I love investing in stocks where I know my bad habits (Amazon ordering) help juice a company’s bottom line.

One of my favorite REITs falls into this camp.

It’s phones have been ringing off the hook to get ahold of its invaluable warehouse and industrial properties which are the backbone of all e-commerce operators.

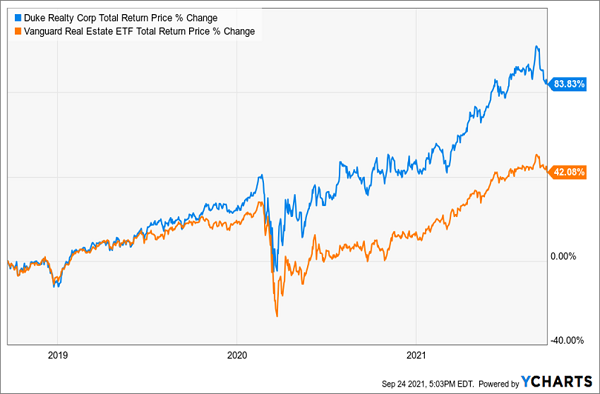

Its shares have also helped investors DOUBLE their otherwise pedestrian returns from the Vanguard Real Estate ETF (NYSE: VNQ) over the past three years.

Not only have its returns outpaced the market, but it has a habit of paying out special dividends that our retirement portfolios can certainly appreciate.

In a moment, I’ll discuss this REIT in the midst of huge secular e-commerce tailwinds … but first, a quick story.

I hate to bring up painful memories.

Does the toilet paper shortage of 2020 evoke strong feelings for you?

For me, it was a time I’d like to forget.

Locked in my house, tapping away in my pajamas at 3 a.m. to try and secure a Whole Foods grocery order.

Oh, and why on earth was I Clorox wiping my grocery bags?

The overwhelming panic and demand put so much strain on manufacturers that they couldn’t keep up.

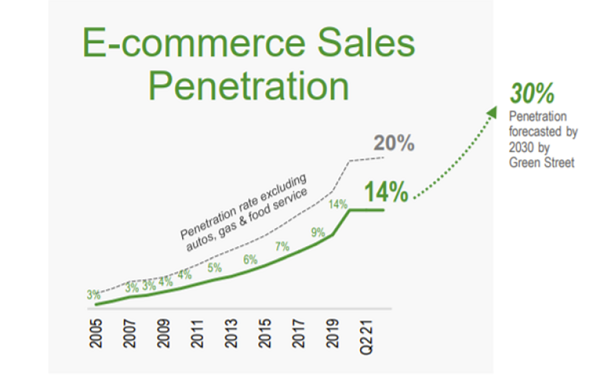

The seismic shift to e-commerce throughout the pandemic accelerated so quickly that it is estimated that online adoption jumped ahead by ten years in only three months!

Source: DRE Investor Presentation.

I’m here to provide one idea that has already been a massive beneficiary of this growth but one that should continue to benefit as companies work to fortify online operations moving forward.

The stock is Duke Realty (NYSE: DRE), and it is the largest U.S.-based, pure-play industrial REIT.

DRE owns and operates 540 state-of-the-art logistics and industrial properties, housing some of the world’s biggest online retailers and manufacturers.

These properties are massive. In total, DRE’s properties cover over 160 Million Square Feet!

Source: DRE Investor Presentation.

I love the diversity of its tenant base, as it leases to not only the Amazon’s of the world but the shipping giants such as United Parcel Service (NYSE: UPS) and FedEx Corp. (NYSE: FDX), along with manufacturers like Samsung and home improvement retailers such as The Home Depot Inc. (NYSE: HD). Note: Yes, The Clorox Co. (NYSE: CLX) is also a customer.

Increased online demand should continue to support high occupancy rates for DRE at its owned properties (already at a VERY healthy 98% occupancy rate). Still, I see several other reasons why this story has years of growth ahead.

The first is in regards to reshoring.

You might have noticed we have a wee bit of a supply chain issue at the moment. Have you tried to buy a car recently? Or even a pair of soccer cleats?

The supply chain is a total disaster. Hence, the U.S. is working to bring manufacturing back from abroad to help improve the situation and reduce our reliance on China.

What does this mean for investors? Well, ultimately, higher demand for industrial-based facilities that an S&P 500 holding such as DRE can offer.

At the end of 2020, reshoring announcements were up 5-times versus pre-pandemic levels, with over 80% of manufacturers indicating they were “likely” to “extremely likely” to reshore.

The other secular trend that has me very excited about an investment in DRE also involves e-commerce operations. But it’s not the growth in e-commerce purchases but the actual ability to facilitate the returns of these purchases that has me excited.

Known as “reverse logistics,” the ability to facilitate online returns is becoming a big focus for any major online retailer.

Online returns are roughly two-times to three-times that of in-store returns, and thus, the need for modern facility space (such as that which DRE provides) that can handle this sort of demand is growing exponentially.

The trends in e-commerce are supportive of continued growth in the industrial and logistics warehouse space.

So, let’s dive a little further into DRE to see why I am so excited about this company as an investment.

Interestingly, DRE’s growth plans are primarily focused on Tier 1 Coastal areas — think California, South Florida, New Jersey, and Seattle — areas in which it says demand is “unprecedented.”

The strategy goes against the grain of those that say the Sunbelt is the place to be (something I’ve discussed in previous pieces) — thus, giving DRE a differentiated strategy, as Tier 1 coastal areas are among the most desirable and are currently supply constrained.

And while it has shown growth of Funds From Operations in the high single digits over the past three years, expectations are that it should be able to generate low double-digit growth for at least the next three years. Something I think is quite attainable given the secular trends at play here.

DRE shareholders have done quite well over the past three years, nicely outpacing the REIT market on a total return basis.

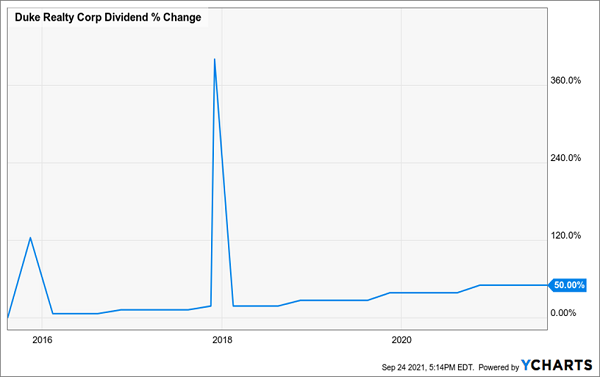

The strong price action has led to a current dividend yield on DRE of only 2.1%. However, management has grown the dividend at 50% over the past six years while also occasionally spitting out special dividends to shareholders.

In terms of valuation, DRE trades at around 27-times forward Funds From Operations, which is a premium to its five-year average, but slightly below the Industrial peer group valuations of 29-times.

Consider DRE a high-conviction, total-return story: one with a fortress balance sheet (investment grade rated), a high-quality management team and a business that will continue to benefit from e-commerce tailwinds.

I think the current industry discount is unwarranted, and I’d be using any pullbacks in DRE to start a position.

To learn more about generating monthly dividends as high as 8%, click here.