The S&P 500 has been chopping sideways near all-time highs for a few weeks now.

This is where tools like my Green Zone Power Rating system come in handy …

While it feels like stocks aren’t moving much compared to the ripping recovery rallies we saw just a few months ago, I can assure you that certain individual stocks are motoring higher. It just takes some hunting to find those true outperformers.

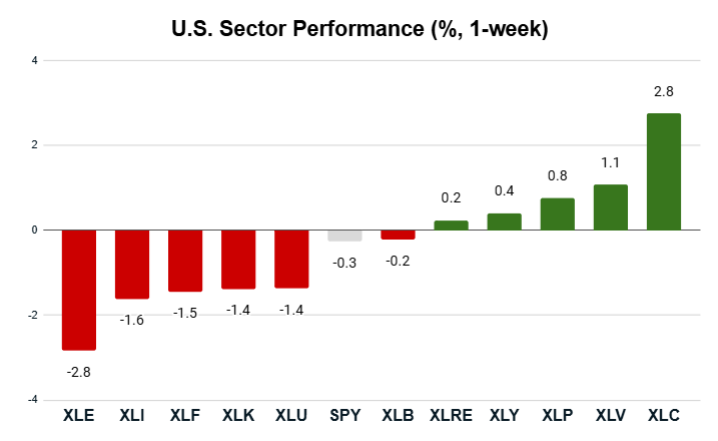

With that said, let’s see how the broader S&P 500 sectors closed out last week:

Key Insights:

- The S&P 500 (SPY) lost a little ground, closing 0.3% lower.

- Six sectors outperformed the S&P 500, while five sectors lagged the broader index.

- The energy sector (XLE) reversed course, losing -2.8%.

- The communications sector (XLC) led the pack with a 2.8% gain.

The five sectors that lagged the broader S&P 500 did so at a significant clip, with each of these sectors losing at least 1.4%. What’s more, the energy sector (XLE) reversed course in a significant way after two weeks of strong outperformance (more on that below).

Let’s run the numbers using my Green Zone Power Rating system to see what we can learn…

Alphabet’s Massive Win

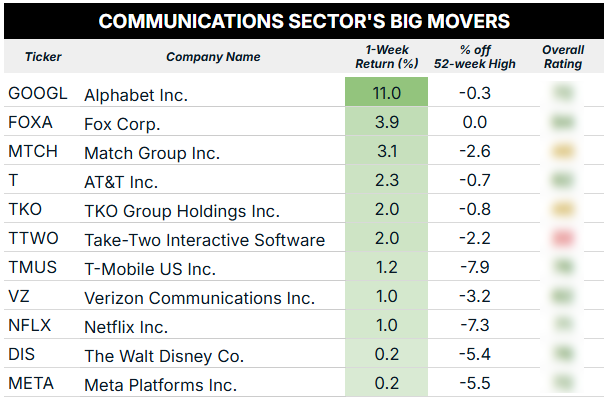

With a 2.8% gain over the shortened trading week, the communications sector (XLC) left the rest of the market in the dust.

Below, you’ll find the 11 communications sector stocks that gained and closed last week within 10% of their 52-week highs:

The big winner was Alphabet Inc. (GOOGL)…

The mega-cap tech giant landed a massive win as it avoided significant penalties in its antitrust lawsuit, which has dragged on for the past five years.

Investors responded by pushing the stock 11% higher, and adding roughly $230 billion to Alphabet’s market cap over the shorter trading week.

Looking at the rest of the list above, I’m encouraged to see many stocks rating “Bullish” in my Green Zone Power Rating system. I’ll have more on that front in tomorrow’s edition…

If you want to dig in now to how these stocks stack up, click here to find out how you can gain full access to my system with a subscription to Green Zone Fortunes, my flagship investing service.

Let’s move on to last week’s laggard…

Energy Sector Reverses Course

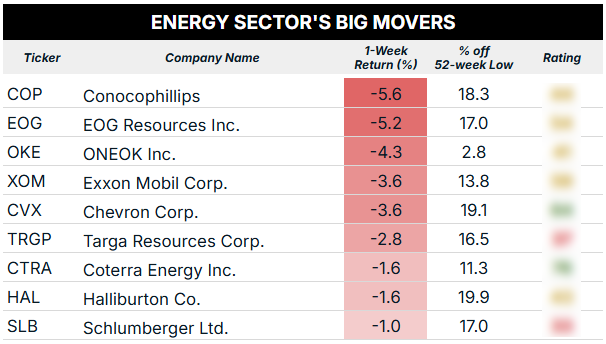

After leading the pack for two weeks, the energy sector (XLE) gave back some gains, closing the four-day trading period 2.8% lower.

Here are the energy stocks that closed within 20% of their 52-week low:

The big trend I’m seeing here is the heavier weight toward “Neutral”-rated stocks in my Green Zone Power Rating system. Five of the nine stocks above fall into that category, while we have two each that are “Bullish” or “Bearish.”

That tracks considering the broader energy sector has been pretty choppy over the last year. XLE’s one-year performance is essentially flat.

I’m still encouraged by its performance since April’s tariff sell-off. But it’s weeks like this that tell me it’s best to “get picky” instead of investing through a vehicle like an exchange-traded fund (ETF).

To good profits,

Editor, What My System Says Today