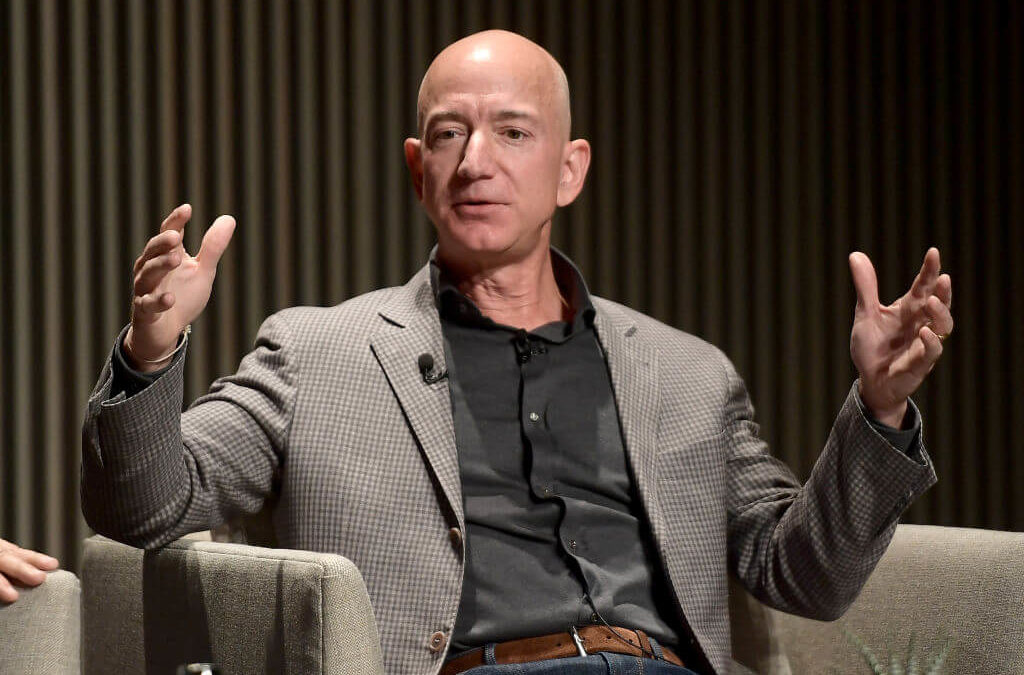

Amazon CEO Jeff Bezos issued a challenge to other retailers to match his company’s pay and benefits, and Walmart fired back that Amazon should start paying taxes in an escalation of a feud over worker pay.

Bezos said in his annual letter to shareholders Thursday that other retailers — though he didn’t specifically name any — should do better than Amazon’s $15 minimum wage and take theirs to $16.

“Today I challenge our top retail competitors (you know who you are!) to match our employee benefits and our $15 minimum wage. Do it! Better yet, go to $16 and throw the gauntlet back at us. It’s a kind of competition that will benefit everyone,” Bezos wrote.

Walmart and Target are two of Amazon’s top competitors, and they’ve been working to raise employee wages but still lag behind Amazon. Target said last week it is raising its minimum hourly wage $1 to $13 in June, and has a goal of $15 an hour by the end of 2020. Walmart’s minimum is $11 an hour, set in January 2018. Though, Walmart says its average worker makes $17.55 an hour in wages and benefits.

Walmart also helps subsidize college tuition costs for employees who are working toward a degree.

Walmart EVP of Corporate Affairs Dan Bartlett shared an article on Twitter highlighting the fact that Amazon paid $0 in federal taxes on more than $11 billion in profits last year.

Hey retail competitors out there (you know who you are ????) how about paying your taxes? https://t.co/Rmh3VZOHsG @JeffBezos

— Dan Bartlett (@danbartlett6) April 11, 2019

Amazon has done a lot to improve worker pay, but has come under fire for not having to pay federal taxes. Sen. Elizabeth Warren announced a plan Thursday to tax “real” corporate profits — what a company tells its shareholders it made, not what is reported to the IRS after dumping profits in loopholes — at 7% above $100 million. Warren called out Amazon by name for not carrying a fair share of the tax burden as one of the world’s most valuable companies.

In addition to not paying any federal taxes in 2018, Amazon also received a $129 million tax refund. The low tax bill reportedly stems from the Tax Cuts and Jobs Act passed by Republicans, which allows carryforward losses from years when the company wasn’t profitable, tax credits for R&D investments and stock-based employee compensation, according to CNBC.

Amazon would have paid about $698 million under Warren’s plan, according to Fortune.

Walmart reportedly paid more than $3 billion in federal corporate income taxes in 2018 alone.