A former U.S. industry giant recently pushed back…

U.S. Steel Corp. (NYSE: X) rebuffed a buyout deal from fellow former giants Cleveland-Cliffs Inc. (NYSE: CLF) worth north of $7.2 billion.

Back in 1901, U.S. Steel became one of the first $1 billion businesses when 10 companies combined to form the juggernaut.

But the steel industry in the U.S. has stalled out in recent years. Exports of U.S. semifinished and finished steel products dropped 51.4% from 2012 to 2020.

While the steel industry’s heyday may have passed, today I’m going to look at another metal industry that’s poised for a breakout.

It’s opening the door for languishing steel manufacturers to refocus and target new growth.

And I’ll use Adam O’Dell’s proprietary Green Zone Power Ratings system to identify a big player that’s doing just that … while paying its investors a decent dividend as well.

Aluminum’s Resurgence

When you think of aluminum, the first image that comes to mind is likely the can of soda you just finished.

But it’s used for much more … like window frames and critical aircraft parts.

Aluminum is nontoxic, highly malleable and very strong when combined with other metals like copper and silicon.

And the need for aluminum is only going higher:

In 2021, the world consumed 64.2 million metric tons of aluminum. IAB South Africa expects that figure to jump to 78.4 million metric tons by 2029 — a 22.1% increase.

The U.S. was the fourth-highest exporter of aluminum in the world in 2021 — behind China, Germany and Canada.

What’s more, S&P Global projects the price of one pound of aluminum will hit $1.36 by 2028 … up from just $0.76 in 2020.

With consumption and price on the rise, companies in aluminum production are poised to increase revenue and profits in the coming years … all good news for investors.

Using our Green Zone Power Ratings system, I found a highly-rated stock in the industry that also pays a strong dividend.

Reliance Steel Is a “Strong Bullish” Play on the Trend

While it’s not as old as U.S. Steel, Reliance Steel & Aluminum Co. (NYSE: RS) has been around since 1939.

It produces products made from aluminum, brass, copper, titanium and, yes, steel.

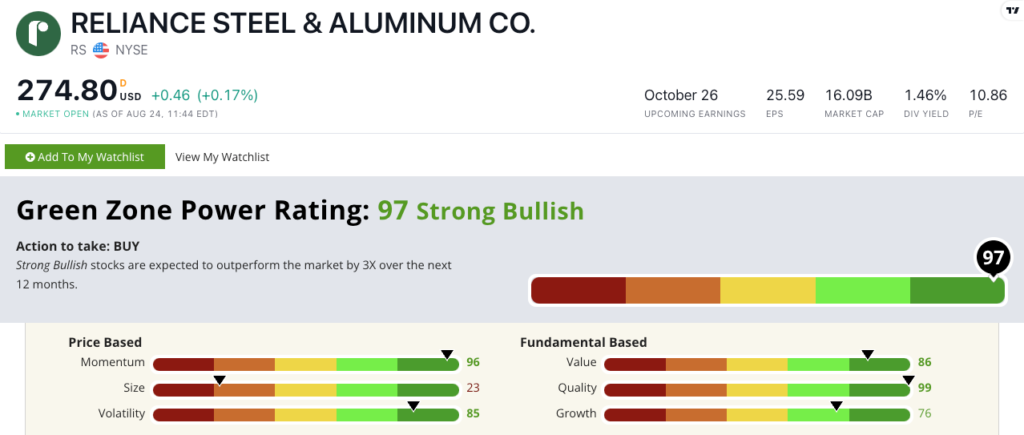

RS rates 97 out of 100 on our Green Zone Power Ratings system. We’re “Strong Bullish” on the stock and expect it to outperform the broader market by 3X over the next 12 months.

The stock earns its highest mark on Quality (99). Its 20.9% return on equity is four times higher than the metal products industry. And its 10% net margin is five times higher than the peer average. You can see why it rates in the top 1% of stocks on the Quality factor.

On our Momentum factor, RS earns a 96. Since June 1, the stock has gained more than 18% and is trading around 7% off its 52-week high. This tells me the stock has plenty of room to run.

As a cherry on top, RS pays a 1.46% forward dividend yield, which equals around $4 per year for each share they own.

A little extra income never hurts!

Bottom line: We need more aluminum every year … and that’s driving prices up.

This is great news for companies like RS. Higher demand and higher price means the potential for higher profits.

That’s what makes Reliance Steel & Aluminum a compelling stock to examine for your portfolio.

Stay Tuned: Watch Out for Dividend Traps

Tomorrow, Adam has a warning about high-yielding dividend stocks. He’ll show you how to use Green Zone Power Ratings to sidestep these stocks that look like good buys at first glance.

The Money & Markets team is also releasing its new book tomorrow, so keep your eyes on your inbox.

Endless Income: 50 Secrets for a Happier, Richer Life is chock-full of ways that you can generate new streams of income. Ideas like:

- How to collect $510 or more a month … for life … simply for “insuring” a part of your nest egg.

- Three simple words you can use to put 40% more money in your pocket for retirement.

- How you can boost your 401(k) or IRA as much as 194% in eight years by being FIRE’d…

You can secure a copy of this new book after its release tomorrow. We’ll have all the details in future editions of Stock Power Daily.

Until then…

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets