking.

Today’s Power Stock is Avnet Inc. (Nasdaq: AVT), an American semiconductor manufacturer.

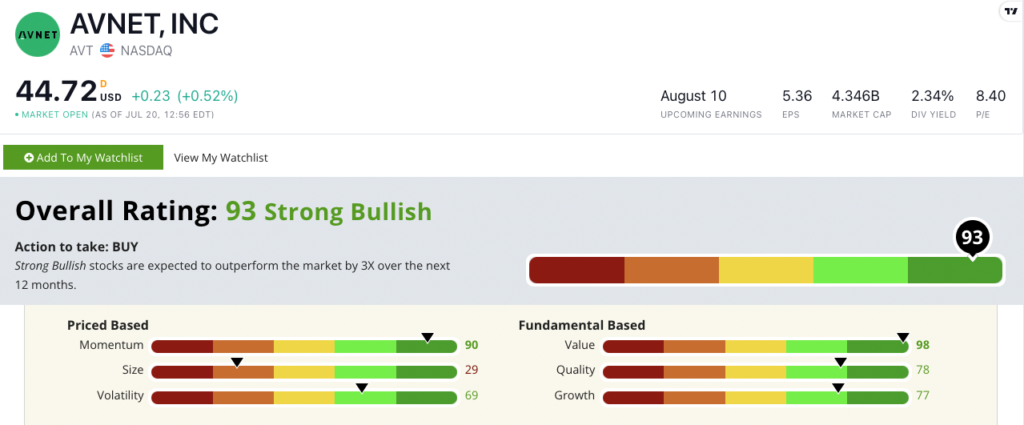

AVT Stock Power Ratings in July 2022.

In addition to selling semiconductors, Avnet provides electronic components for use across sectors including:

- Automotive.

- Medical.

- Defense and aerospace.

- Telecommunications.

Avnet stock scores a “Strong Bullish” 93 out of 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

AVT Semiconductor Stock: Value + Momentum

AVT just posted a strong third quarter.

Highlights include:

- Total sales of $6.5 billion — up 32.7% from the same quarter a year ago.

- A 72% increase in earnings per share over 2021.

Avnet is an excellent value stock, earning a 98 on the metric in our proprietary system.

Its price-to-earnings ratio is 8.4, which is more than three times lower than the information technology industry average. AVT stock is a deal, folks.

Avnet’s growth is also strong.

Its one-year annual earnings-per-share growth rate is 756%, and it just came off a blockbuster quarter for sales.

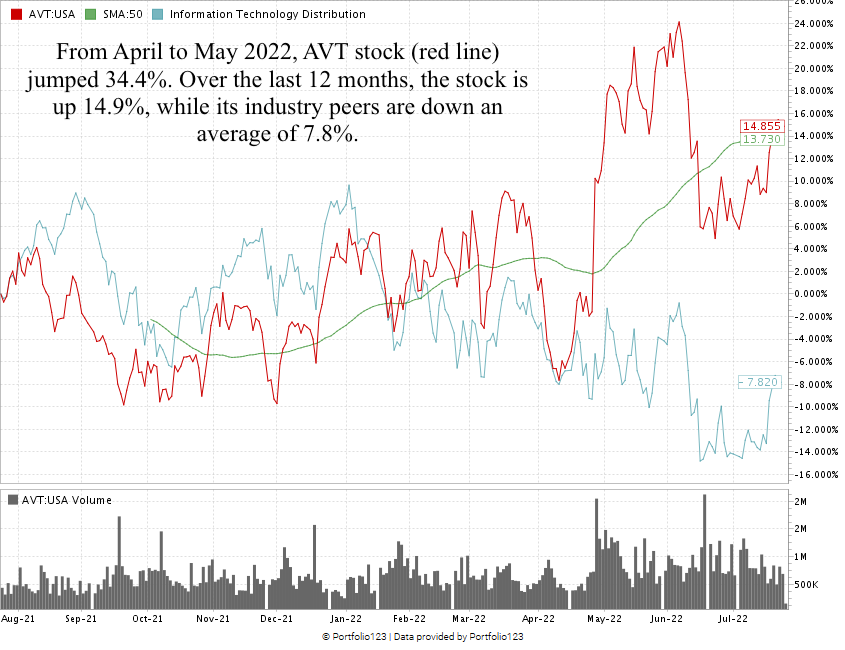

After hitting a low in April, AVT went on a tear, gaining 34.4% in two months.

Broad market headwinds pared those gains, but the stock has gained 9.6% since the end of June.

Avnet Inc. stock scores a 93 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

America wants to be more competitive in the semiconductor market.

The U.S. government’s recent bill gives that effort a $50 billion boost.

I’m confident Avnet Inc. is an excellent semiconductor stock for your portfolio.

Bonus: Avnet’s forward dividend yield of 2.3% means it pays shareholders $1.04 per share, per year.

Stay Tuned: Biopharma Power Stock

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on an excellent gene therapy Power Stock.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Love Stock Power Daily? Don’t forget to check out The Stock Power Podcast, where I dive deep into one of our “Strong Bullish” Power Stocks and tell you why you should consider it for your portfolio.

Best of all? This is a separate stock from the ones I share five days a week in Stock Power Daily!

Check out the podcast on our YouTube channel or your favorite podcast provider.