This week is marked down as one of the busiest in the market as more than 150 companies are set to unveil their quarterly earnings.

Those earnings will set the tone for market fluctuations for the next several weeks as companies like Lockheed Martin, Boeing, Facebook, Twitter and Exxon release their reports.

However, amid the influx of results, one company to keep a close eye on is Amazon.com Inc.

The online retail giant has tentatively scheduled Thursday, April 25 as its report date for the fiscal quarter ending May 2019.

Analysts, including Zach’s Investment Research, have pegged Amazon’s earnings per share at $4.61 which, according to Piper Jaffray’s Craig Johnson, is a clear undervaluation of the company’s earnings.

A rationale for that undervaluation is the fact that analysts may be underestimating the impact of Amazon’s growth in sectors outside its traditional e-commerce business mode.

“Now of course they have their e-commerce business, and that industry in particular is growing in the low double digits, but their cloud business is where it’s at,” Johnson said to CNBC’s Trading Nation last week. “That’s high margin, it’s growing at over 40% per year, and it’s all recurring revenue. … Their ad business is ramping up, which is also high margin. They’re actually stealing ad dollars from Facebook and Google. And no one is even talking about them in the streaming wars.”

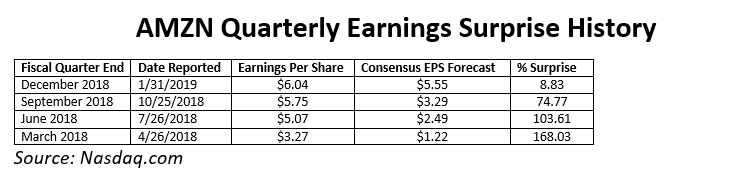

Another thing to keep in mind is the fact that Amazon’s quarterly earnings have beat the consensus EPS forecast in each of the last four quarters. In their December 2018 earnings statement, the company’s earnings were 8.83% higher than the forecast. Before that, in September 2018, the earnings were 74.77% higher.

Because of this potential undervaluation, AMZN could prove to be a solid buy for investors as it indicates strong uptrend for the stock.

“If you take a look at that chart you’re making a pretty good-looking base, you’re making a nice series of higher highs and higher lows, so I think at this point in time this is a stock that I would trade to the long side heading into earnings season. … [It’s] a stock that should hold up well despite whatever the earnings release is,” Johnson said.

CNBC reported FactSet analysts expect Amazon to earn $4.71 per share on $59.7 billion in revenue. Earnings Whispers suggest the company could report earnings of $4.95 per share.