You know the standard financial planning formula.

When you’re young and have all the time in the world, your portfolio should be mostly — if not entirely — invested in stocks. You have time on your side, and suffering through a bear market or two along the way is no big deal.

But as you get older, you gradually take your chips off the table, gliding out of the stock market and into bonds.

The rule of thumb for years was that your allocation to stocks should be something along the lines of 100 minus your age. A 65-year-old should have roughly 35% of their portfolio in stocks. But as life expectancies have stretched out, so has the recommended stock allocation.

These days, many financial planners recommend a stock allocation of 120 minus your age. So, that same 65-year-old should have 55% of their nest egg in stocks. You could round up to 60% for a good, old-fashioned 60/40 portfolio.

All of that is fine and good. But what do you do with that remaining 40% that is supposed to be invested in bonds?

The 10-year Treasury yields just 0.78%, and this is after a significant spike in yields since September. High-quality corporates yield a little higher, but not much. The yield on 10-year AAA-rated bonds is less than 0.9%. Sure, inflation is still low. But even in a zero inflation world, these are pitiful yields.

Due largely to pitiful bond yields, J.P. Morgan expects the annual returns on a 60/40 portfolio to be just 3% over the next decade.

So, what can we do about this?

This reminds me of the old joke by Charles Dudley Warner that everyone always complains about the weather, but no one does anything about it. We can’t make yields go higher.

There’s no magic solution here. But I have a few alternatives to traditional bond investing in a low-yield world.

3 Alternatives to Traditional Bond Investing

Consider Low-Volatility Dividend Stocks

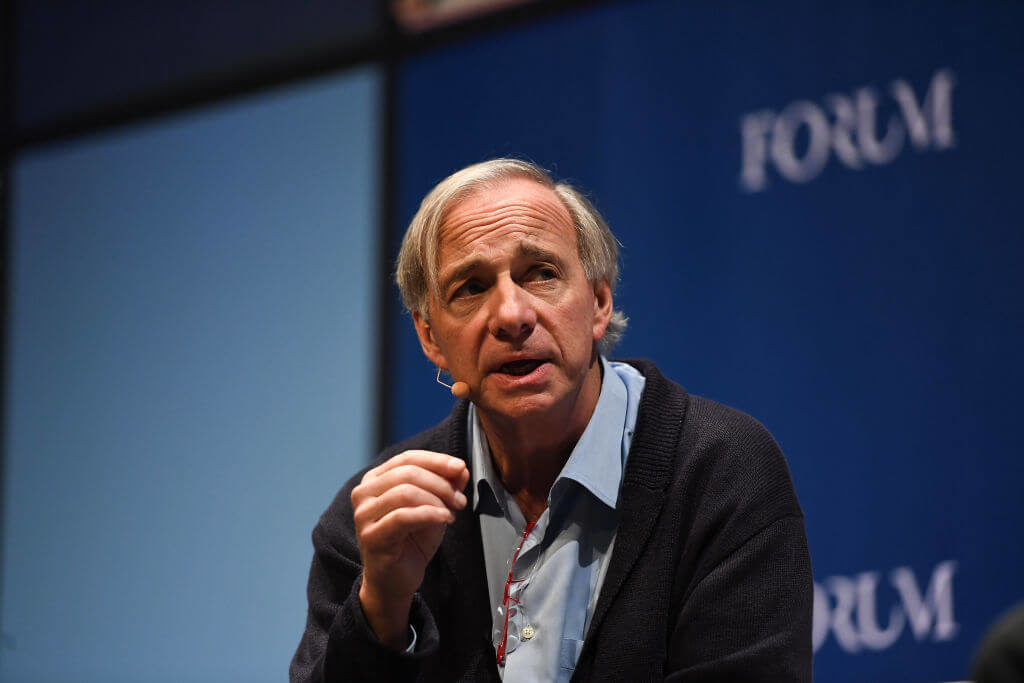

Ray Dalio is one of the wealthiest and most successful fund managers in history, and he built his wealth in a remarkably conventional way.

Ray Dalio is one of the wealthiest and most successful fund managers in history, and he built his wealth in a remarkably conventional way.

Unlike a lot of other hedge fund titans, Dalio never took excessive risk. He simply tweaked the weightings on his asset allocation to give a higher allocation to bonds, even using leverage. (His “risk parity” concept called for sizing your positions so that each asset class contributed equally to portfolio volatility.)

Well, Dalio is doing things differently these days.

The man that made billions by pairing his stock portfolio with an aggressive bet on bonds is now moving part of his bond allocation to low-volatility, dividend-paying stocks.

You have to be careful there. Low-vol stocks are still stocks and are naturally riskier than bonds. Your portfolio will likely have more ups and downs.

But, you can still find plenty of yields in the 2% to 3% range, which is better than what most quality bonds offer at the moment. If you are looking for a low-volatility dividend stock, check out my write-up on Flowers Foods Inc. (NYSE: FLO) here.

Actively Manage Your Bonds

I had an allocation strategy before COVID-19 blew up the world.

Whenever the 10-year Treasury yield would go over 3%, I would rebalance my portfolio, selling off some of my appreciated stock and topping-up my bond allocation. Whenever yields would drop under 2%, I would rebalance again, selling off some of the bonds and rotating slightly more aggressively to stocks. The idea was to constantly buy low and sell high.

Well, we probably won’t see 3% yields in Treasurys any time soon. But you can still take a more active role. When yields periodically drop, use that as an excuse to lighten the load in bonds. And when yields rise to multi-month highs, perhaps add a little more exposure.

This isn’t a recipe for massive, market-crushing returns. But every nickel counts in a low-yield world.

Consider Actively Trading

Here’s another alternative to bond investing.

Most financial planning assumes you buy index funds and let them ride. Over a 30-year time horizon, that’s probably great advice.

But over shorter windows, active trading can be an important part of the mix too. While active trading has a reputation for being riskier, it doesn’t need to be. Trading is only as risky as your risk management allows. Here are some keys to managing risks:

- Keep your position sizes modest.

- Follow your trading rules (i.e., don’t deviate from your plan).

- Honor your stop losses.

Doing this can ensure you aren’t taking major risks.

Consider carving out part of your portfolio for active trading strategies. If executed well, gains from the trading strategies could compensate for lack of returns in fixed income or buy-and-hold stock strategies.

You don’t have to swing for the fences here. The idea is to augment your portfolio returns, not make millions overnight.

Low yields are likely to be the norm for the foreseeable future. Finding some alternatives to bonds can help you squeeze more into your nest egg without taking on too much risk.

Money & Markets contributor Charles Sizemore specializes in income and retirement topics. Charles is a regular on The Bull & The Bear podcast. He is also a frequent guest on CNBC, Bloomberg and Fox Business.

Follow Charles on Twitter @CharlesSizemore.